21:51, 02-Apr-2018

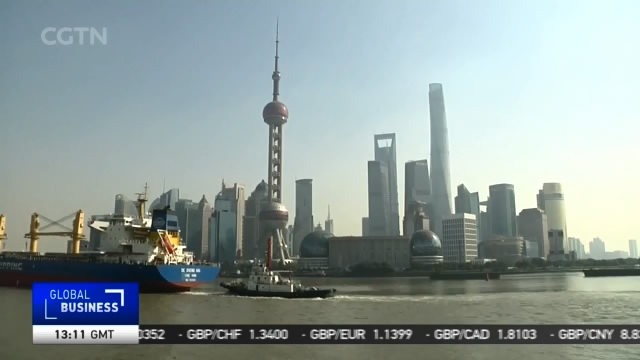

China Woos Tech Firms: Pilot welcomes stock or CDR issuance for innovative firms

Chinese market analysts are busy digesting the impact of an influx of China tech listings. This after China unveiled a pilot program last Friday to support innovative companies' domestic listings and issuance of China Depositary Receipts.

The scheme came only two weeks after the idea was floated at the annual Two Sessions--unheard of in policy-making speed. It would allow qualified overseas-listed companies with market value above 32 billion US dollars to issue shares or depositary receipts in the mainland market. The scheme also applies to unlisted "unicorns" that have a valuation of no less than 20 billion yuan or fast growing revenues. This is to ensure the Chinese market has a higher "tech content", as companies need to be in high-tech sectors such as Internet, big data, cloud computing, artificial intelligence, software and integrated circuits. For years, Chinese tech IPOs have gone overseas because of easier profit requirements in other markets.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3