Business

18:21, 12-Oct-2017

IMF urges de-risking actions in China

By CGTN’s Gao Songya

The International Monetary Fund (IMF) has called on China to take broader reform measures to reduce the economy’s reliance on rapid credit growth in its latest stability report.

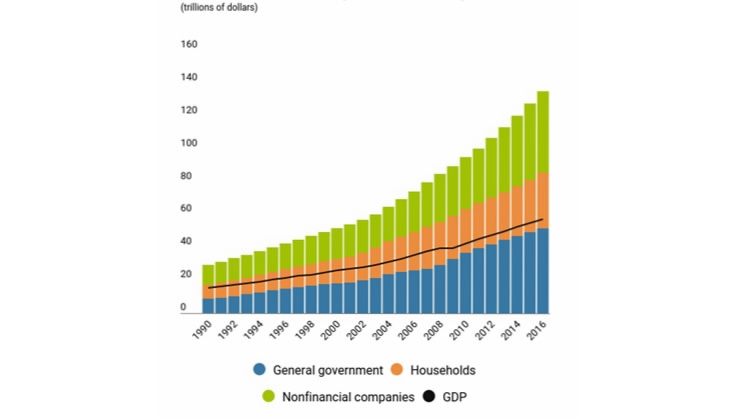

The report warned of looming financial vulnerabilities globally. Low yielding assets, rising debt levels in big economies, China’s credit growth and political tensions are four major factors adding to the uncertainties.

Increasing borrowing of the Group of 20 countries from 1990 to 2016. /IMF Photo

Increasing borrowing of the Group of 20 countries from 1990 to 2016. /IMF Photo

The report said China’s credit growth points to elevated financial stability risks. The assets of the banking sector have reached 310 percent of gross domestic product (GDP), up from 240 percent at the end of 2012.

Also, smaller banks in China should particularly watch out for their “shadow” lending and wealth management products, which could be potential risks.

James Daniel, assistant director of IMF’s Asia & Pacific Department, said it is encouraging to see China's top leadership keep de-risking on the top of the government's agenda, noting that the efforts already resulted in growth rates slowing down.

But Daniel also stressed the importance of a growth pattern that does not involve huge debts. He said innovation, which China leads in many areas, is part of a broader theme of increasing productivity, so is the ever stronger private sector.

The “private sector is becoming more productive and efficient, helping growth in China in a very profitable way,” said Daniel.

China’s financial stability matters so much because the country now plays a larger role both within the IMF and globally.

“Many of our best economists are Chinese, we actually have Chinese people leading our management, shaping the way IMF is working, which is entirely appropriate and we hope that to continue,” said Daniel.

(Cao Qingyun also contributed to the story)

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3