Business

18:32, 20-Nov-2017

Debt regulation urgent after payday loan suicides

By CGTN’s Yang Jing

The necessity of regulating China’s burgeoning payday loan industry has been brought home by a tragic case in Neijiang, southeast China’s Sichuan Province.

“My wife was two months pregnant when she committed suicide,” said a man surnamed Li quoted by local newspaper Chengdu Business on Thursday.

Li’s wife, Ye, a 36-year-old already with a young son, killed herself by drinking pesticide on November 12. She had recently told her family that she could not pay off her debt of around 80,000 yuan (12,076 US dollars) borrowed from several online lenders, Chengdu Business reported.

After Ye’s death, her family received numerous phone calls and messages urging them to repay the debt, even including threats to harm her son.

Ye is not the only person in China who has found themselves in a desperate situation after taking out high-interest cash loans. In April, a college student in the eastern city of Xiamen also reportedly committed suicide under the pressure of online debt.

Cash loans thrive in China

Compared with loans from banks, online cash loans can usually be obtained quickly and without thorough background checks, but with much higher interest rates calculated on a monthly or daily basis.

Online lenders have seen explosive growth in China. There are 2,693 such businesses in China, mainly in Beijing, Shanghai and Guangdong Province, Wu Zhen, general secretary of the National Committee of Experts on Internet Financial Security Technology, said at a forum on Thursday.

However, the real number of payday lenders could be much more than that, considering many are difficult to track, Yang Wang, research director of the Hande Fintech Research Institute, told CGTN.

