Tech & Sci

18:08, 04-Jul-2017

Samsung to invest billions in South Korea to widen chip lead

Samsung will invest at least 18.6 billion US dollars in South Korea to extend its lead in memory chips and next-generation smartphone displays, in a plan that promises to create almost half a million jobs.

The investment underscores Samsung's determination to widen its lead in memory chips, which are expected to propel Asia's third most-valuable company to record profit this year. Samsung routinely invests more than ten billion US dollars in chips annually, helping it stay ahead of competitors such as cross-town rival SK Hynix and Japan's Toshiba.

Under its latest spending plan, Samsung will put 14.4 trillion won into its new NAND factory in Pyeongtaek by 2021. It will also invest 6 trillion won in a new semiconductor production line in Hwaseong, but did not elaborate on timing or product.

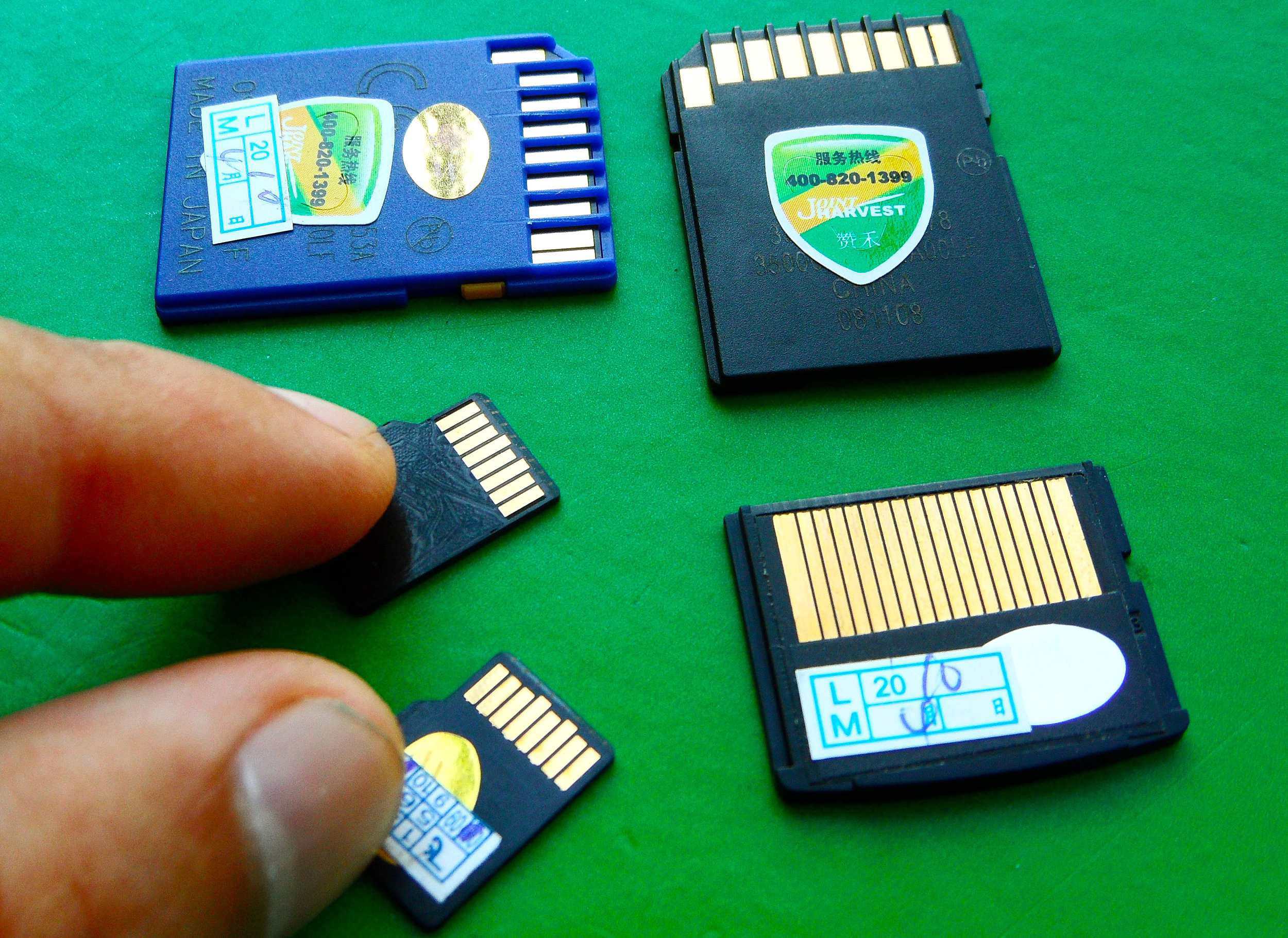

NAND chips are suffering shortages worldwide in recent years. /VCG Photo

NAND chips are suffering shortages worldwide in recent years. /VCG Photo

SUPPLY SHORTAGE

Memory makers are widely expected to post record profits in 2017, as prices rise in response to demand for more features in smartphones and servers, as well as a persistent supply shortage which analysts and industry sources said is more acute for NAND chips due to an increasing adoption of high-end storage products.

Samsung, SK Hynix and Toshiba have committed billions of dollars to boost NAND output in recent years, yet shortages are expected to persist at least through 2017 as new facilities will not make meaningful supply contributions until next year.

Some analysts said additional capacity across the industry could cause slight oversupply in early 2018, but prices are unlikely to drop because demand is so strong.

China is trying to develop its own memory chip producers in the past several years. /VCG Photo

China is trying to develop its own memory chip producers in the past several years. /VCG Photo

CHIPS IN CHINA

Samsung also said it will add a production line to its NAND plant in China's Xi'an city, though it has not yet set an investment amount or time frame.

Some South Korean companies in China have seen sales decline or have had to reduce operations ever since Beijing objected to Seoul's deployment of a US anti-missile defense system in March. But components makers have not reported any problems, with Samsung still among China's biggest suppliers of chips and displays.

China is trying to develop its own memory chip producers but it is likely to take several years before they can compete with existing makers, analysts said.

(Source: Reuters)

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3