Business

08:51, 07-Mar-2018

Minister: China's government debt to GDP declined to 36.2% in 2017, risks under control

CGTN

China's finance minister on Wednesday said the country’s government debt-to-GDP ratio in 2017 dropped to 36.2 percent, down from 36.7 percent in 2016, reiterating confidence in controlling local government debt and containing systemic risks.

“China’s debt level is well below the international prudential limit of 60 percent, and lower than some major economies and other emerging markets,” said Finance Minister Xiao Jie at a press conference on the sidelines of the first session of the 13th National People's Congress, China's national legislature.

By the end of 2017, combined government debt in China stood at 29.95 trillion yuan (about 4.74 trillion US dollars), including 13.48 trillion yuan central government debt and 16.47 trillion yuan local government debt.

VCG Photo

VCG Photo

Xiao projected that the ratio will not have big changes in the coming few years.

Acknowledging the existence of illegal debt-raising practices by some local governments, the minister vowed to take multiple steps to contain debt growth.

To rein in rising debt risks, China overhauled the management of government bonds in 2014, streamlining fund-raising channels for local authorities while putting a cap on annual bond issues.

Despite some irregularities in local governments' financing activities, China's government debt risks are generally within control, noted Xiao.

Proactive fiscal policy unchanged

Though China lowered its budget deficit target for 2018, the first downward adjustment since 2013, the proactive direction of China's fiscal policy remains the same, Xiao pointed out on Wednesday.

China lowered its fiscal deficit target to 2.6 percent of GDP for 2018, down by 0.4 percentage points compared with 2017.

"This year’s budget deficit target is set at 2.38 trillion yuan, which is of the same size as last year. The reduction in the deficit-to-GDP ratio is mainly due to China's steady economic growth and accelerated fiscal revenue growth. Meanwhile, the reduction keeps China’s macroprudential policy options open," explained the minister.

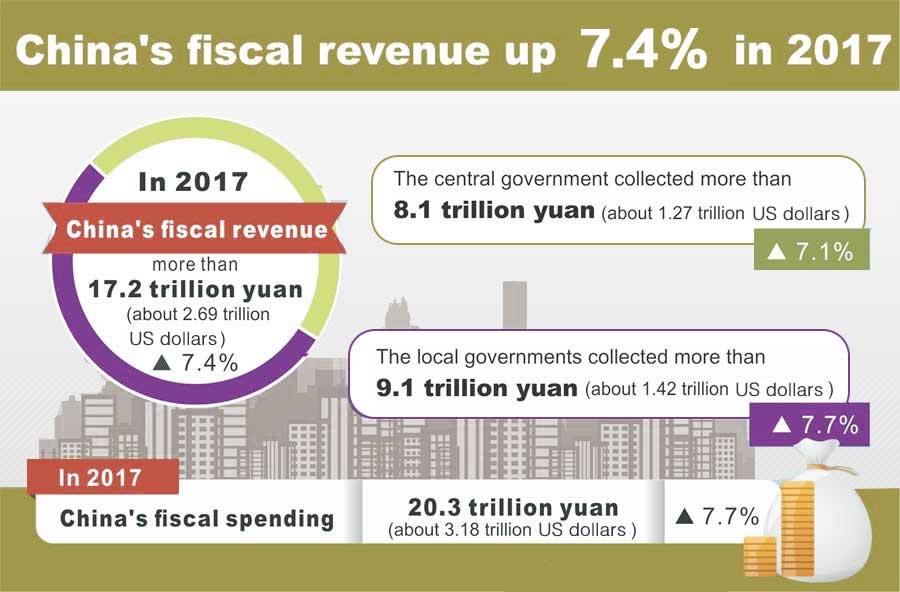

China's fiscal revenue rose by 7.4 percent year-on-year to 17.3 trillion yuan (2.7 trillion US dollars) last year on the back of stronger-than-expected economic growth. The growth rate was markedly above 4.5 percent in 2016, data from the Ministry of Finance evidenced.

The country's economy expanded by 6.9 percent in 2017, with the pace of growth accelerating for the first time since 2011.

With the economy on a firm footing and fiscal revenue increasing, China will continue its efforts in tax reduction to lower business costs and sustain the strength of economic recovery.

China will turn the three tax brackets into two, prioritize lowering rates in manufacturing and transportation, and raise the threshold of annual sales revenue for micro- and small businesses.

China will reduce taxes on businesses and individuals by more than 800 billion yuan (about 126 billion US dollars) in 2018.

A total of 918.6 billion yuan was saved last year via China's ongoing reform to replace business tax with value-added tax (VAT).

China to prudently advance property tax legislation

VCG Photo

VCG Photo

When asked about China’s long-discussed property tax, Shi Yaobin, vice finance minister of China, said the Budgetary Affairs Commission of the National People's Congress (NPC) Standing Committee and the Ministry of Finance are jointly drafting the law, and debate on important issues and internal consultations are underway.

The law will fill the gap in taxing home ownership, as China's current housing tax mechanism mainly taxes development and property sales.

This initiative is being fast-tracked, starting a new chapter in the housing market.

The vice minister indicated that charged on estimated home prices, rather than market ones, the tax will be levied by local authorities.

China’s property prices have skyrocketed over the past decade, partly due to investors’ preference for owning houses, resulting in extensive speculations on the housing market.

The introduction of the property tax is expected to deter further speculation, drive homeowners to sell their extra houses before the enforcement of the new tax, and subsequently increase housing supply.

(CGTN's Xia Cheng also contributed to the story.)

7km

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3