Business

15:05, 07-Sep-2017

Robot finance: Deutsche Bank boss spells out human cost of automation

Nicholas Moore

The chief executive of Deutsche Bank on Wednesday warned that automation in the finance industry will lead to a “big number” of job cuts, in comments reflecting the current climate of apprehension over the pros and cons of rapid technological advancement.

John Cryan told a conference “we won’t need as many people. In our banks we have people behaving like robots doing mechanical things, tomorrow we’re going to have robots behaving like people.”

Deutsche Bank CEO John Cryan. /AFP Photo

Deutsche Bank CEO John Cryan. /AFP Photo

While automated technology in finance is already boosting efficiency, will the rapid growth of RPA (Robotic Processed Automation) improve the world of finance, or put a high-skilled, well-paid workforce out of a job?

What is RPA?

When robotics, industry and the future are mentioned in the same sentence, most people imagine machines autonomously driving across warehouse floors, giant hydraulic arms working with pace and precision on a factory line or even humanoid robot waiters.

But with the finance and banking industry, the automation Cryan mentions is typically in the form of RPA software that handles databases, number-crunching, rule-based decision making and other complex but monotonous processes previously done by human employees.

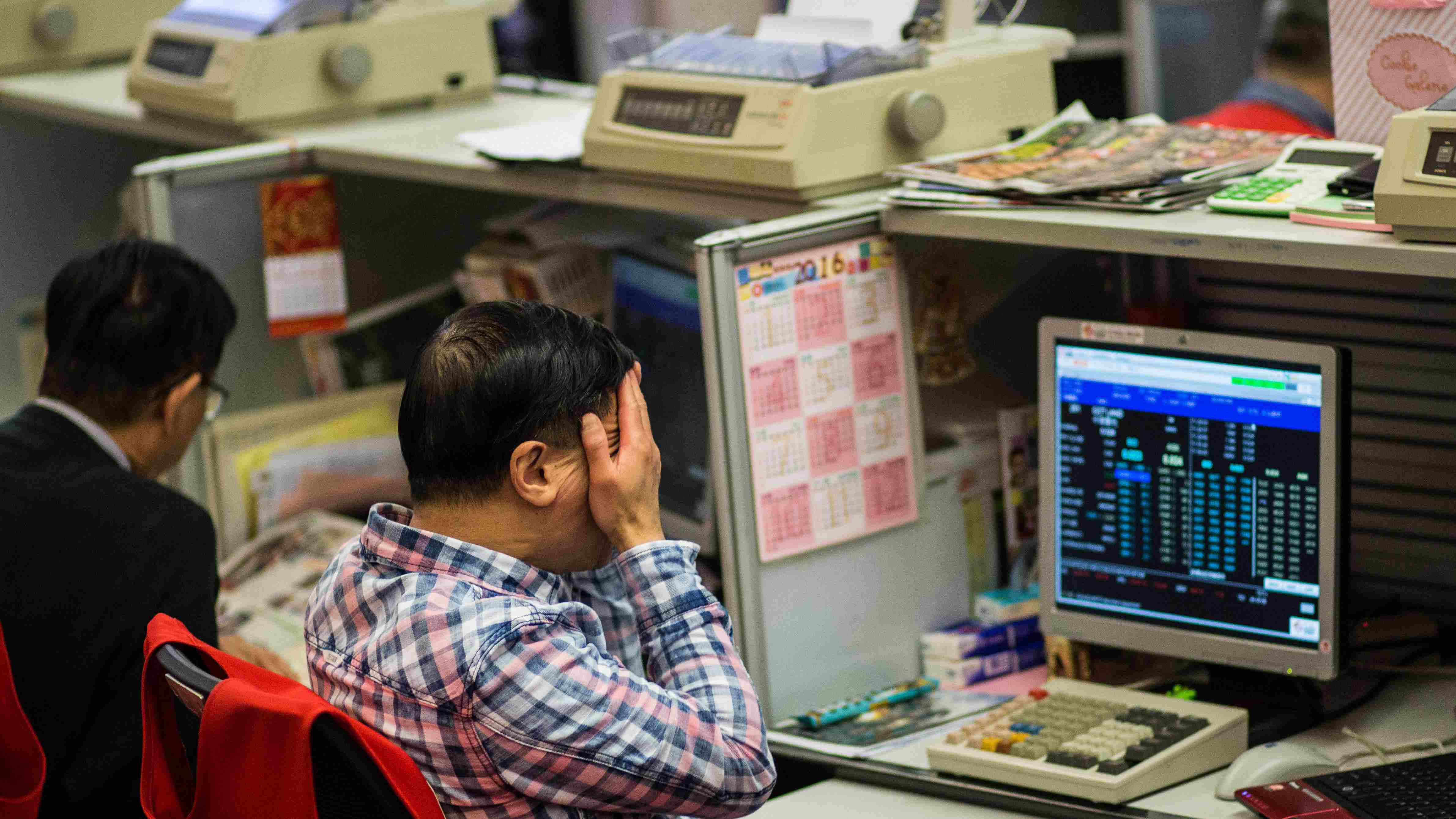

The world of finance is embracing technology - but will it come at a cost to workers? /AFP Photo

The world of finance is embracing technology - but will it come at a cost to workers? /AFP Photo

RPA plays a key role in self-service banking by improving efficiency, ruling out human error and speeding up transactions. With the growth in cognitive technology, machine learning, and AI technology, RPA is set to grow rapidly in the coming years.

Are human workers under threat?

The Institute for Robotic Process Automation says that RPA bots cost a third of the price of an offshore full-time employee and one fifth of an onshore worker. Such potential savings mean that RPA is set to boom, and likely at the expense of many human workers.

Grand View Research estimates RPA will grow from a current value of 125.2 million US dollars to become an entire industry in its own right, worth 8.75 billion US dollars by 2024.

PwC is anticipating an expansion of automation in Chinese finance companies, where it believes “RPA can reduce manual processes by 70 percent and… significantly cut down error rates to less than 0.05 percent.”

