Politics

15:06, 02-Dec-2017

US Senate passes historic tax reform in big win for Trump

CGTN

US President Donald Trump moved closer to a major legislative triumph when the US Senate passed a landmark tax reform bill after a marathon session early on Saturday.

The bill dramatically lowers the corporate tax rate from 35 percent to 20 percent, and includes more modest tax cuts aimed at individuals across all income levels, as did a House of Representatives version last month.

The Senate voted 51 to 49 in favor of the nation's largest tax overhaul in 31 years, overcoming stubborn internal Republican resistance and dismissing Democrats angry over the last-minute, handwritten changes to the legislation.

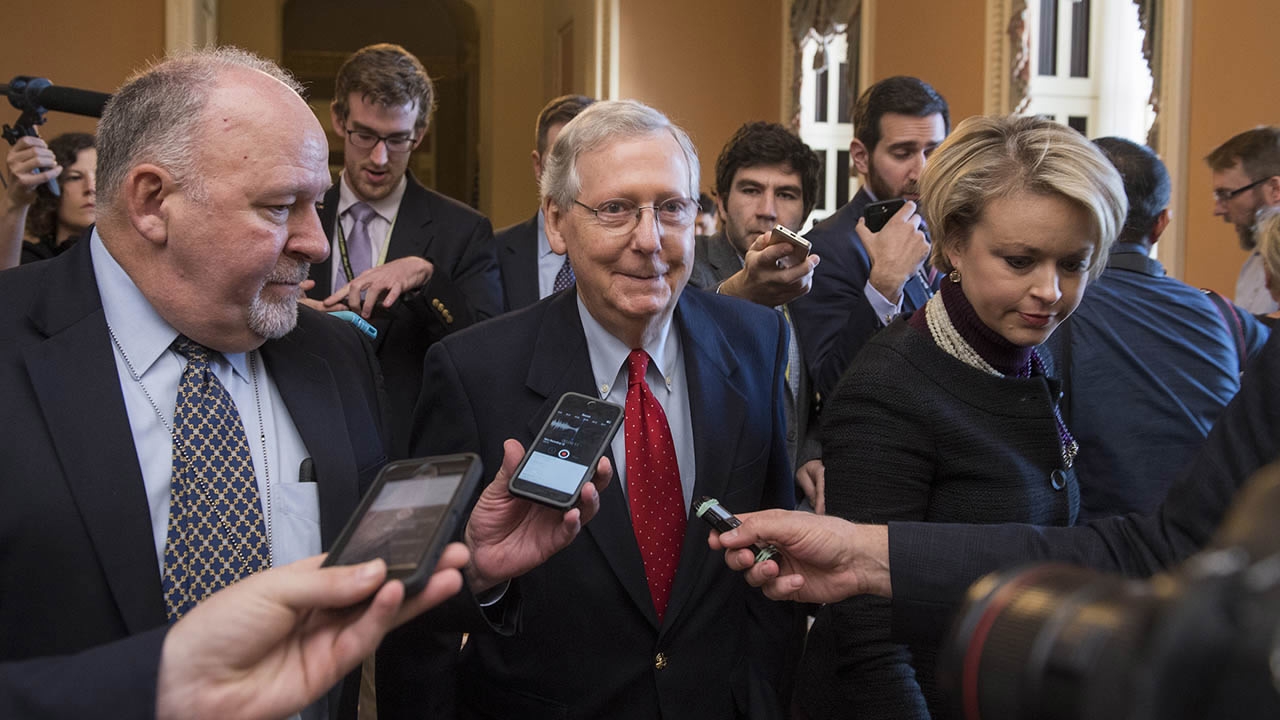

US Senate Majority Leader Mitch McConnell leaves the Senate floor during debate over the Republican tax reform plan on December 1. /Reuters Photo

US Senate Majority Leader Mitch McConnell leaves the Senate floor during debate over the Republican tax reform plan on December 1. /Reuters Photo

Just 24 hours earlier, the bill was on the brink of collapse when a handful of Republican deficit hawks balked at the controversial plan's 1.5 trillion-dollar price tag for 10 years.

