Opinions

12:05, 11-Dec-2017

China’s aims to improve business environment to increase competitiveness

By CGTN’s Ren Xueqian

Dean of the Chinese Academy of Fiscal Sciences Liu Shangxi said the impact of the new US tax plan would affect the international economy.

He, however, said the overall direct impact on China would not be as significant compared to the European Union, where US foreign direct investment is high.

Liu said the EU is now concerned whether the tax cut will lead to global tax cuts and increase deficits for other countries.

“If this happens, it might weaken their fiscal policies, force them to expand fiscal analysis, and lead to more market complications,” Liu added.

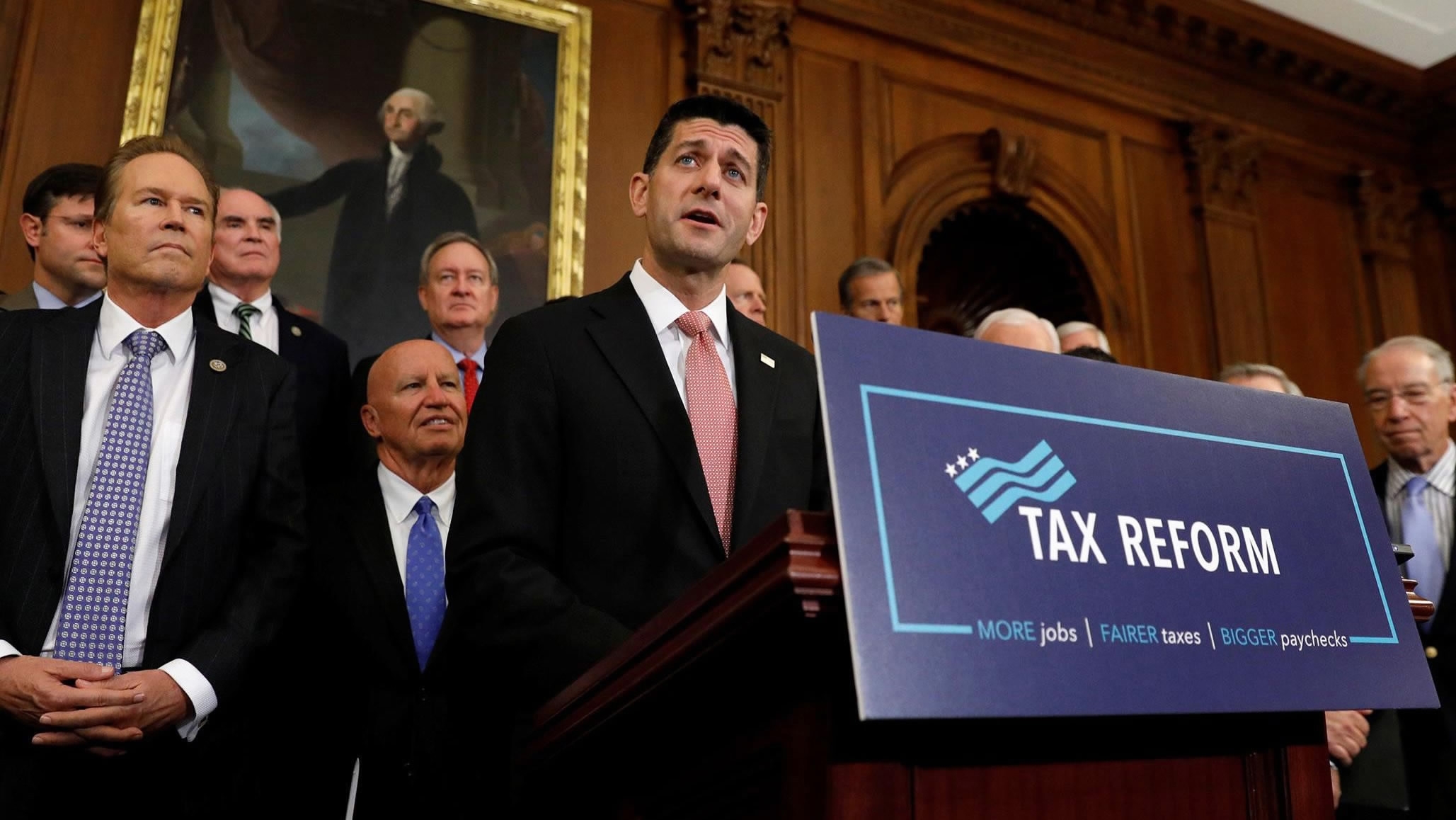

Speaker Ryan and fellow Republicans discuss the GOP tax plan on Capitol Hill, September 27, 2017. /Reuters Photo.

