21:35, 10-Jul-2018

US-China Trade Friction: Analysts: Impact of trade tensions limited

Updated

20:38, 13-Jul-2018

02:58

Moving to trade issues now. What is the outlook for consumer and producer prices as the trade war between the United States and China continues? Our reporter Chen Tong talked to some experts to find out.

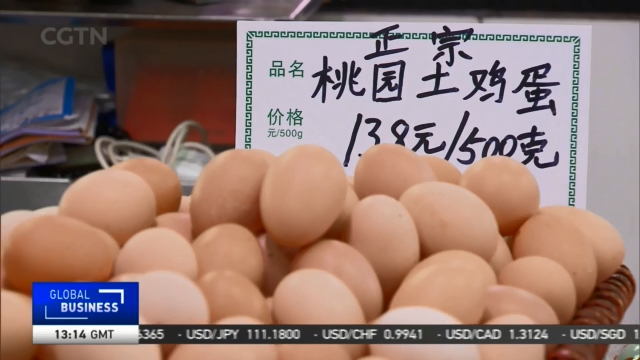

On a year-on-year basis, food prices grew 1.4 percent in the first half of the year. While that made for a stable growth rate in the first six months, there is concern that China's tariffs on U.S. agricultural products could push up domestic consumer prices. China's counter-tariffs of 25 percent in response to the US duties took effect last Friday. China is now the world's largest importer of soybeans, for example, and the United States was one of its largest suppliers. Experts remain optimistic about consumer prices, however, saying that they are not facing pressure for either deflation or inflation.

HUANG XIAODONG, DEPUTY DIRECTOR INSTITUTE FOR ADVANCED RESEARCH, SUFE "Overall consumer prices are quite stable. The tariffs on U.S. soybeans may push up the domestic soybean prices and then push up food prices as well. But we don't think the tariffs will have a large impacts on the CPI because the weight of soybean foods only accounts for a small part in the CPI. Currently, we are not facing any pressures of deflation or inflation, so the tariff should not result in any shock to consumer prices."

While consumer prices may not be seriously affected by the tariffs, China's trade data may see some changes. The country's trade surplus narrowed by 31 percent during the first five months of the year and experts believe that the tariffs will continue to shrink it. The shrinking trade surplus could put further depreciation pressure on the Renminbi.

ZOU PINGZUO, CHIEF RESEARCHER PBOC FINANCIAL RESEARCH INSTITUTE "The trade disputes will affect our trade surplus and that will affect the supply and demand of our foreign currency, so the value of the Renminbi will see some fluctuation. But what's supporting the Chinese currency is the country's productivity. We have 1.4 billion people, a very large work force. In addition, our technical capabilities are improving, so we have a lot of advantages in that area. We also have a lot of natural resources. As long as government policy is appropriate, the value of the Renminbi won't depreciate significantly in the long term."

And in fact, after continually falling for weeks, the value of the Renminbi against the dollar has just started appreciating a bit. The Renminbi midpoint fixing against the dollar was 6.6259 today, 134 basis points stronger than yesterday.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3