21:49, 27-Mar-2018

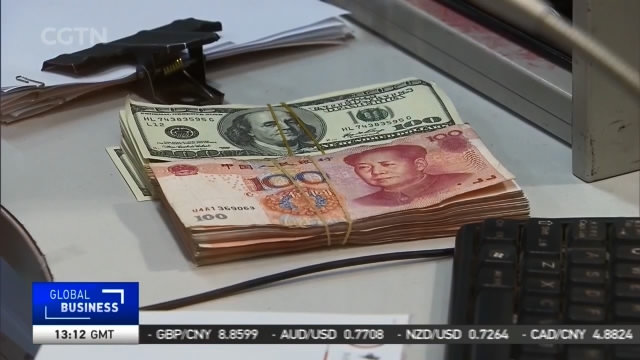

Sino-US Trade Disputes: RMB against the dollar continued to strengthen

The value of the Renminbi against the dollar continued to strengthen today as the Chinese central bank raised its midpoint fixing by over 300 points. The RMB has been on an upward trajectory Since Beijing outlined plans last Friday to consider reciprocal tariffs on US imports. Chen Tong takes a closer look at the ups and the downs.

After falling to a one-month low last Friday, the value of the offshore Renminbi against the dollar got as high as 6.25 yuan per dollar on Monday. The People's Bank of China set the Renminbi's midpoint fixing today at its strongest level since August 2015. The US dollar index has seen a continuous decline since the Federal Reserve raised US interest rates last Thursay.

GUO JIAYI, DIRECTOR MACRO DEPARTMENT, CIB ECONOMIC RESEARCH "If a trade war breaks out, it's not going to be good news for the United States. The US dollar index has seen a large decline, which will actually help raise the value of the Renminbi. You have to focus on what the markets are doing. At the end of the day, China and the US will finally return to the negotiating table. Even there are some actions taken, they won't last long. As a result, the market isn't very pessimistic, and we're not seeing evidence of capital outflows."

The foreign exchange market is not the only one being stirred up by the trade disagreements. Prices of some commodities are seeing declines. Futures prices for rebar in Shanghai, for example, fell slightly last Friday, continuing their price decline of about 15 percent that began in early March. Futures prices for aluminum in Shanghai and iron ore in Dalian have also fallen.

SHAO YU, CHIEF ECONOMIST ORIENT SECURITIES "Both nation's trade moves have the power to shock global imports and exports and affect economic output. For example, if China doesn't produce any iPhones, raw materials purchases will be affected, and investors will see it as a weakening of the global economy. Commodies are cyclical products. If economic growth weakens, it will impact their pricing, because that introduces uncertainty about the whole global economy."

US Treasury Secretary Steve Mnuchin said over the weekend that China and the US are continuing to work on agreements. And Chinese Premier Li Keqiang also repeated pledges to maintain trade negotiations and ease market access for American businesses. Global stock markets were shocked by talk of trade disputes last Friday, but have started to calm so far this week. The Shanghai Composite Index sank 3.4 percent last Friday but that decline has also slowed, and the three main US indexes have also picked up.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3