Business

18:42, 27-Mar-2018

Experts: Chinese brands should aim wider than US market

By CGTN’s Yang Jing

Leading Chinese companies saw their brands value surge amid rising protectionism, branding experts said, noting there are many markets full of potential for Chinese brands to explore other than the US.

Apart from the current trade tensions between China and the US, a more pressing problem is that the US Committee on Foreign Investment in the US (CFIUS) is trying to rewrite rules that will affect joint ventures and investors, said Martin Sorrell, the CEO of WPP Group in an annual branding report press conference on Monday in Beijing.

With CFIUS expanding its influence, Broadcom’s failed bid for Qualcomm is just the tip of the iceberg, he noted.

Martin Sorrell, the CEO of WPP Group speaks at a press conference on March 26. /BrandZ Photo

Martin Sorrell, the CEO of WPP Group speaks at a press conference on March 26. /BrandZ Photo

Singapore-based Broadcom said on March 14 that it had abandoned efforts to take over US smartphone chip maker Qualcomm, two days after its bid was blocked by US President Donald Trump over national security concerns, which reports said were caused by Broadcom’s ties with China.

Chinese tech gear maker Huawei Technologies Co Ltd’s planned deal with US carrier AT&T Inc to sell its smartphones in the US also collapsed in January because of security concerns.

Overseas markets’ little trust in Chinese brand has been a major challenge but Huawei has been committed to overcome it by respecting local culture and building connection with young generation around the world, the company told CGTN via e-mail on Tuesday.

Under these conditions, Chinese brands should look at other choices for overseas expansion in places such as the Middle East and Latin America, Doreen Wang, Global Head of BrandZ, Kantar Millward Brown, told CGTN at the sidelines of the report release.

For example, in addition to ranking at the third in terms of smart phone shipment in global market last year, Huawei also won more than 15 percent market share in Latin America, Middle East and Africa combined, the company said, noting it has positioned itself as a global company at the very beginning and now its overseas market revenue is higher than the domestic one.

Even without the resistance by Trump’s administration towards foreign investment, it is difficult to persuade consumers in the US, a highly mature market, to accept new brands when they already have so many choices, but these emerging markets on the other hand have a large population of young people, that are potential consumers and are open to new brands, she said.

Doreen Wang, Global Head of BrandZ, Kantar Millward Brown speaks at a press conference on March 26. /BrandZ Photo

Doreen Wang, Global Head of BrandZ, Kantar Millward Brown speaks at a press conference on March 26. /BrandZ Photo

Many Chinese companies, such as drone maker DaJiang and smart phone makers OPPO and VIVO, have made great leaps in both domestic and international markets, particularly in places like India, according to Wang.

Under the pressure of rising labor costs and increasing consumption, Chinese companies have had to build their own brands instead of being OEM (original equipment manufacturers) and many of them have made great progress in internet, e-commerce and smart hardware, Wang said.

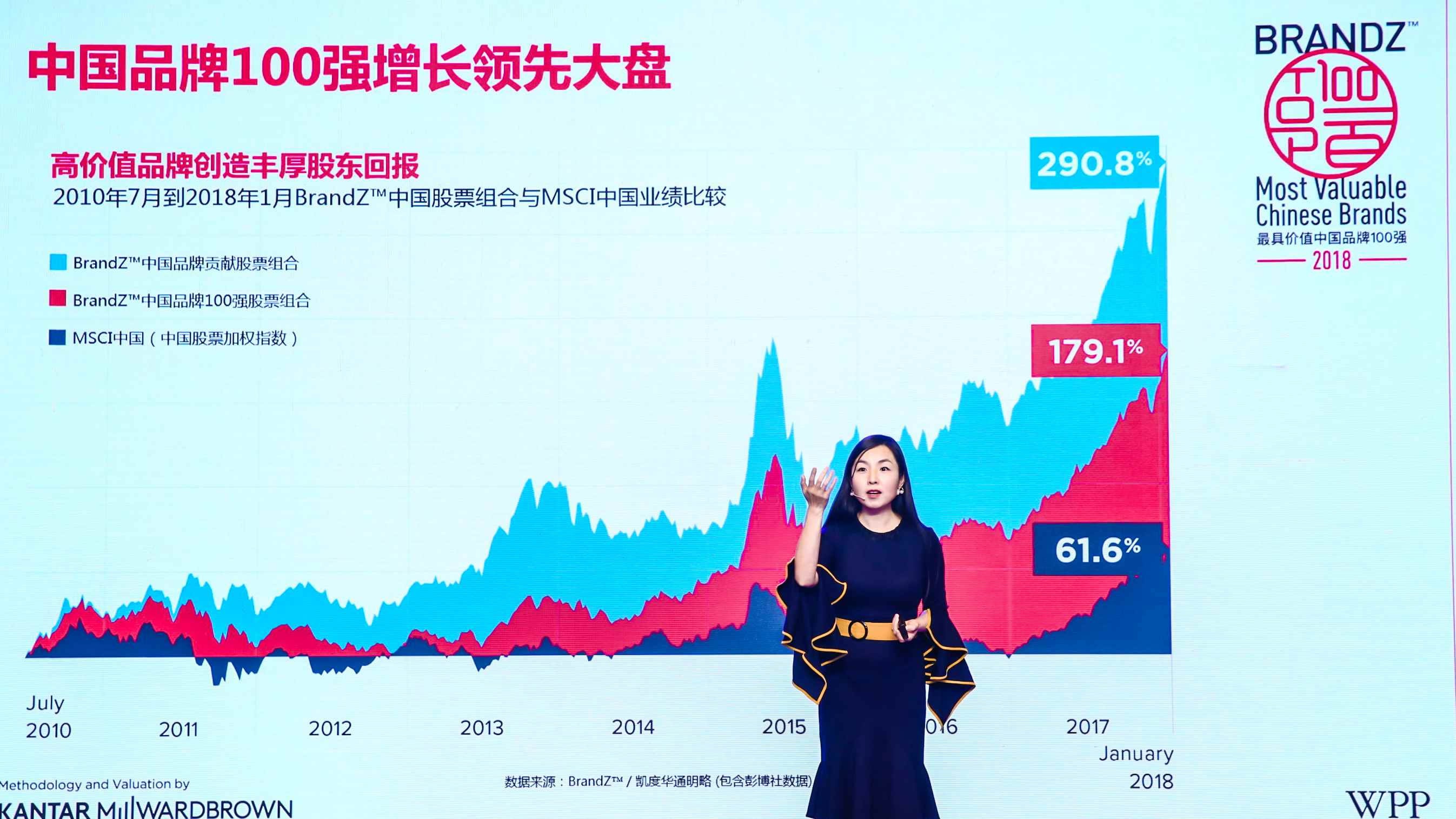

The top 100 Chinese brands (all owned by public companies) have achieved a 23 percent year-on-year growth in brand value, with the value standing at 683.9 billion US dollars this year, according to the BrandZ top 100 most valuable Chinese brands, a yearly study on brands released on Monday by WPP and Kantar Millward Brown.

Internet giant Tencent retained the coveted title of China’s most valuable brand for the fourth consecutive year, with a value of 132.2 billion US dollars, a 25 percent increase from 2017, according to the report.

E-commerce mammoth Alibaba continued to grow at a phenomenal rate, achieving an impressive 53 percent year-on-year increase in brand value, now worth 88.6 billion US dollars.

The brand value ranking report combines financial data with consumer opinions gathered from interviews with over 400,000 Chinese consumers to give a dollar value to how brand powers business.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3