Sports

23:33, 02-Mar-2018

Transfer tax signals new era for Chinese Super League

Charlotte Bates

Transfer deadline day ground to a halt on Feb. 28 in what was a relatively quiet window and after a turbulent season that bore witness to a 100-percent transfer tax on foreign players, is this a sign of the future for the Chinese Super League?

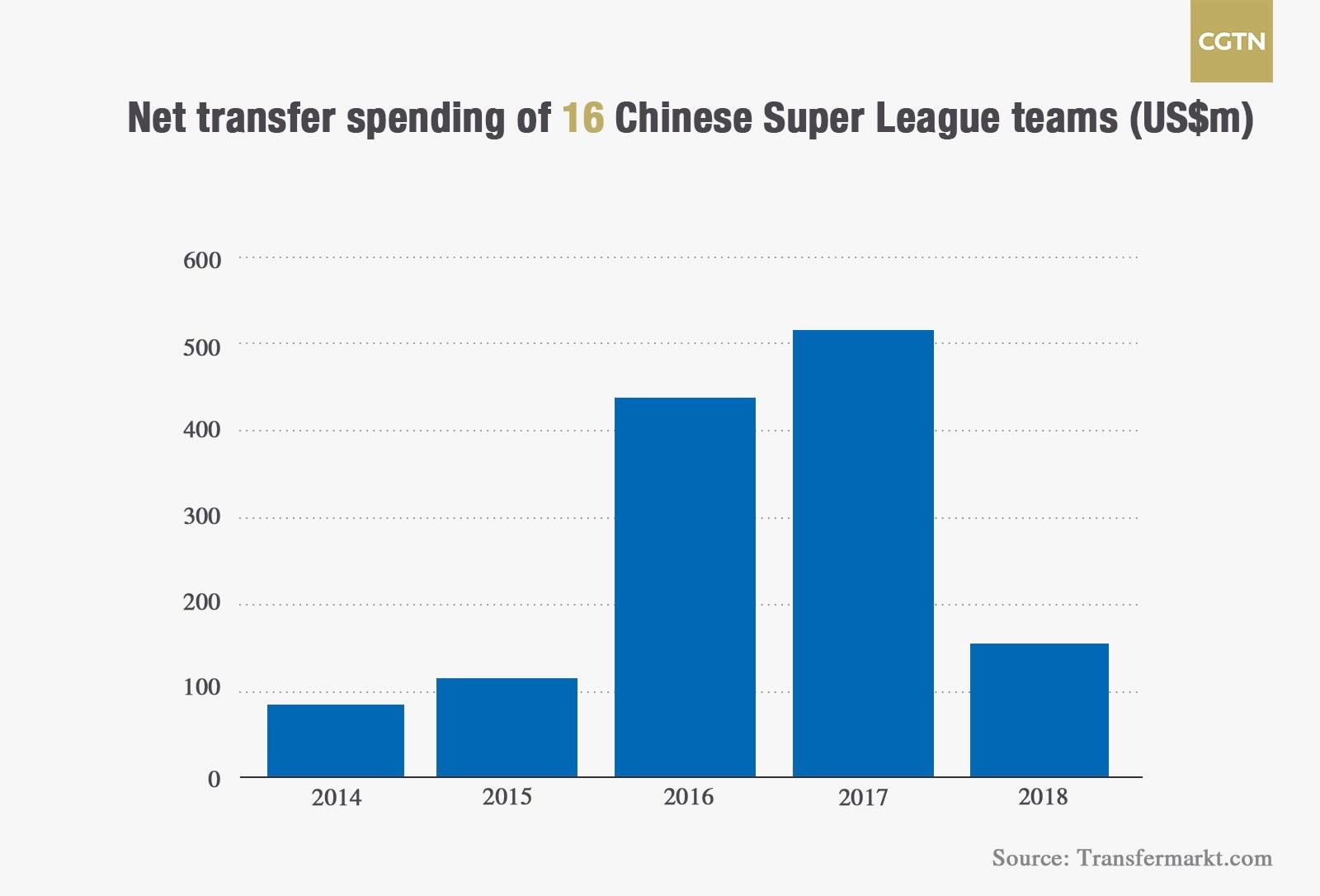

In previous years, the league gained worldwide attention as the new destination for major signings, spending more than 500 million US dollars on foreign players such as Oscar, Hulk and Carlos Tevez.

Following a string of mega-buck signings that saw Ramires reportedly being paid over 275,000 US dollars per week by Jiangsu Suning in 2016, Premier League Arsenal manager, Arsene Wenger, exclaimed that “we should worry. China looks to have the financial power to move a whole league of Europe.”

However, restrictions on the import of overseas players appear to have dramatically slowed the clubs' spending power in a transfer market that looked set upon overturning football’s global established order.

The newly implemented 100-percent tax rule effectively means Chinese clubs have to pay double the price to sign foreigners after the Chinese FA accused them of paying over-the-top wages and burning money.

