Opinions

17:52, 22-Jul-2018

Opinion: Forced technology transfer? Here is the truth!

Updated

17:53, 25-Jul-2018

Li Yong

Editor’s note: Li Yong is a current affairs commentator and senior fellow at the China Association of International Trade. The article reflects the author’s opinion, and not necessarily the views of CGTN.

For a period of time, the allegations on China’s “forced technology transfer” have been a buzzword, when the US talks about China’s business environment. It has also become one of the two key accusations of China’s “economic aggression” to the US.

China’s Commerce Ministry rebutted that it’s a distortion of history and reality.

Let's look at the history.

Since China’s opening up in 1978, China has been widening its doors to foreign investment.

In the early days and in the years leading up to China’s accession to the WTO in 2001, China adopted a cautious and progressive approach in its reform and opening-up measures. Industries were classified into three categories, namely, open, restricted and prohibited.

Over time, the categories have been revised to respond to the needs of the business realities, and until today, we see a negative list of only 48 sectors that are off-limits for foreign investments.

There is also a free-trade-zone (FTZ) negative list, which has 45 sectors that are not open to foreign investments.

Foreign investments can have their presence in China in three forms, equity joint venture, contractual joint venture and wholly-owned foreign enterprise (WOFE). Wholly foreign-owned enterprise has always been an option for foreign investments, although the areas in which WOFEs are allowed have changed over time.

In some areas, equity joint venture was a required form of entry, while contractual joint venture was a flexible form of business entity in which the contributions made by the partners to the joint venture are subject to negotiation.

December 7, 2013: French Prime Minister Jean-Marc Ayrault (C) visits Dongfeng Peugeot-Citro Automobile (DPCA) plant in Wuhan./ VCG Photo

December 7, 2013: French Prime Minister Jean-Marc Ayrault (C) visits Dongfeng Peugeot-Citro Automobile (DPCA) plant in Wuhan./ VCG Photo

It is a fact that some joint ventures were established on the basis of equity requirements, for example, in the auto industry. But, it is NOT true that the foreign automakers were forced to transfer their technologies.

They can even make their own decisions to come and go. Peugeot came to Guangzhou, China in 1985, and for some reasons other than technology transfer, Peugeot sold its assets and left China in 1996.

The brand came back in 2002, partnering with another local automaker in Wuhan. Motorola set up its wholly-owned enterprise in Tianjin, China, in 1992. There was no such thing as forced technology transfer in the case of Motorola.

What is the reality then?

China has not used technology transfer on foreign investments as a precondition of market access and there have been no such requirements whatsoever in China’s regulations regarding foreign investments.

The transfers are all based on the owners’ free will and contractual arrangements after negotiations.

The key considerations of the foreign investors were purely business, for example, the market potential for their product(s), the risks, their own ability to cover the market, options to optimize the cost-and-benefit scenario, quick return on investment, etc.

Many chose to work with a local partner, even though the option of wholly foreign-owned enterprises was available. Synergy and complementarity are the explanation.

October 3, 2003: Motorola (China) Electronic Co., Ltd. in Tianjin, China./ VCG Photo

October 3, 2003: Motorola (China) Electronic Co., Ltd. in Tianjin, China./ VCG Photo

The legitimate reasons why they wanted to have a joint venture partner in China include, to name a few, to share the risks, and benefit from their local knowledge, industry experiences, existing channels of distribution, understanding of business environments and culture and their network of supply chains.

Foreign investors were willing to bring their technologies, most of which were embedded in their product offerings, to China, as they saw them as their unique opportunities in China. They were transferred, but not at no costs.

Technologies are often priced in as part of the investment, determining the final equity structure of the joint venture. The transfers are all done by smart business people who have had years of experiences in the West, and they are in China to make money, not to be taken advantage of.

The terms of technology transfer in a joint venture contract are very complicated, and technologies are tightly protected.

It has not always been a fair deal in the so-called technology transfer. In some cases, the transfer was a trap, ending up in the sales of outdated equipment, some being second-hand.

This is a demonstration that the business world is not a perfect one, and no one can blame the other with moral superiority. The business reality is not one-dimensional, and not as simple as those that one can learn from textbooks.

