Business

21:09, 24-Sep-2017

Zimbabwe central bank allays fears of basic commodities shortages amid Forex scarcity

CGTN

Zimbabwe's central bank has dismissed social media reports claiming that there will be a shortage of basic goods on the market due to a dearth of foreign currency.

"Peddling of such fake news is quite unfortunate. There are no shortages of basic commodities in Zimbabwe. On the contrary, foreign exchange allocation for basic and essential commodities has been increased to ensure that shortages of commodities do not occur within the economy," John Mangudya, governor of Reserve Bank of Zimbabwe, said in a statement Sunday.

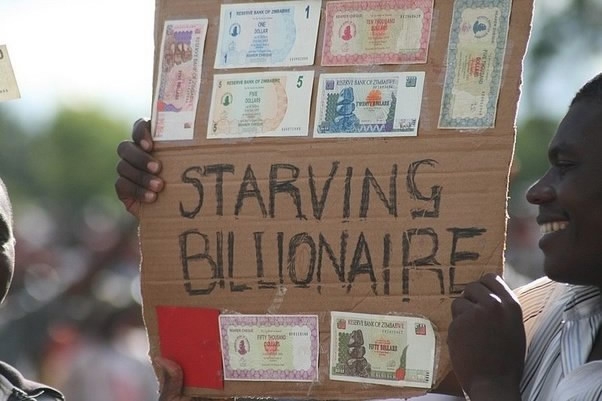

A protester shows worthless bank notes near the capital Harare, 2008. /Zimbabwe today Photo

A protester shows worthless bank notes near the capital Harare, 2008. /Zimbabwe today Photo

The rumors have triggered panic buying and hoarding of basic commodities by the public.

The price of most basic goods has gone up in recent weeks, igniting fears of shortages experienced during the peak of the hyper inflationary era in 2008.

Although Zimbabwe introduced bond notes in November 2016 to tame cash shortages, the bank note shortages have intensified causing the emergence of the Forex parallel market where the US dollar is being sold for a premium.

Zimbabwe's farmers bemoan the country's multi-currency system. /Zimbabwe today Photo

Zimbabwe's farmers bemoan the country's multi-currency system. /Zimbabwe today Photo

Zimbabwe introduced multiple currencies in 2009 after its currency had been rendered worthless by hyperinflation.

The multi-currency basket has nine currencies including the US dollar, British Pound, Euro, Chinese yuan and Japanese yen. The US dollar is currently the main trading and circulating currency in the country.

Zimbabwe has for years been unable to generate enough foreign currency to meet its requirements due to low exports and absence of balance of payment support from multilateral lenders.

10903km

Source(s): AP

,Xinhua News Agency

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3