Cloud

09:40, 30-Nov-2017

Amazon adopts open cloud technology as competition heats up

CGTN

Amazon on Wednesday announced its adoption of Kubernetes, a popular open-source technology, in a sign of increased competition in the cloud computing business, which Amazon Web Services has long dominated.

Kubernetes has emerged as a standard among companies as they build more applications on public clouds, the big computer data centers that are displacing traditional customer-owned computer systems.

Earlier this year companies including Microsoft, Oracle and IBM announced their support for Kubernetes, which was originally developed by a team at Google.

Amazon's logo/Reuters Photo

Amazon's logo/Reuters Photo

AWS Chief Executive Andy Jassy made the Kubernetes announcement at Re:Invent, AWS’s annual conference in Las Vegas which this year attracted more than 40,000 attendees. Amazon also announced a marketing deal with the US National Football League and a flurry of other AWS features, including machine learning and artificial intelligence algorithms.

One of Kubernetes’ key advantages is its ability to run an application on any public cloud, including Microsoft’s Azure and Alphabet’s Google Cloud Platform, making it easier to migrate from one cloud vendor to another.

Amazon had previously offered a service of its own that was similar to Kubernetes, but the Google technology has established itself as the standard for such so-called “container” technologies and AWS ultimately had little choice but to support it, analysts said.

“This is an example of AWS looking outside of their own world in response to customer need,” said Joe Beda, one of the creators of Kubernetes and the chief technology officer of Heptio, a Seattle startup that builds software around Kubernetes technology.

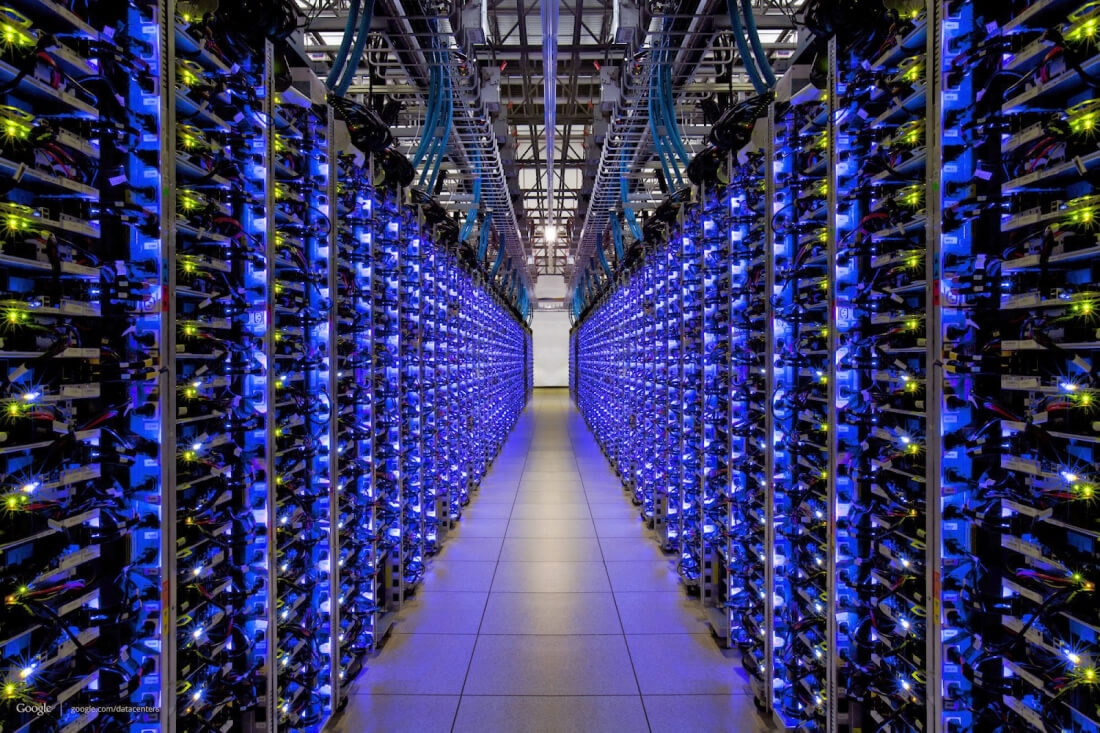

AWS pioneered the cloud computing business in 2006./AP Photo

AWS pioneered the cloud computing business in 2006./AP Photo

Microsoft, Google gain ground

AWS pioneered the cloud computing business in 2006 with a service touted as a quick and easy way for a smaller business to get affordable, high-powered computing services. It soon began to catch on among larger companies and continue to grow very rapidly, hitting 4.6 billion US dollars in revenue on 42 percent year-over-year growth in the most recent quarter.

But the market has begun to change. Although AWS’s share of the worldwide cloud infrastructure market has increased from 43.8 percent in the first half of 2015 to 45.4 percent in the first half of this year, two of its key rivals have also gained share, according to IDC, the market research firm.

Google Cloud Platform’s slice has grown from 1.7 percent in 2015 to 3.1 percent earlier this year, and more notably, Microsoft Azure’s share has increased from 5.6 percent to 10.3 percent in that time span.

“Amazon is still the clear market leader, but the cloud infrastructure market is massive and there’s room for many players,” said Amit Agarwal, chief product officer of Datadog, a New York startup that lets companies monitor their operations on public clouds.

Google Cloud Platform’s slice has grown from 1.7 percent in 2015 to 3.1 percent earlier this year./Fortune Photo

Google Cloud Platform’s slice has grown from 1.7 percent in 2015 to 3.1 percent earlier this year./Fortune Photo

Under the new deal with the National Football League, AWS will be one of the league’s “official technology providers,” allowing AWS to market its connection to the league and advertise during football broadcasts that it is powering the games’ “Next Gen Stats.”

The price of the deal was not disclosed.

“We’re working with some of the NFL broadcasters to investigate what are the great use cases for how to embed (this partnership) for the fan experience,” said Ariel Kelman, AWS vice president of worldwide marketing.

The idea is to market AWS to decision-makers without IT backgrounds, such as the chief executive and chief financial officers, Kelman said.

“Before they didn’t have to do that because they were the only guys in town,” said Brett Moss, a senior vice president of at Ensono, a Chicago IT services provider, said of the marketing effort. “Not anymore.”

Source(s): Reuters

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3