Clubs spending more than 7 million US dollars on foreign players have to pay the same amount into a Chinese football development fund for grassroots growth, a proposal that has arguably stunted transfer activities.

Pulling on the transfer handbrake

Comparing this year’s spending of 154 million US dollars down from over 500 million US dollars in previous years, China football expert and founder of Score Sports, Yang Qiang, told CGTN Digital: “The trend [is not going] to be as strong as 2016."

"In the coming seasons, clubs will still pay hefty salaries to have decent players, but it will become harder and harder because of this hard cap on transfer fees,” he added.

Mark Dreyer, who runs the China Sports Insider website, said that in principle, the concept of reining in overspending was admirable. “I totally agree with the intention behind it. The problem was the implementation.

"It’s much better to spend 30 million US dollars on the development of Chinese grassroots football in the long term, than on an overpaid player who is actually bringing in little or no benefit to Chinese football,” he told CGTN.

Shanghai Greenland Shenhua signed a two-year contract last year with Argentine striker Carlos Tevez, who became the world’s highest-paid player in a deal reportedly worth 40 million US dollars.

But, after an unsuccessful spell on the field, which saw the club pay the former Manchester United and Manchester City striker nearly 900,000 US dollars per week for a pitiful three goal return, Tevez re-joined his boyhood club Boca, calling his time in Asia a ”seven-month holiday.”

“The Tevez headlines had sort of angered those at the top,” Dreyer said. “No one wants to see money being wasted on someone like Tevez, particularly when the return is minimal to zero as he turned out so badly. It was just disastrous from start to finish.”

Carlos Tevez signing helped take CSL spending to a record high. /VCG Photo

Carlos Tevez signing helped take CSL spending to a record high. /VCG Photo

Can you manufacture talent?

President Xi Jinping’s football reform drove huge investment into the sport, spurred on by his desire for China to not only host a World Cup, but also win one by 2050.

Failure to qualify for Russia 2018 wasn’t the best start, but with the new emphasis on grassroots, the long-term quality of football will, in principle, improve and China should be able to qualify for the World Cup in Qatar.

As a result, the focus has switched to youth development with the aim to have at least 20,000 training academies and 70,000 pitches by 2020.

The Chinese FA set new regulations that help their home-grown talent, requiring clubs to field the same number of under-23 Chinese as foreign players in each game and cutting overseas players starting quota from four to three.

Down the rabbit hole

Clubs immediately tried to find ways around the rules and responded to last season’s obligation to field a local under-23 player in every game by substituting them onto the pitch for the last few minutes of each game only.

Dyer explained how the CSL have become highly skilled at avoiding the new regulations: “What we’ve seen is players have come out on long-term loans to avoid paying the transfer fee. That was particularly the case for [the] Antony Modeste transfer, who is supposedly on a long two-year loan from FC Koln in Germany.”

Cedric Bakambu's move to Beijing Guoan confirmed /VCG Photo

Cedric Bakambu's move to Beijing Guoan confirmed /VCG Photo

“Then we have the ongoing Beijing Guoan with Cedric Bakambu from Villarreal, who was bought out of his contract, but was portrayed as a free agent - clearly the money somehow was paid by the club,” he added. “They then could sign him on for free. By the letter of the law, it’s correct, but it’s clearly going against the spirit."

The CFA had a meeting on Feb. 27 where all represented clubs attended, and the governing body reiterated its doctrine against these loopholes.

China football expert Qiang said: “I think maybe it will tighten its grip on those issues, but you need to be an expert to understand all these loopholes. I’m not so sure the decision makers at the national sports administration currently really understand how the industry is going around them."

The return of the big spender

Despite not being able to come close to the 600 million US dollars spending power from clubs in England’s Premier League, the world’s richest football competition, the Chinese Super League is still enticing record-breaking talent.

