Business

20:27, 29-Oct-2017

Who will be the next US Fed chief?

CGTN

Who is going to succeed Federal Reserve Chair Janet Yellen as the world’s most powerful banker and continue to steer the global economy? The disclosure is just days away.

The White House has confirmed that US President Donald Trump will announce his choice for the chairman of the Federal Reserve next week. The announcement is crucial to global monetary policymaking, as an alarm has been sounded worldwide over cheap money-saturated markets.

Colors nailed to the mast?

Janet Yellen, the current Fed chair /Photo from VCG

Janet Yellen, the current Fed chair /Photo from VCG

A number of candidates have been floated over the past few months whose views on money supply range from dovish to hawkish. A dovish attitude is often reflected in turning on the monetary tap.

Janet Yellen, the current Fed chair who is about to step down next February, is on the shortlist for the position after her interview with Trump on October 19.

To keep the current head could minimize the impact on markets brought about by the change of individual policy preference.

Yellen’s policies tend to stand in between dovish and hawkish. The unemployment rate weighs heavily on her decisions regarding the change of interest rates.

The Republican president used to accuse Yellen of maintaining low interest rates to help former US President Barack Obama, his Democratic predecessor, in 2016. However, the critical tone was reversed this September when Trump said he likes and respects her.

Federal Reserve Governor Jerome Powell delivers remarks during a conference at the Brookings Institution in Washington, DC, US, on August 3, 2015. /Photo from VCG.

Federal Reserve Governor Jerome Powell delivers remarks during a conference at the Brookings Institution in Washington, DC, US, on August 3, 2015. /Photo from VCG.

Another candidate that has ranked high on the shortlist is Jerome Powell, a current governor of the Federal Reserve and a colleague of Yellen’s.

In controlling money supply, Powell has a dovish tag on him but he has also embraced Yellen’s policy, keeping the faith that a tighter job market will eventually push wages higher and end a lengthy period of worryingly low inflation.

However, Powell’s stance on regulating Wall Street draws him closer to Trump and away from Yellen in relation to Dodd-Frank, an act that puts banks on a leash. Trump has long planned to loosen the legal yoke, while Yellen is more pro the regulation.

