21:34, 25-Jun-2018

China RRR Cut: 700 bln yuan liquidity boost, scale larger than expected

01:48

To monetary policy where China has lowered the reserve requirement ratio of most of the country's banks. That means banks can park LESS money at the central bank and help support the real economy. Xia Cheng reports.

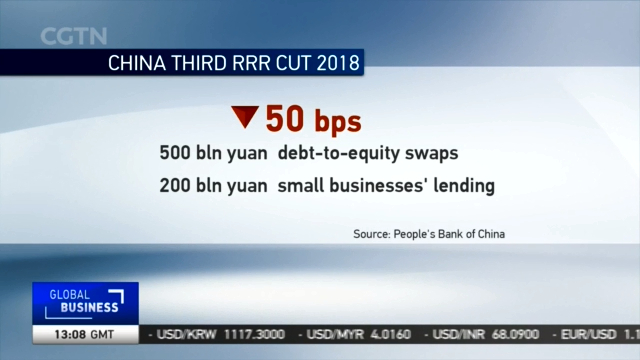

The PBOC, China's central bank, cut the triple R over the weekend by 50 basis points.

The new ratios will take effect from July 5th.

The central bank says the cut was to support debt-to-equity swap programs and help small businesses in financing.

The move will release 700 billion yuan or about 107 billion US dollars of liquidity into the financial system.

YANG DELONG, CHIEF ECONOMIST FIRST SEAFRONT FUND MANAGEMENT "700 bln yuan to be released! That's far more than what market previously expected. For the last reserve cut in April we already had 400 bln yuan out in the market. And this time the scale is even bigger. It will ease a lot of nerves for the cash-starved businesses."

Some analysts believe it's a prudent move, given that M2 money supply and non-government financing are growing rather slowly.

WEN BIN, CHIEF RESEARCHER CHINA MINSHENG BANK "The reserve reduction this time will help with structural reforms in the banking sector. State-owned joint-stock commercial banks giving out 500 billion yuan to proceed with debt-to-equity swaps -- that's also going to push forward de-leveraging. And another 200 billion yuan from smaller and foreign banks will be used to lower financing cost for small and micro firms."

It is the third reserve requirement cut by the central bank so far this year and will bring reserve requirement ratios to 15.5-percent for large banks and 13.5-percent for smaller ones. XC CGTN

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3