17:07, 02-Jul-2018

Stocks Regulations: Stricter regulations deter many companies from IPO applications

Updated

16:55, 05-Jul-2018

02:48

The number of initial public offerings waiting for regulatory approval has been sliding for the past two years. Known as the "IPO quake lake", the number of companies on the waiting list had grown dramatically until 2016, but stricter oversight imposed since then has resulted in many companies simply giving up. Our reporter Chen Tong has been talking to the experts to see just what's been going on.

As of the end of May 2018, the number of IPO applications awaiting approval by the securities regulator had fallen from some 900 in June 2016 to only 279. The gradual draining of the "IPO quake lake" stems from the strengthening of approval oversight, which has resulted in 150 applications being rejected by the regulator in the past three years.

YANG ZHONGNING, INVESTMENT CONSULTANT INDUSTRIAL SECURITIES "In the past, many companies thought that they had it made, just by being listed. But recent reviews by the CSRC show that the regulator is strictly monitoring the operations of listed companies and that those which violate regulations will pay the price for it. So many listed companies are no longer under the impression that a successful IPO application is the end of things. That's why many companies, especially those with poor fiscal performance, have given up on going public."

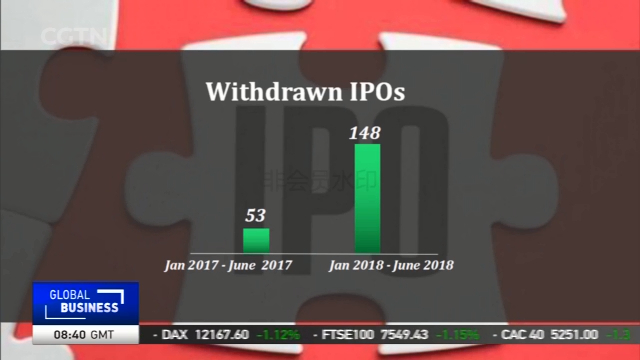

Further dampening sentiment for IPOs, the CSRC said in March that companies which fail to gain approval would be banned from attempting backdoor listings for three years. Some 150 companies have withdrawn their IPO applications during the first six months of this year, a year-on-year increase of 180 percent. The total of new IPO applications saw a year-on-year decline of 36 percent during the same period. While companies are now more cautious about going public, experts believe this amounts to the government's giving more signs of support for the real economy as opposed to just supporting activity on the stock market.

S2: CAI JUNYI, CHIEF ANALYST SHANGHAI SECURITIES "China will be strongly supporting the real economy in the next two to three years, and is also offering strong support to the issue of CDRs. Though the number of successful IPOs is falling, there will still be many companies planning to go public. In other words, China is widening the path for the development of the new economy."

Government support for the real economy is also reflected in increased support for start-up companies. Several commercial banks have been issuing plans to support the financing needs of unicorn companies, and cities including Hangzhou, Guangzhou and Suzhou are also planning to set up incubators for start-up companies seen as having good potential.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3