Business

20:22, 21-Oct-2017

Tencent-backed gaming and shopping company Sea stumbles in US IPO

By CGTN's Han Jie

Shares of Singapore-based online gaming and e-commerce company Sea, holding the very first major US IPO from a Southeast Asian tech firm, had a bumpy start to life on the New York Stock Exchange (NYSE) on Friday.

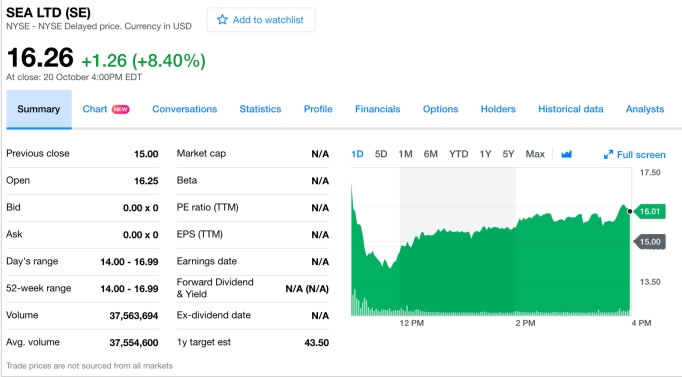

The company raised 884 million US dollars from its listing. Above the expected range of 12 US dollars to 14 US dollars, the company’s share price is 15 US dollars apiece. The company’s shares opened at 16.25 US dollars on the NYSE but fell below 15 US dollars within the first hour of trading, and later stabilized slightly above 15 US dollars.

Above the expected range of 12 US dollars to 14 US dollars, the Sea holding's share price is 15 US dollars apiece. /NYSE Screenshot

Above the expected range of 12 US dollars to 14 US dollars, the Sea holding's share price is 15 US dollars apiece. /NYSE Screenshot

Although there had some initial uncertainties, the Tencent-backed company share, which is listed as “SE”, boosted the original offer size of 49.69 million shares by 18.7 percent in response to strong demand.

"We built a very strong foundation for our company, and more importantly, we acquired a crucial asset: our local knowledge," according to CNBC’s interview with the company’s CEO Forrest Li in "Squawk Alley" on Friday.

The firm, often called the Tencent of Southeast Asia, is Southeast Asia’s highest valued tech company. The company includes online gaming service Garena which has its games licenses from Tencent, virtual payment app AirPay, and e-commerce marketplace Shopee. Chinese giant tech company Tencent holds the company’s 40 percent stake.

Singapore-based Sea Limited Chairman and CEO Forrest Li /CNBC Photo

Singapore-based Sea Limited Chairman and CEO Forrest Li /CNBC Photo

As US exchanges are set to record their busiest year for IPOs from Asian firms since 2010, the NYSE has been increasingly targeting firms from fast-growing Asian economies.

Five companies, including Singaporean online games maker Sea Ltd, China's oldest peer-to-peer (P2P) lender Ppdai Group and search company Sogou Inc, are currently pitching their plans for initial public offerings to investors, adding to the 10 Chinese firms that have listed so far this year in the US.

IPO proceeds from Asian companies listing on Nasdaq and the NYSE peaked in 2014, when e-commerce behemoth Alibaba Group Holding Ltd went public in a record 25 billion US dollar deal.

4481km

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3