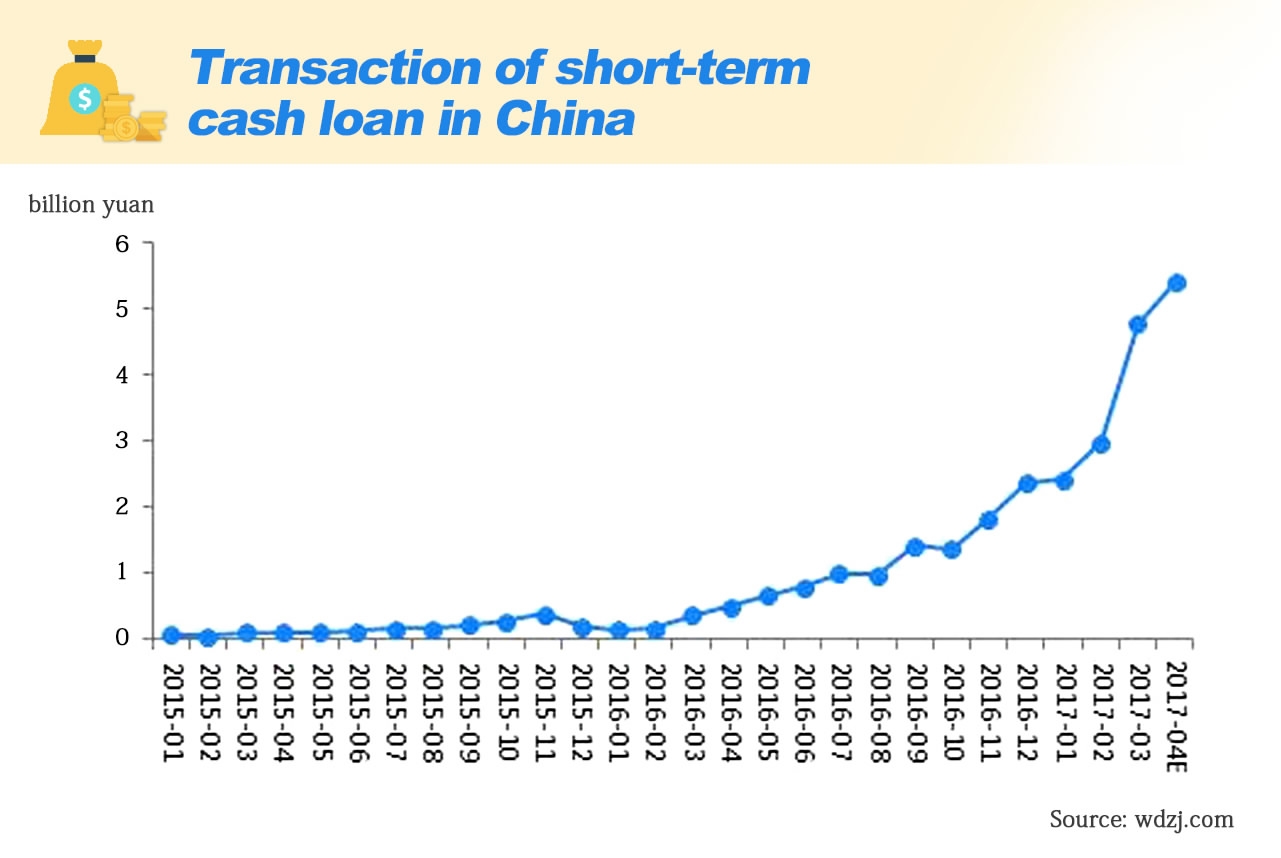

There were 12 times as many short-term personal cash loan transactions in March 2017 than in the same month a year earlier, according to a report released in April by financial news website wdzj.com. It defined short-term personal cash loans as those with maturity shorter than one month and less than 10,000 yuan.

The report estimated that China’s total market volume of personal cash loans is somewhere between 600 billion yuan and 1 trillion yuan.

Driving forces of the bonanza

Chinese micro-credit provider Qudian, which had the biggest US listing by a Chinese fintech firm this year, reported more than threefold year-on-year growth for both revenue and profits in the third quarter.

Although Chinese regulators have capped the annual interest rate of private loans at 36 percent, that limit is obviously overlooked by the profit-seeking industry.

Qudian said among its transactions in 2016, 59.5 percent of its annualized fee rates exceeded the 36-percent roof, although it reduced the rates to be in compliance with the regulation. That led to a revenue cut equal to 21 percent of total revenue in 2016, according to its prospectus filed to US Security and Exchange Commission.

Qudian is one of the “very few of companies” in the cash loan business that consistently meets the 36 percent requirement, the company’s CFO Yang Jiakang said after the release of its third-quarter earnings report on November 13.

A page of a cash loan app /VCG Photo

A page of a cash loan app /VCG Photo

So it isn’t surprising that the payday loan business thrives as a result of high profits and weak regulation.

In addition to profit, market needs are another driving force, Yang Wang said, noting that there are thought to be more than 400 million people in China who have little access to credit due to no or poor credit records.

Banks are being encouraged to lend to underserved groups as a part of national effort to develop inclusive finance, but they and credit firms are understandably too risk-adverse to lend to borrowers with weak credit records. The cash loan companies build a bridge by being a marketplace to connect the two sides, Yang Wang said.

Strengthening regulation

Although Qudian CEO Luo Min said in an interview that his company will not resort to violence in debt collection, there have been many cases similar to Ye and the college girl’s tragedies, leading to a heated discussion on whether online loans are usury.

Another concern is multiple borrowings. Research has found that there are currently more than a million cash loan consumers in debt to multiple platforms, according to Wu.

If the multiple borrowing escalates and subprime lenders, who lend to people with poor credit, come close to going bust, the risk will expand to the wider financial system, according to Yang Wang.

Regulators are aware of these risks.

After banning cash loans targeted at students, officials of China’s central bank are planning to toughen the regulation.

All financial businesses including cash loans must be supervised and be licensed, Ji Zhihong, director of the Financial Markets Division at the People’s Bank of China, said at a forum on October 28.

Like regulating the once-surging peer-to-peer finance sector, lawmakers will make it more difficult to enter the market and cap the profitability of cash loan businesses, Yang Wang said, noting a reasonable profit margin will rationalize the overheated market.

He also said that considering some local Internet finance regulators have already started surveying cash loan businesses, a set of more specific regulations should be published soon, even before the end of this year.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3