Business

19:58, 08-Jul-2017

7 out of top 10 global cities with highest house prices growth are in China

Seven of the ten cities that saw the highest growth in property prices in the first quarter of 2017 are in China, despite the average appreciation rate growing at a slower rate than the previous quarter, according to the Global Residential Cities Index released by Knight Frank, a London-based real estate consultancy.

The company tracked house prices in 20 Chinese cities, and found that the average price appreciation rate stood at 15.9 percent year on year in the first three months of 2017, down from the 19.2 percent registered in the last quarter of 2016.

Government measures that have placed restrictions on buying property, such as raising the minimum down payment ratio and limiting second home purchases, have helped slow the upward trend of prices in China.

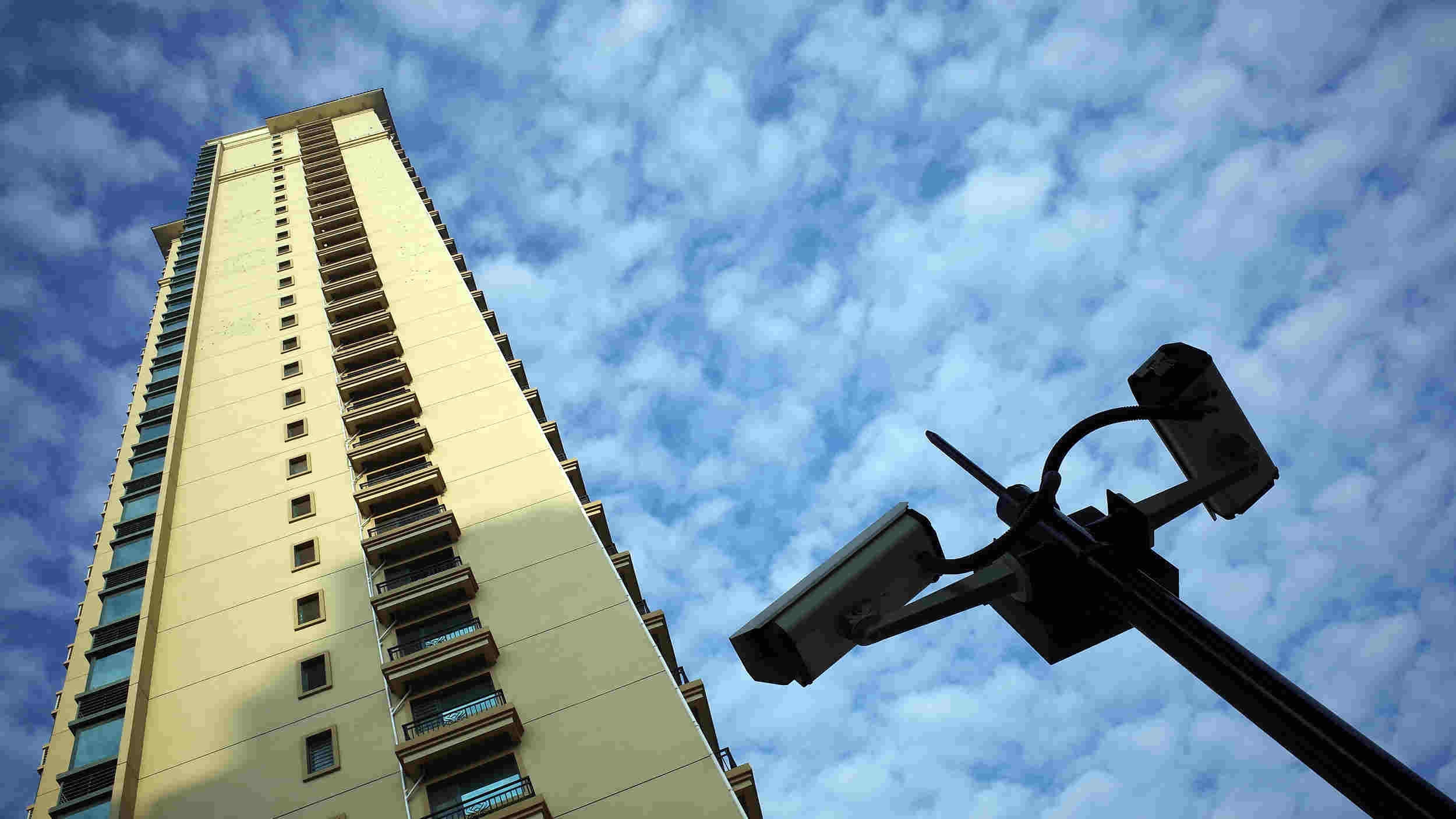

Wuxi, in east China's Jiangsu Province, topped the ranking of Knight Frank Global Residential Cities Index, with house prices increasing 31.7percent in the first quarter of 2017. /VCG Photo

Wuxi, in east China's Jiangsu Province, topped the ranking of Knight Frank Global Residential Cities Index, with house prices increasing 31.7percent in the first quarter of 2017. /VCG Photo

Three second-tier Chinese cities saw the fastest increase of property prices worldwide, namely Wuxi (31.7 percent) and Nanjing (28.8 percent), two cities of east China's Jiangsu Province, and Zhengzhou (25.4 percent) of central China's Henan Province.

Shanghai (19.7%) and Beijing (20.5%), which previously ranked third and sixth respectively, dropped to the 13th and 12th positions.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3