While RPA software bots are not physical machines, the advent of AI technology could see automation replace human workers in the financial sector on a big scale. /AFP Photo

While RPA software bots are not physical machines, the advent of AI technology could see automation replace human workers in the financial sector on a big scale. /AFP Photo

PwC’s Global FinTech Survey China Summary 2017 estimates that 68 percent of financial institutions in the country will increase their FinTech partnerships in the next five years, stating “Chinese financial institutions regard themselves as a source of disruption, and are keen to adopt emerging technologies such as… RPA.”

As far as the workforce is concerned, KPMG estimates that in the next 15 years, three-quarters of current offshore jobs will be performed by software bots capable of working 24 hours a day, seven days a week.

Research by McKinsey suggests that by 2025, RPA may be capable of performing the equivalent productivity of as many as 140 million workers worldwide.

So it doesn’t look good for finance workers?

On the contrary, many leading banks and financial institutions are trying to sell RPA to their employees as an exciting opportunity to work alongside robots, rather than be replaced by them.

Deutsche Bank’s John Cryan himself further added on Wednesday that RPA could improve current jobs by freeing workers from monotonous tasks. By working alongside RPA software, Cryan said accountants at Deutsche would have much more time to “analyze the numbers, form valid opinions what those numbers mean and not just produce them.”

A relic of the past? Human stockbrokers at Barclays, London in the early 2000s. /AFP Photo

A relic of the past? Human stockbrokers at Barclays, London in the early 2000s. /AFP Photo

Whether or not the RPA revolution will be a source of mass unemployment or the key to freeing skilled employees from monotonous tasks remains to be seen.

Antony Jenkins, the former CEO of Barclays, said in July this year that he believes technology will deliver a “Uber moment” to financial services, expecting the number of people employed in the sector to “decline by as much as 50 percent over the next 10 years.”

However, Wired is more optimistic, giving the example of the last major technology disruption to the banking sector – the ATM. Introduced in the 1970s and developed on a major scale in the 1990s, fears that the Automated Teller Machine would replace human bank clerks were unfounded – the number of human bank tellers actually increased in the 2000s, thanks to ATMs making “it cheaper to open branches, so banks opened more of them.”

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3