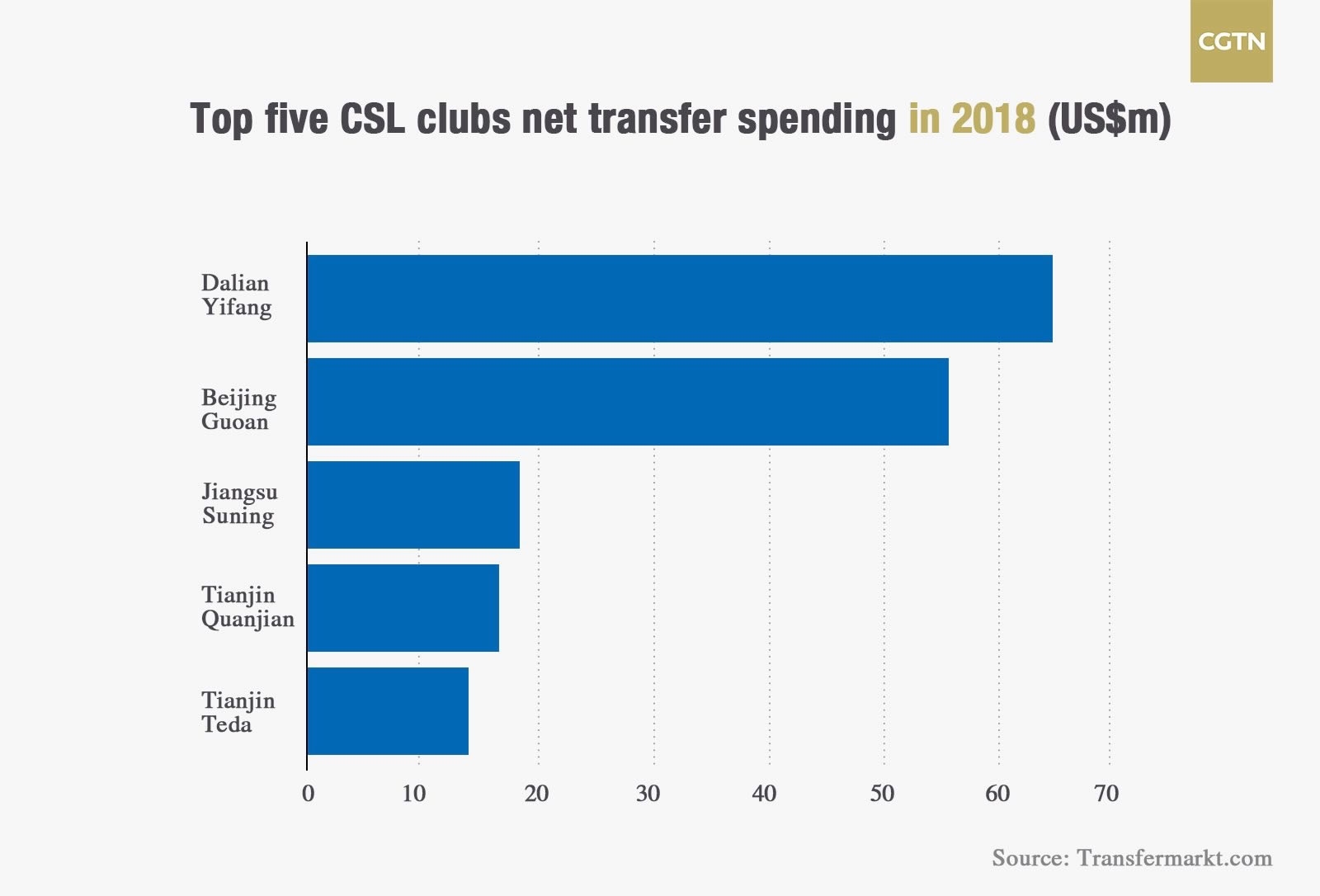

In a move that shocked the football world, Chinese conglomerate Dalian Wanda Group relinquished its 17-percent stake in La Liga club Atletico Madrid, and under the pressure to refocus domestically, bought hometown club Dalian Yifang, taking two big-money Atleti players along with it.

Yannick Carrasco and Argentina international Nicolas Gaitan joined former Premier League defender Jose Fonte at the newly promoted side, in a move that conveys both the CSL’s big salary allure as well as the Chinese clubs’ continued willingness to spend in a market fraught with difficulty.

The 24-year-old Belgian international Carrasco was recently tipped as one of the most exciting prospects in Europe, having initially moved to Atletico Madrid from Monaco in 2015 and scoring in the Champions League final in his opening season.

“Last week, I would have said it stopped a lot of spending, but these guys are going to cost a fair bit of money, so it is going to start again,” Dreyer stated. “The belief is that if Wanda is back, it will start big spending again. Players are still coming to China because their salaries are huge.”

Qiang believes that this new influx of talent could reflect future league trends: “The paycheck will still be very attractive, because they may not be able to pay out the big transfer fees, but for free agents and for players who would value personal income over other things, this could still be a very attractive league.”

Regaining control

Earlier this season, Javier Mascherano, a former Barcelona and Liverpool midfielder, swapped Barcelona for Hebei China Fortune for a fee just below the 7-million-US-dollar tax threshold, which could reflect the CSL’s new narrative to find value and save on the imposed transfer tax.

Chinese Super League stadium crowds have increased year on year. /VCG Photo

Chinese Super League stadium crowds have increased year on year. /VCG Photo

Attendance also seems to be on the rise with Chinese Super League matches averaging 23,822 in 2017, well above the average of games watched in Italy, France, and the Netherlands. Guangzhou Evergrande Taobao had the highest average club attendance at 45,587.

“I would say the long-term trend is still very much up,” Dreyer commented. "The attendance is growing, and with the sharp increase in interest in the league, the hope is it will grow in a more stable way. The boom and cycle of China is typical; the longer-term trend is still positive.”

With both the newly promoted side Dalian Yifang and champion hopefuls Beijing Guoan spending over 80 million US dollars between them on transfers, it is clear that the Chinese Super League will not be disappearing into oblivion any time soon.

The question is, will this more controlled level of spending and home investment be the new model for a league that is constantly fluctuating?

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3