10:39, 14-Jun-2018

US Monetary Policy: Federal Reserve raises interest rates

02:04

Is the era of low interests rates for the US dollar finally coming to an end? Well, the US Federal Reserve appears to be signalling that reality. They've announced another rate hike and a change in tone. CGTN's Daniel Ryntjes reports from Washington.

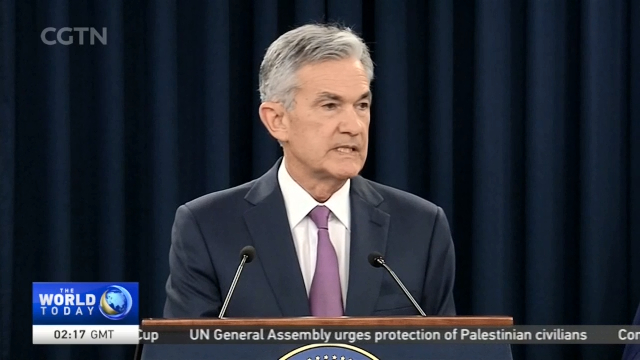

The federal funds rate has been raised another quarter point to a range of between one and three quarters to two percent. That will lead to slightly higher dollar borrowing costs across an economy in good shape, according to Fed Chairman Jerome Powell.

JEROME POWELL, CHAIRMAN US FEDERAL RESERVE "Economic growth appears to have picked up in the current quarter, largely reflecting a bounce back in household spending. Business investment continues to grow strongly and the overall outlook for growth remains favorable. Several factors support this assessment. Fiscal policy is boosting the economy. Ongoing job gains are raising incomes and confidence."

Members of the Federal Open Market Committee predict they're likely to raise rates two more times this year. That translates to a further half percent, in contrast to the expected quarter point they predicted last month.

For the longer-term, the Fed thinks growth rates will not be as high in 2019 and 2020, which means they still foresee a gradual upward path for interest rates.

JEROME POWELL, CHAIRMAN US FEDERAL RESERVE "We think that gradually returning interest rates to a more normal level as the economy strengthens is the best way the Fed can help sustain an environment in which American households and businesses can thrive."

Powell is also promising to double the number of press conferences he provides to ensure the public understands the committee's thinking after these two-day rate-setting meetings.

DANIEL RYNTJES WASHINGTON US Federal Reserve officials have also dropped language in their regular statement suggesting the Federal Funds Rate will remain at lower than normal levels, signalling that this long era of ultra-low rates is coming to an end. Daniel Ryntjes, CGTN, Washington.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3