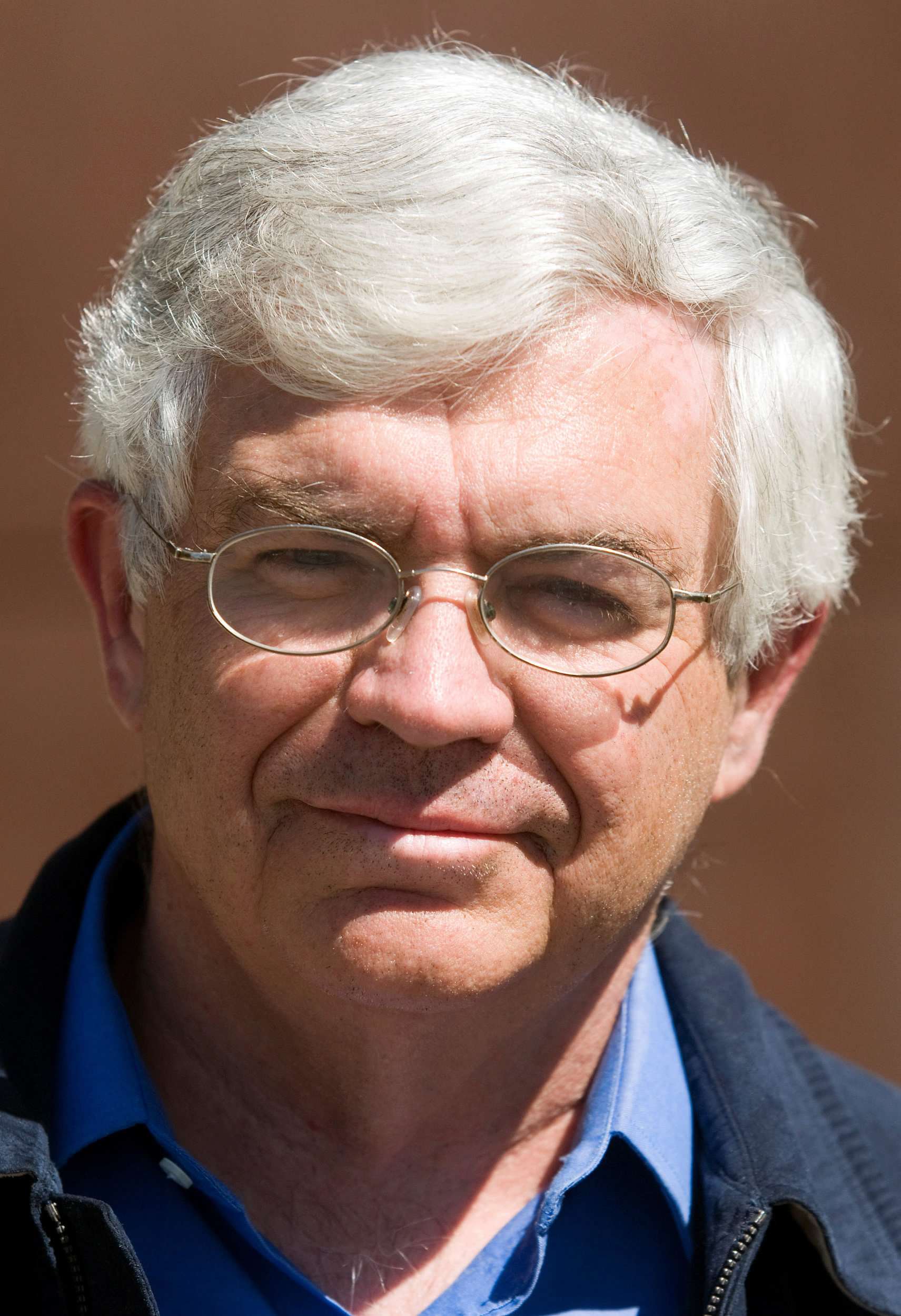

Stanford Economics Professor John B. Taylor speaks with journalists at the Jackson Hole Economic Symposium in Jackson Hole, Wyoming August 21, 2009. /Photo from VCG

Stanford Economics Professor John B. Taylor speaks with journalists at the Jackson Hole Economic Symposium in Jackson Hole, Wyoming August 21, 2009. /Photo from VCG

Stanford University economist John Taylor, 71, is a front-runner for the job that can be labeled as a hawk concerning the Fed’s policies.

A long-time adviser to Republican presidents and presidential candidates, and a former Treasury Department official, Taylor is backing a more rule-based device to set interest rates rather than leaving them at the Fed governor board’s whim. According to his model, also known as the “Taylor Rule,” the interest rates should be put around 3 percent, far higher than the current 1.15 percent.

This position has landed him the criticism of handcuffing US monetary policies with rigid rules, on which Taylor has tried to soften his tone. During a meeting at the Boston Fed on October 21, Taylor clarified that he favored a flexible implementation of policy rules and did not want to tie the Fed’s hands or suggest that he was motivated by a distrust of policymakers.

Other contenders for the job of leading the Fed include more hawks than doves.

Glen Hubbard, dean of Columbia Business School since 2004 is among the critics of current Fed policies. In January this year he criticized the Fed for trying to do too much to support the economy, calling its monetary policy “past its shelf life.”

Former Fed governor and Morgan Stanley banker Kevin Warsh’s potential nomination for the top job of the Fed is also expected to point to tighter monetary policies down the road. Now a senior fellow at Stanford University’s Hoover Institution, a conservative think tank, Warsh is also an open critic of Yellen.

John Allison, former chief executive of BB&T Bank, is one of the most hawkish candidates who have been flagged as a potential successor to Yellen. However, in an interview with Bloomberg earlier in October, Allison had talked down his inclination to serve in the central bank.

"No, I really wouldn’t in all honesty," Allison told the US media when asked about the chairmanship. “I really would like to get rid of the Fed. I’ve been very vocal about that. I think their job is impossible.”

Out of a monetary trap

Tame the dollar?

Tame the dollar?

One of the most urgent challenges facing the new chairman will be wrestling with the low interest rates that have driven up the prices of nearly all assets in the market without cooling down the engine for growth.

Price hikes are immanent in the US. Records have been renewed several times in the S&P 500, while house prices have surpassed the 2008 peak. Bond yields are also falling across a wide range of portfolios. The hunger for high-yield investment, fueled by cheap borrowing, could blind investors about the risks lurking in the assets they are buying, yet not fully understanding.

To wind up easy monetary policy by raising interest rates, however, means increasing borrowing costs, which could blunt businesses’ impulses to spend, hurting growth and the labor market.

The most recent growth data, released on Friday that showed the US economy had recorded 3 percent annual growth in the third quarter, can give the new chair a way out of this predicament with more aggressive interest rate rise.

Ian Shepherdson of Pantheon Macroeconomics, a consultant, told the Financial Times that the growth rate could be an omen for a rebound in US jobs that is “months away,” which suggests the Fed may be looking at a bolder option of hiking interest rates since its last move in June.

“Nothing drives Fed policy like the unemployment rate,” he said.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3