Business

14:50, 27-Feb-2018

EU official: Brussels can regulate Bitcoin if risks escalate

Nicholas Moore

The European Union will move to regulate Bitcoin and other cryptocurrencies if risks emerge without international response, the bloc’s chief of financial security warned on Monday.

Valdis Dombrovskis, the head of Financial Stability, Financial Services and Capital Markets Union as well as vice-president for the Euro and Social Dialogue, called the recent Bitcoin craze a “global phenomenon,” adding that it is “important there is an international follow-up at the global level.”

Valdis Dombrovskis, the head of Financial Stability, Financial Services and Capital Markets Union as well as vice-president for the Euro and Social Dialogue. /VCG Photo

Valdis Dombrovskis, the head of Financial Stability, Financial Services and Capital Markets Union as well as vice-president for the Euro and Social Dialogue. /VCG Photo

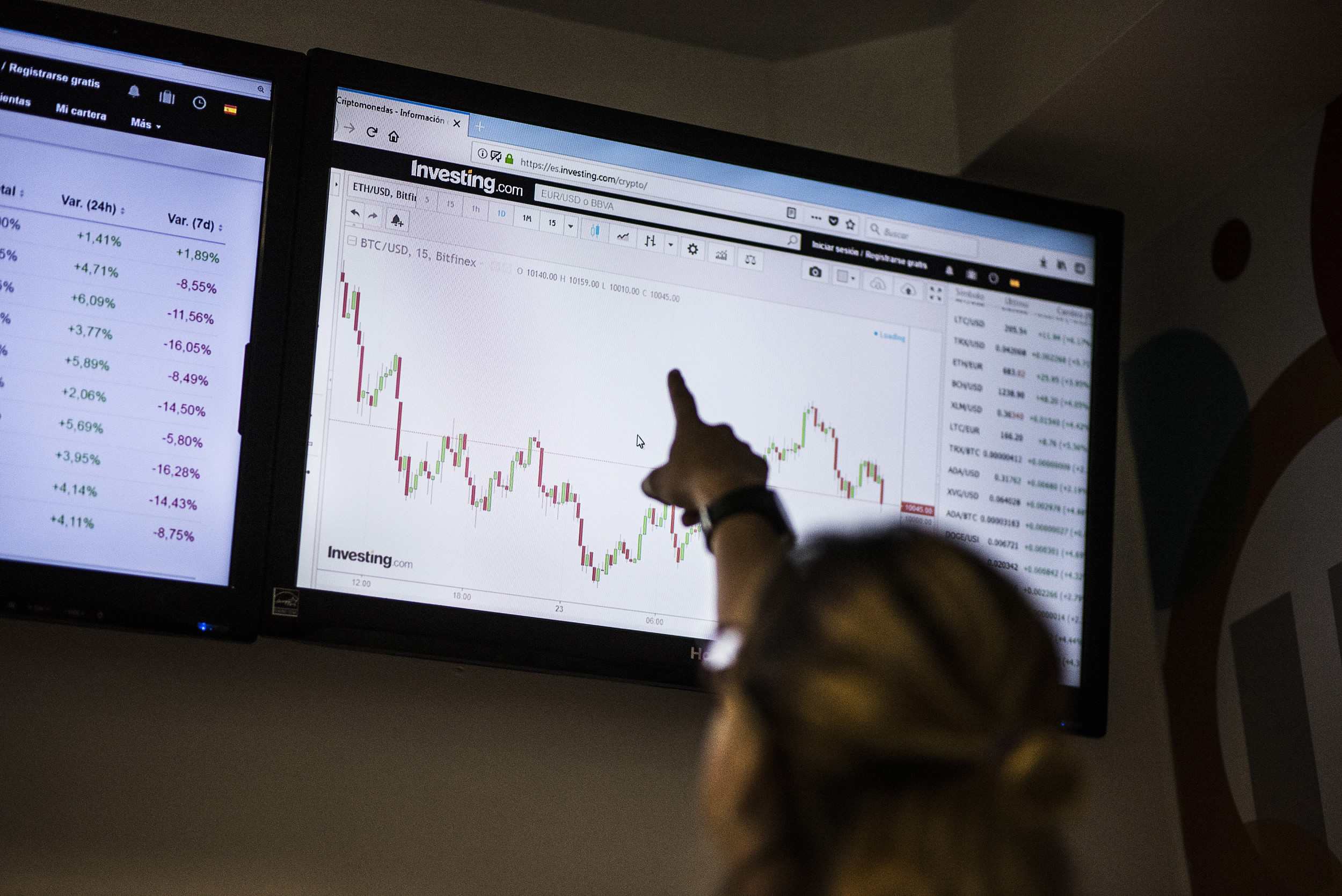

Bitcoin hit highs of around 20,000 US dollars in December 2017, but a huge drop at the start of this year saw investors lose huge amounts of money. The cryptocurrency is currently trading at around 10,000 US dollars, but remains highly volatile.

Dombrovskis, a former prime minister of Latvia, said that if there was no “clear international response emerging” in the case of growing risk, he could “not exclude the possibility” of regulating cryptocurrencies at the EU level.

Cryptocurrencies are likely going to be on the agenda at this year’s G20 Summit in Buenos Aires, with governments around the world still lacking unity on how much, if any, regulation should be placed on tokens like Bitcoin, Litecoin and Ethereum.

China was one of the earliest countries to move to regulate cryptocurrencies, identifying the risks of initial coin offerings and ruling them illegal in September 2017, before closing down exchanges in the country.

South Korea also banned ICOs and stopped anonymous trading, while Japan has taken a softer approach in ruling cryptocurrencies legal, as long as they comply with national regulations.

A man walks past an electric board showing exchange rates of various cryptocurrencies including Bitcoin (top L) at a cryptocurrencies exchange in Seoul, South Korea, December 13, 2017. /VCG Photo

A man walks past an electric board showing exchange rates of various cryptocurrencies including Bitcoin (top L) at a cryptocurrencies exchange in Seoul, South Korea, December 13, 2017. /VCG Photo

Japan’s support of cryptocurrencies however backfired in January when Coincheck, one of the country’s biggest coin exchanges, was hacked and saw 530 million US dollars’ worth of virtual currencies stolen.

Most European leaders have approached Bitcoin and other cryptocurrencies with skepticism, with French President Emmanuel Macron calling for an international approach to regulation during the World Economic Forum in Davos last month.

VCG Photo

VCG Photo

International Monetary Fund Chief Christine Lagarde said last month that some form of cryptocurrency regulation would be inevitable.

However, Estonia – one of Europe’s most vocal supporters of digital technology with its e-residency scheme – has been toying with the idea of launching the estcoin, its own virtual currency.

That idea was however quickly criticized by European authorities, with European Central Bank President Mario Draghi saying “no member state can introduce its own currency; the currency of the Eurozone is the euro.”

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3