21:25, 02-May-2018

US Tech Giants Thrive: Q1 results beat expectations

02:38

Three major US tech firms -- Google's parent company Alphabet, Facebook and Amazon -- have now turned in their first quarter financial reports, and they're all very impressive. Just a week previously, however, the companies' stock prices were suffering. Why was that? Mi Jiayi has more.

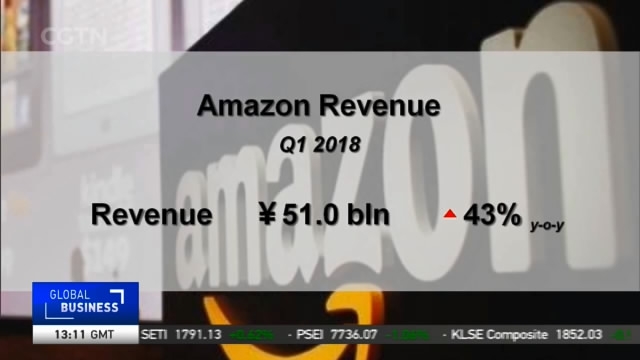

Results at all three of the US tech firms beat market expectations. Google parent Alphabet's revenue hit 31.15 billion US dollars, 26 percent higher than the same period last year. Facebook recorded revenue of 11.97 billion US dollars, well above expectations despite its privacy scandal. Amazon's first quarter revenue hit 51 billion US dollars, up 43 percent from a year ago. The three companies have one thing in common, which is that their online advertising business supports the lion's share of their revenue, in some cases as high as 70 percent. And that business seems not to have been dented by the recent outbreak of privacy issues. However, the impact of the privacy controversy might not be fully represented in the income numbers.

ETHAN WANG, HEAD OF INVESTMENT STRATEGY STANDARD CHARTERED CHINA "Two reasons. One is that the Facebook incident happened pretty late in the first quarter, almost in April. And so there was not much impact on its business operations for that period. The other reason is that the original incident backdates to two years ago, and Facebook investigated the advertising company involved, so wasn't as powerful as a current event."

Notably, however, the major US tech firms saw their stock prices fall after the earnings releases. Alphabet released its figures on April 23, and the stock price fell 4.8 percent. All the five major tech firms in the US -- Facebook, Amazon, Apple, Netflix and Google -- together saw their market value fall by 85 billion US dollars. One major reason was that despite the good revenues, the tech firms are also spending more money developing other businesses, including smart driving, cloud computing and artificial intelligence.

ETHAN WANG, HEAD OF INVESTMENT STRATEGY STANDARD CHARTERED CHINA "We can see these tech firms are spending more money, which will affect their profitability, and the impact will be reflected in their stock prices. But in the longer run, these expenses are not a bad thing. Take Amazon as an example, it has been investing in cloud computing for a long time, and the return from this business has been growing substantially over the past few quarters. So the new businesses into which the companies are putting money could be new sources of income in the longer term."

Some analysts are warning that the uncertainty over government regulations on privacy protection may pose a threat to the tech firms future advertising business, and that is a good reason for them to find other sources of revenues as fast as they can.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3