Business

22:25, 31-Jul-2017

China’s H1 trade volume surges, outbound investment plummets

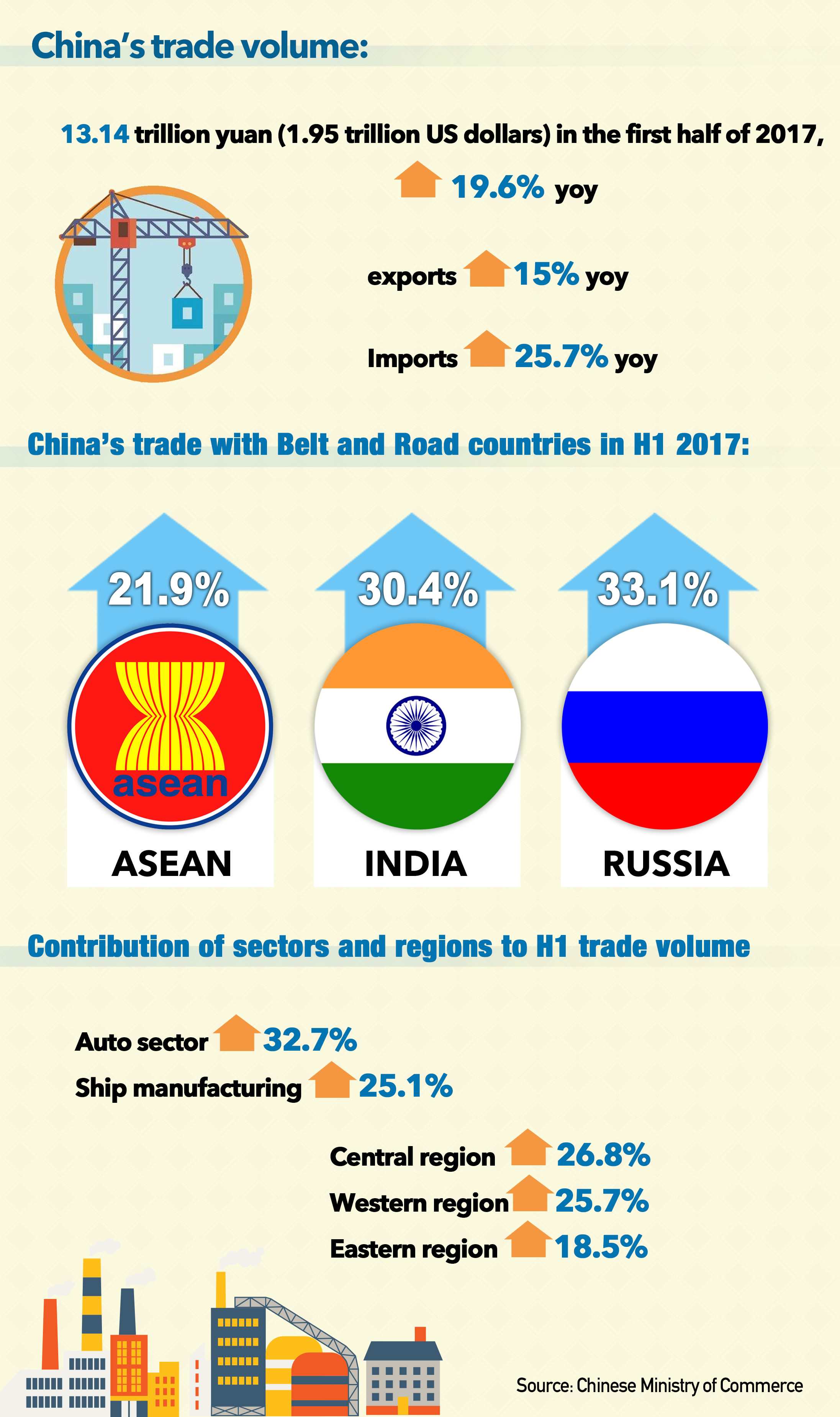

China's foreign trade volume rose almost 20 percent year on year in the first half of 2017 to 13.14 trillion yuan (1.95 trillion US dollars), putting an end to two years of decline, according to official figures released on Monday.

"The global economy is seeing an accelerated growth, and global trade is also picking up speed,” said Qian Keming, China's vice minister of commerce, at a press conference.

CGTN Infographic

CGTN Infographic

Deciphering China-US trade imbalance

In US dollar-denominated terms, China’s trade surplus with the US in the first half of 2017 was 6.5 percent higher than in the first half of last year, showed data released earlier this month by the General Administration of Customs.

Asked at Monday’s press conference for his opinions on the trade imbalance, Long Guoqiang, deputy head of the Development Research Center of the State Council, replied that China and the US both benefit from the trade.

“The US has imported a large amount of affordable consumer goods from China, and that has saved a lot of money for their consumers... Also, the US has a serious income gap problem – if consumer costs had not declined, this problem would have become even more severe. At the macro level, while maintaining growth, the US does not have to resort to austerity measures containing inflation.”

A cargo vessel anchors at the foreign trade container wharf of Qingdao Port in east China's Shandong Province, October 13, 2016. /Xinhua Photo

A cargo vessel anchors at the foreign trade container wharf of Qingdao Port in east China's Shandong Province, October 13, 2016. /Xinhua Photo

Long attributed the imbalance to three main factors.

First, the US and Chinese calculating approaches vary, creating the potential for price disparity between offshore and onshore prices.

Hong Kong plays an important role in trade as a transit hub. While calculating import figures, the US includes goods being shipped from the Chinese mainland to the US via Hong Kong as China’s exports. Calculating exports, the US does not regard those goods traveling from the US to China via Hong Kong as China’s imports. This factor may distort the picture, Long said.