It was salvaged only after extensive negotiations. Tax writers tweaked the 479-page measure deep into the night, leaving Democrats furious over last-minute handwritten changes.

Trump, who has been more active in the legislation's navigation through Congress than he was with the Obamacare repeal bill that failed earlier this year, has been desperate for a congressional win.

He has repeatedly stressed he wants the tax bill on his desk by the year end.

Now, the two versions of the legislature must be reconciled into a single bill, and approved again by both chambers before it makes it to the president's desk for his signature.

Democrats fumed that they received the text – peppered with extensive handwritten modifications that earned scorn from opposition lawmakers – only a few hours before the vote.

"We understand they have the votes to pass their bill despite a process – and a product – that no one can be proud of and everyone should be ashamed of," top Senate Democrat Chuck Schumer told colleagues.

Haste and the darkness of night were Trump's allies in the process, Schumer said.

Holdouts relent

As the final votes were tallied, grinning Republicans congratulated one another with handshakes, backslaps and hugs.

A trio of Democrats including Senator Ron Wyden, a ferocious opponent of the bill, stood motionless in the back of the chamber.

Demonstrators against the Republican tax reform bill outside US Capitol in Washington, DC., on November 30. /Reuters Photo

Demonstrators against the Republican tax reform bill outside US Capitol in Washington, DC., on November 30. /Reuters Photo

Mindful of the historic nature of the vote, Vice President Mike Pence presided over the chamber during final passage.

Several Republicans who had voiced concerns about the bill were ultimately lured by McConnell's agreement to make changes.

Senators Bob Corker and Jeff Flake, a pair of Trump critics, worried about the impact of the tax cuts on the country's massive deficit.

A nonpartisan congressional tax scorekeeper had projected the tax overhaul would add one trillion dollars to the deficit, even after accounting for expected economic growth from the plan.

The analysis complicated Trump's argument that the tax cuts would pay for themselves through additional economic growth.

Flake eventually agreed to back the legislation, after receiving assurances from the White House that action would be taken to shield thousands of young "Dreamer" immigrants from deportation.

Corker hoped to offset the cost of the tax cuts by including a rise in the corporate tax rate in later years, but the effort failed.

He was the lone Republican no vote on the bill, but his opposition was not enough to derail it.

'Rubik's Cube'

Lawmakers said a deal was reached to raise tax deductions for certain small businesses, a move that got two more wavering senators on board.

Protesters hold a "People's Filibuster to Stop Tax Cuts for Billionaires" at a rally outside the US Capitol on November 30. /AFP Photo

Protesters hold a "People's Filibuster to Stop Tax Cuts for Billionaires" at a rally outside the US Capitol on November 30. /AFP Photo

As an offset, the bill's tax rate for US corporations repatriating profits from abroad would rise, from 10 percent to possibly 14 percent.

"It's like the Rubik's Cube trying to fit everybody's concerns in. But I think we've ended up with a better bill," Senator Rob Portman said.

Republicans hold a narrow 52-48 Senate majority. With all Democrats opposing the tax plan, just three Republican defectors would have killed it.

Senator Susan Collins had voiced deep skepticism about the bill but ultimately gave her backing after securing changes, including on health care and local taxes.

The Senate and House must negotiate a compromise bill, and contentious votes are likely in the weeks ahead.

"Now, we will move quickly to a conference committee so we can get a final bill to President Trump's desk," House Speaker Paul Ryan said in a statement.

Democrats argue that the plan is too expensive and will accommodate only the rich, and that it could ultimately impact cherished US entitlement programs like Medicare.

"The federal treasury is being looted tonight!" leftist Senator Bernie Sanders roared in the chamber.

11159km

Source(s): AFP

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3