15:34, 29-Jun-2018

China Market Reform: New ownership easing steps to take effect July 28

Updated

14:42, 02-Jul-2018

02:11

China has unveiled a long-anticipated easing of foreign investment curbs on sectors including banking, the automotive industry, agriculture, and heavy industries. It's the latest move Beijing has made to fulfil its promise to open its markets further. CGTN's Yang Zhao has the details.

The National Development and Reform Commission, China's top economic planner, published on its website a new version of the so-called "negative list" that will take effect on July 28th. The list is shorter, has less restrictions and opens up the market even further. The number of items on the list was cut to 48 from 63 and it widens market access for foreign investment to 22 industries.

Investment restrictions on the service sector have been dramatically narrowed down. Beijing will allow 51 percent foreign ownership of brokerages and life insurers, and remove cap entirely by 2021. China will also ease or scrap ownership caps on businesses including passenger railway networks, shipping companies, power grids, gas stations, and wholesale crops.

The manufacturing sector in China will also turn more foreign capital-friendly. Foreign ownership limits for commercial car manufacturing will be removed by 2020, and for passenger cars by 2022. Restrictions on aircraft and shipbuilding industries will also be lifted.

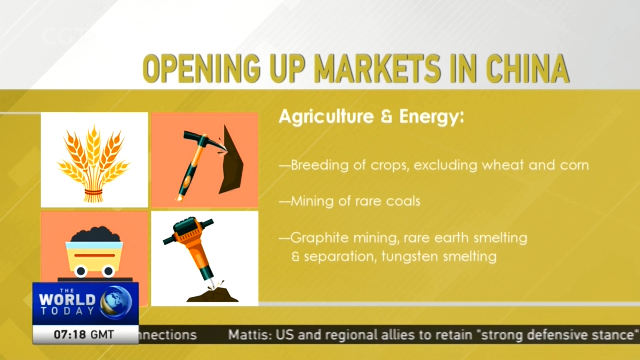

Foreign capital will also be allowed to access the agriculture and energy industries. This will include the breeding of crops, except wheat and corn, rare earth smelting, and the mining of rare coals.

Many of the measures are being implemented following China's promise in April to further open up.

China's top trading partners, the United States, and the European Union, have long been calling for less restrictions to enter the world's second-largest economy. But China has repeatedly said it will continue market reforms at its own pace, stressing it will open them up based on its own needs and not due to external pressure. YZ, CGTN.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3