21:58, 12-Dec-2018

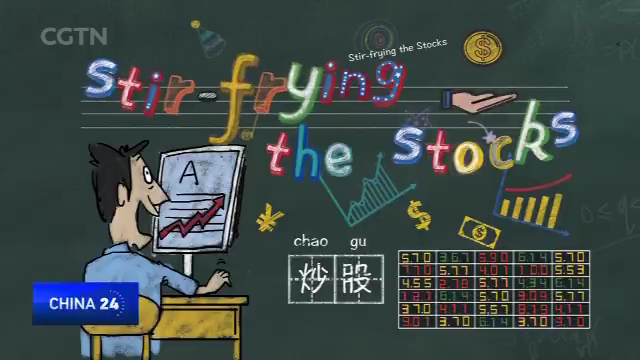

Chinese Terminology: Stir-frying the stocks

Updated

21:31, 15-Dec-2018

02:30

And now, it's time for China 24's special series - "Chinese Terminology". We help explain the magnitude of China's reform and opening up. Today, our Jeff Moody looks at the term Chao Gu or "Stir-frying the stocks".

These are the lines that keep traders on their toes, as they navigate the ups and downs of the stock market.

In China, it was not until the 90s that stock trading became widespread. This gave rise to the term "chao gu", also known as "stir-frying the stocks". The Chinese used the word "chao" or "stir-fry" to describe this form of speculation, and the volatile nature of stock trading -- the quick buying and selling of stocks to "keep them hot".

This grand building -- home to the Shenzhen Stock Exchange -- continues to be a thriving hotbed of finance. Established in December 1990, it's one of the two major stock exchanges in Chinese mainland now.

When stock trading was first introduced, many Chinese people were suspicious of it. However, China's senior leader Deng Xiaoping dispelled people's doubts and set the wheels in motion for the development of the stock market. Workers, students and even retired grandpas and grandmas flocked to join the army of "stir-frying the stocks", hoping to make a quick fortune. Some of them got rich overnight, while some others lost their whole fortune. "Chao gu" became a mandatory daily activity for many -- one that's as important as cooking a meal.

Today, China has the third-largest stock market, and it's well regulated. Investing in it has become common practice, these days with a much cooler head. The frenetic world of "stir-frying the stocks" is thankfully not as hot as it once was.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3