14:46, 27-Oct-2018

US Mid-Term Elections: Trump's tax reform leaves middle-class with mixed feelings

Updated

14:04, 30-Oct-2018

02:38

With mid-term elections approaching in the US, Republicans are making a case that Trump's economic policies have benefited the country's middle class. That includes a landmark tax reform law, passed late last year - which slashed the corporate tax rate from 35 percent to 21. But critics say the new legislation doesn't benefit everyone. Daniel Ryntjes reports from Washington.

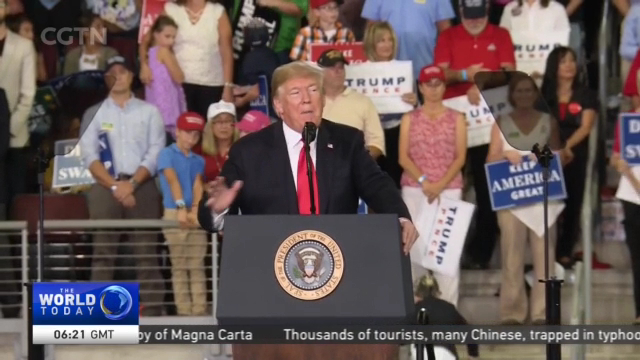

Erie County Pennsylvania helped elect Donald Trump in 2016. He's asking those voters to support Republican candidates in the approaching mid-term elections.

DONALD TRUMP US PRESIDENT " A vote for a Republican Congress is a vote for lower taxes, less regulation, and more products made right here in the USA."

Republicans passed a landmark tax reform law in the U.S. Congress in December of last year, promising benefits to America's middle class.

RICHARD REEVES, DIRECTOR FUTURE OF THE MIDDLE-CLASS INITIATIVE, BROOKINGS INSTITUTION "It gave a big tax cut to the rich, a very small one to the middle class and even that is only going to last a few years. Against a backdrop of a middle class that continues to struggle, even as the U.S. economy pulls itself out of recession, the benefits of that recovery are not yet being felt in any serious way by those families that are in the middle of the income distribution."

In Warrenton, Virginia some voters are feeling the benefits, others are not.

"Yes, actually my paycheck is a little bit more, not a lot more, so it has given us some relief. I just think they could do a lot better."

"Those tax cuts are not meant to help families that are everyday workers and have five kids to support. Those tax cuts just aren't meant for us."

Warrenton's mayor, a local store owner, is concerned that the tax cuts will increase America's future mountain of debt.

CARTER NEVILL MAYOR OF WARRENTON "We've seen a lot of elderly Congress people reward themselves, reward their friends, reward their generation with a wonderful tax cut. But the bill's going to come due in our generation. So that means my retirement's gone, my security network or my social benefits are going to dwindle, if they are going to be there at all."

Republicans argue the business tax cuts will boost economic growth sufficiently to avoid a rise in debt levels going forward.

DANIEL RYNTJES WASHINGTON "But in this financial year, the difference between the amount the government spends and the amount it receives, the deficit, rose by 17% to reach $779 billion. Daniel Ryntjes, CGTN, Washington."

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3