Speaker Ryan and fellow Republicans discuss the GOP tax plan on Capitol Hill, September 27, 2017. /Reuters Photo.

Currently, the US imposes a 35 percent tax rate on all earnings generated anywhere in the world.

It is the highest statutory tax in advanced economies when compared to the OECD average of approximately 25 percent, which is about the same rate as China.

Under the GOP’s new tax bill, corporate tax would be lowered to 20 percent and would allow US companies to permanently treat overseas profit as if it had already been repatriated.

It means businesses will no longer owe full taxes on profits made abroad. Instead they would be taxed at a minimal rate depending on the types of foreign earnings and that rate would be paid over several years.

“If we add this tax reduction on overseas profits to the overall corporate income tax cut, we think these measures will incentivize US companies to repatriate their post-tax foreign earnings. It might even lead to a wave of overseas profit reparations,” said Zhu Qing, a professor at Renmin University’s School of Finance.

Speaking of concerns of potential talent and capital flee from the Chinese market, he said China has long carried out tax reforms, and the country’s VAT reform has helped businesses save some 1.7 trillion yuan (approximately 256 billion US dollars) in taxes since 2012.

/VCG Photo

/VCG Photo

Experts said as the world’s second-largest economy, China first drew up its large-scale tax relief plans before the outbreak of the global financial crisis. These reforms, they said, were aimed to help China transform its economic growth patterns in ways that would help boost economic development and confidence in the country’s real economy.

“A country’s tax reforms will be structured to fit the country’s practical needs,” Liu said, “China’s ongoing efforts to improve its business environment and market openness will increase its competitiveness in the global market.”

According to statistics, China has increased the annual taxable income cap for small to medium-sized enterprises (SMEs) from 60,000 yuan to 500,000 yuan. For small and medium tech companies, China is allowing up to 75 percent coverage of pre-tax deductions on R&D expenses, that is up 25 percent from the previous rate.

Since 2013, The Chinese government has also cut over 72 percent of its administrative and institutional fees on activities such as trademark and marriage registrations, business licensing, official inspection and quarantine of cross-border goods, etc. Among that, services charges on businesses were reduced by 69 percent.

Under such deductions, the government has reduced businesses and consumer burden by some 320 billion yuan annually on a national level, and 47 billion yuan each year on provincial levels.

US President Donald Trump has laid out a plan to overhaul the country’s tax code. It includes slashing corporate and individual taxes and removing deductions. /Reuters Photo

US President Donald Trump has laid out a plan to overhaul the country’s tax code. It includes slashing corporate and individual taxes and removing deductions. /Reuters Photo

Liu said the 19th National Congress of the Communist Party of China has emphasized the need for construction of a modern economic system and deepen its supply-side structural reforms. Under such guidelines, he said, China will continue to strengthen its efforts to reduce tax rates in the future.

“These reforms and policies are not intended to help China cope potential impacts of GOP tax cuts, but ongoing development efforts that China has been perfecting on for years," said Liu.

The current US federal corporate tax rate is ranked the highest among advanced economies, levying at nearly 35 percent, plus another 4 percent state income tax rate for a combined total of about 38 percent or higher.

With the new tax plan, the Trump Administration is looking to lower corporate tax by 15 percent, making it the biggest reduction for corporations in over three decades.

The bill is also looking to reduce individual income tax brackets and to double the standard deduction (reduce taxable income) and increase child credit.

Once the bill is passed, the big business cut would become permanent and the rate reductions for most Americans are due to expire in eight years, that’s the end of 2025.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3