Business

11:10, 18-Aug-2017

China home prices post slower growth in July

By CGTN’s Yan Yunli

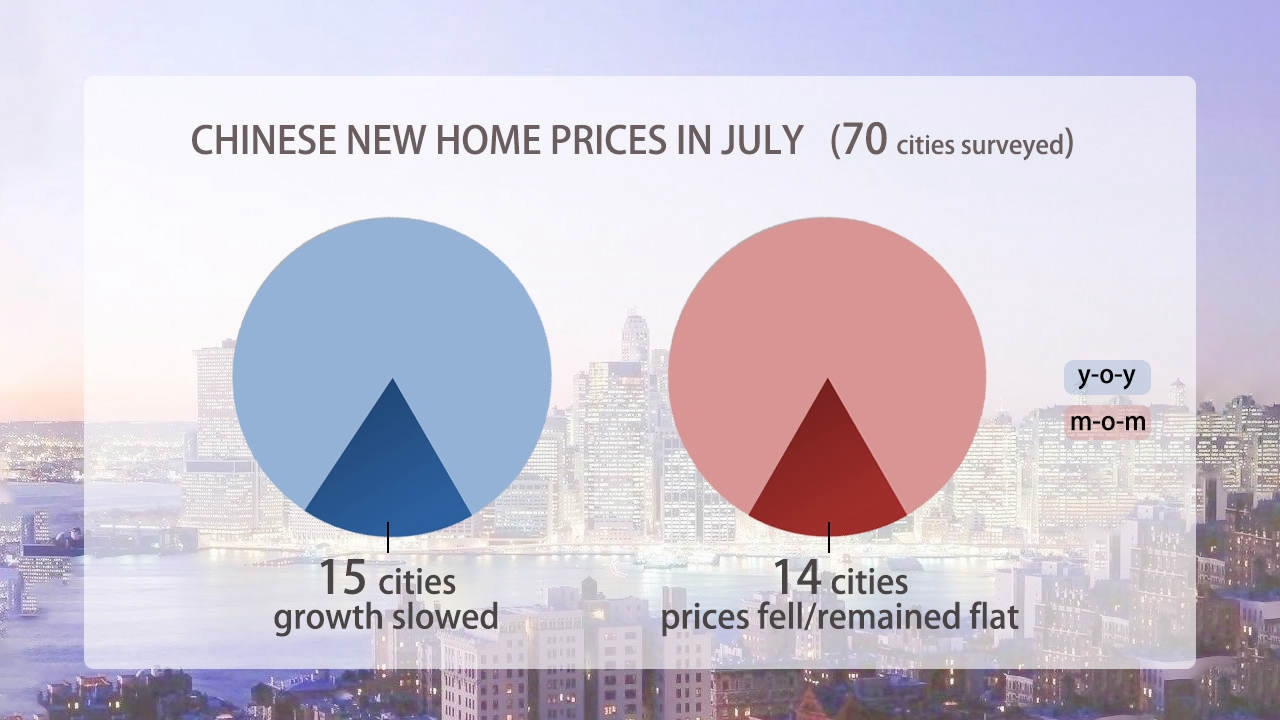

Official data showed Friday that China's once-red-hot property market continued to cool as home prices rose slower in major cities amid tough government controls.

The National Bureau of Statistics (NBS) said average new home prices in China's 70 major cities rose 0.4 percent in July, down from 0.7 percent in June. Liu Jianwei, a senior statistician at NBS, attributed that performance to local governments’ measures to tame the real estate market.

CGTN Photo

CGTN Photo

On a month-on-month basis, new home prices in the first-tier cities remained flat, while existing home prices dipped 0.1 percent. Only Guangzhou gained month on month in new home prices at 0.4 percent. Shanghai remained flat. Beijing and Shenzhen showed a decrease in new home prices monthly.

In the second-tier cities, both new home prices and existing home prices climbed 0.4 percent – the growth was 0.2 percentage points lower than that of June.

When looking at the third-tier cities, new home prices and existing home prices picked up 0.6 and 0.4 percent respectively. Beihai, Shaoguan and Bengbu led the gains. But the growth in this category of cities was 0.3 percentage points lower from the previous month.

On a yearly basis, growth of new home prices and existing home prices fell in the first-tier cities for a 10th consecutive month in July. The figures were down 1.7 and 2.0 percentage points respectively from June.

Growth in new home prices in China's second-tier cities fell for an eighth consecutive month in July. That came as growth in existing home prices in those cities declined for a sixth straight month.

Many analysts expected the sector to lose further momentum in the second half of the year in the face of a tightening monetary policy and an official financial deleveraging campaign.

"The transaction volume in the first- and second-tier cities continues to decrease and home prices have become stable due to the curbing measures. Home prices in the third- and fourth-tier cities are rising because of destocking," said Bai Yanjun, research director at China Index Academy.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3