Second, China is at the lower end of the global value chain as a result of deepening international division of labor. China has been processing inputs from higher-end countries like Japan, South Korea, and the US, and then selling them back.

Taking into account of such factors, former WTO chief Pascal Lamy suggested a new approach, measuring trade in value added.

The new measurement uses both trade statistics and international input-output tables, to separate the domestic content of an export from the cost of the imported components.

"As Lamy said, adopting such methodology, the China-US imbalance would be halved." Long noted.

Yangshan Free Trade Port Area in Shanghai on August 15, 2013. /Xinhua Photo

Yangshan Free Trade Port Area in Shanghai on August 15, 2013. /Xinhua Photo

Third, not only with China does the US have a trade deficit; it has a deficit with many economies. The fundamental cause of such a deficit is the low saving rate and high consuming rate in the US, Long said.

The US dollar is a global currency. To allow dollars to flow to other countries, the US will not give its money away for free, it has to pursue a trade deficit. The US prints money in exchange for others’ goods and services.

"Such unique standing and role of the US means that it has to bear a trade deficit, the problem of Triffin Dilemma", according to Long.

The Triffin Dilemma, given to the drawback of having the world’s reserve currency, was identified in the 1960s by a Belgian-American economist named Robert Triffin.

The dilemma, in brief, is that if you have the world’s reserve currency, you must run a current account deficit to supply the world with liquidity.

Trump wants to turn America into a surplus country as part of making it a winner, but that is going to collide spectacularly with the Triffin Dilemma.

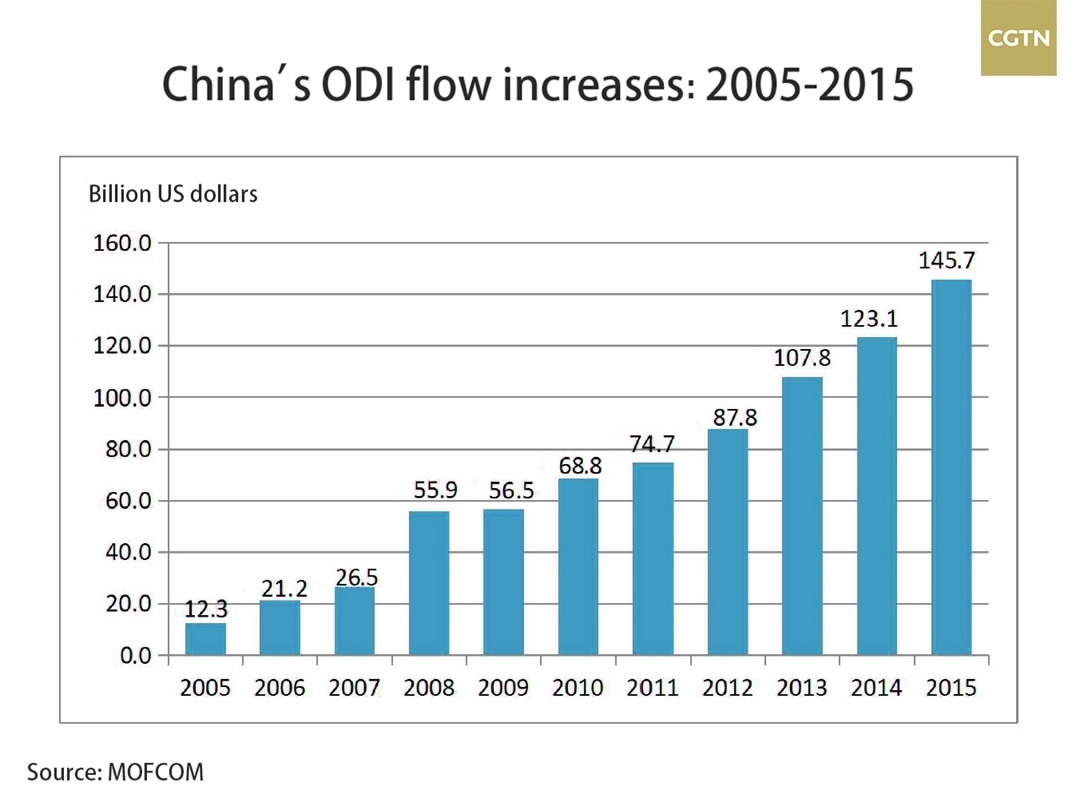

China's ODI plunges in H1

Qian Keming also said on Monday that China’s outbound direct investment (ODI) in the first six months of 2017 plummeted 42.9 percent year on year to 331.1 billion yuan (49.17 billion US dollars), as “irrational” investment has been effectively curbed.

The plunge was mainly due to a high comparison base, continued improvement in China's economy, rising uncertainties abroad and government measures to curb irrational investment, according to Qian.

Last year, there was an acquisition case involving 46 billion US dollars (ChemChina's acquisition of Syngenta), accounting for 82 percent of last year’s investment growth.

VCG Photo

VCG Photo

Yet China’s foreign investment in the Belt and Road countries in the first half edged down only 3.6 percent year on year.

The outward contracting volume in the first half hit 462.2 billion yuan, up 7.2 percent from a year earlier.

Citing Germany as a comparison, Long Guoqiang said it is natural for a country’s foreign investment to go through ups and downs. In 2015, Gemany’s overseas investment reached 93.3 billion US dollars, but the sum declined 63 percent to 34.6 billion US dollars in 2016.

Over the past years, China’s foreign investment has been growing rapidly.

“China has come to a new development stage. China’s enterprises have the need to make investment in the global market, instead of trade only, so that they can consolidate the global market resources,” Long said.

“Our departments have rolled out some measures to regulate the behavior, and we also bring in foreign investment and encourage overseas investment, and such policy direction will not change.”

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3