China

23:08, 29-Dec-2017

Online loans become financial traps for college students in China

CGTN

It’s hard to imagine that a loan of just 2,000 yuan (300 US dollars) could become 300,000 yuan (46,000 US dollars) in just two years, but a Chinese university student from east China's Jiangxi Province knows it could very well happen.

In fact, the bachelor's degree candidate isn't alone in his predicament, other Chinese students are facing the bitter reality and falling victims to online loans, which appear at first appealing but end up being crippling.

Sheng first tried online loans two years ago, when he borrowed 2,000 yuan using small loan provider “Laifenqi", which roughly translates to "come and pay by installments", to invest in stocks and futures trading. Little did he know, he was walking into a bottomless trap, set up by online lending platforms.

Laifenqi logo

Laifenqi logo

After losing his first loan to the stock market, Sheng borrowed money from another lending platform to repay his first loan and its interests. With continuous failure in the stock market, Sheng felt it was becoming more and more difficult to clear his debt, with high interest rates worsening the situation.

Sheng kept borrowing money from other platforms, until the amount of loans snowballed in size and became far beyond his expectation.

His debt reached 300,000 yuan, Sheng’s father told Chinese broadcaster CCTV.

In two years, Sheng borrowed from over 90 different online lending platforms. Some with annual interest rate as high as 2,000 percent.

“I blame myself for not teaching my son well. I’ll pay back my son’s debt as long as the number is reasonable,” Sheng’s father said.

Sheng's father /CCTV screenshot

Sheng's father /CCTV screenshot

According to regulations regarding the application of law on private lending cases, if the annual interest rate of a loan surpasses 36 percent of the capital, the amount exceeding 36 percent of the original sum will be considered as invalid.

Sheng is not the first person to be trapped in the swamp of online loans.

Another college student, with the surname Zheng, from central China's Henan Province, committed suicide in March 2016, after failing to pay back a total amount of 600,000 yuan (92,000 US dollars) to an online lending platform, according to media outlet Beijing News.

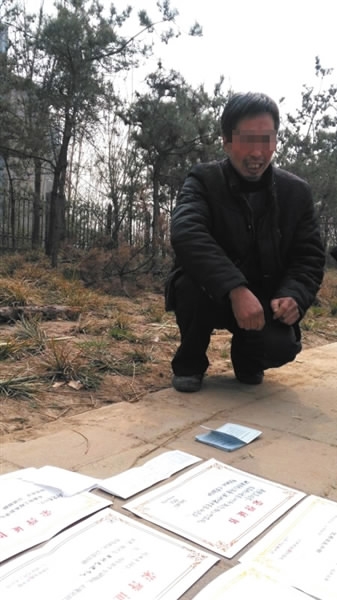

Zheng's father / Photo via Beijing News

Zheng's father / Photo via Beijing News

According to P2P Eye, a peer-to-peer online lending information website in China, there were 5,306 online lending platforms in China in 2017.

To protect college students from such financial traps, The Chinese Ministry of Education banned in September online platforms from lending money to college students.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3