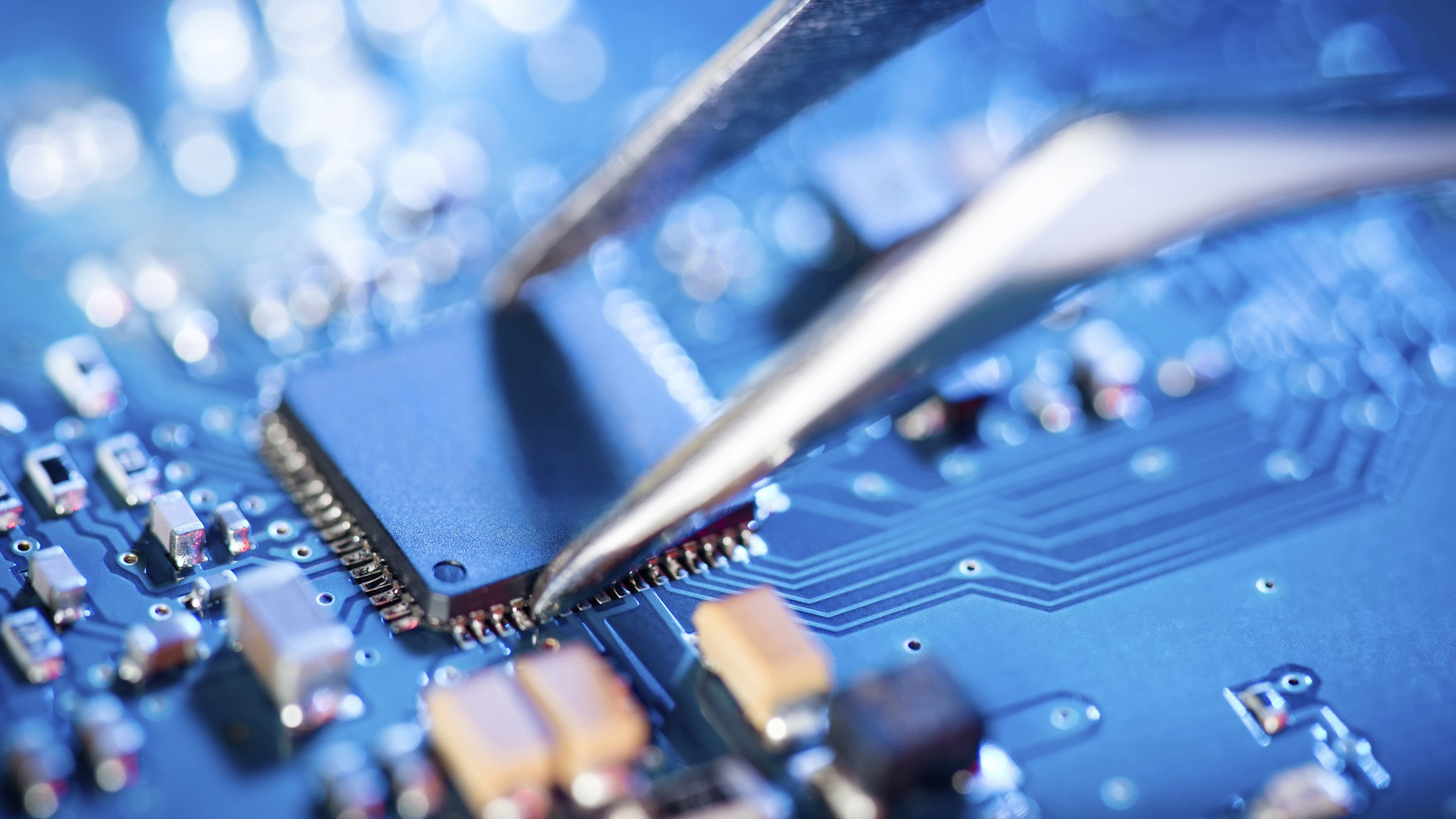

A chip over defocused circuit board./ VCG Photo

A chip over defocused circuit board./ VCG Photo

Technology transfers are not an easy part of a business venture and often involve an experienced team of legal advisors, and the approval of the board of directors will have to be attained before such transfers.

No one can really force a business to surrender their core technologies. No one would want to end up in a deal as a victim or chump of forced transfers.

When the story is told that technology transfer is “forced”, the story-teller must either be ignorant of the business reality or have an ulterior motive to distort the reality to meet his own purpose.

In the case of China-US trade tensions, the purpose of the forced technology transfer story is to demonize China in an effort to isolate the country.

The truth is China is far more business-friendly than those the US have depicted. Tesla has just signed a deal with China to set up its wholly-owned operations in China.

Is Mr. Elon Musk forced to sign the deal? If a person like Peter Navarro tells you that it is a forced deal, don’t trust him unless he says that Elon Musk was forced to invest outside the US because of the protectionist tariffs the US is imposing on the world.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3