Biz Analysis

15:34, 28-Jan-2019

Three immediate tasks for the new CSCR chief

Jimmy Zhu

Editor's note: Jimmy Zhu is chief strategist at Fullerton Markets. The article reflects the author's opinion, and not necessarily the views of CGTN.

The Shanghai Composite Index has dropped around nine percent since Liu Shiyu took over as chair of the China Securities Regulatory Commission three years ago. Out of his seven predecessors, five chairmen saw stocks improve during their tenures.

However, Liu still did a great job overall in terms to sooth market confidence, especially given that his term began just as a stock rout dented market sentiment.

Under Liu's three-year term, Shanghai stocks' value gradually recovered in the first two years, thanks to a pickup in growth activities and greater balancing of cross-border capital flows. 2018's sell-off was mainly due to new factors like a more hawkish Fed, trade disputes and a slower economy.

Data shows that Shanghai stock turbulence over the past three years has much to do with the domestic economy. In other words, stock prices have become more market-oriented.

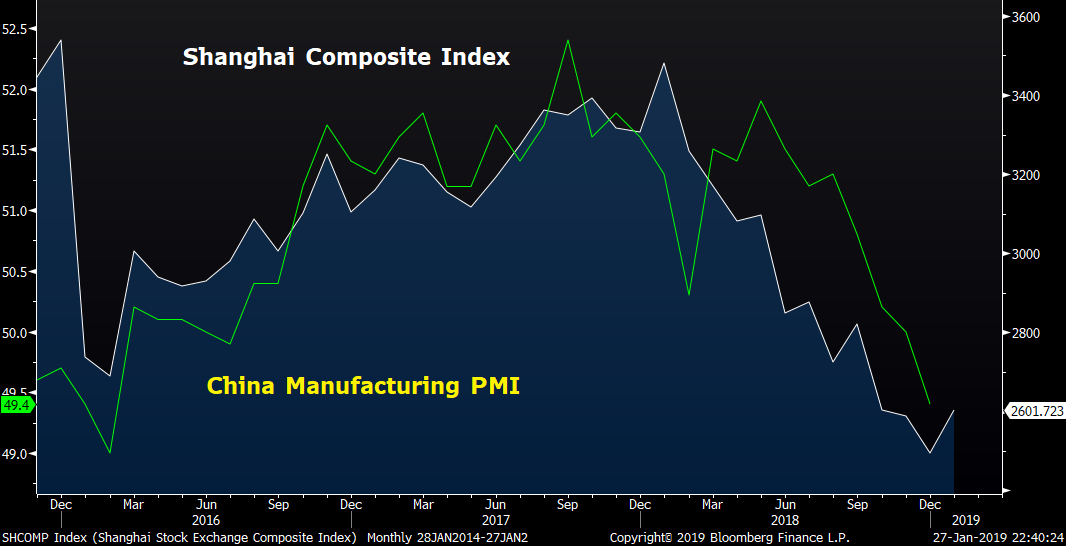

The correlation between Shanghai stocks and China's manufacturing PMI stood at -0.35 from 2013 to 2015, meaning the two components were basically irrelevant to each other. Under Liu's term, that correlation sharply rose to 0.72.

Source: Bloomberg

Source: Bloomberg

Looking ahead, new chairman Yi Huiman has three immediate tasks at hand, after being given a mandate to further improve the efficiency of capital markets and make them better serve the real economy.

Strengthening confidence in capital markets

As mentioned above, a regulatory officer shouldn't be responsible for market performance, which is usually determined by the pace of growth and monetary, fiscal policy.

However, Yi will be responsible for protecting investors' interests and maintaining a fair and orderly market, factors which are crucial to anchoring market stability given ongoing downside risks such as slower growth and trade disputes.

The CSRC is expected to further standardize and strengthen corporate disclosure rules to improve transparency, as the depth of reliable information directly influences investor decisions and the efficiency of capital allocation.

Such information is more important to retail investors, many of whom are not overly familiar with top-down analyses due to a lacking of knowledge of macroeconomics. Therefore, the level of accuracy on information provided by each individual company will directly influence their investment decisions.

Yi began his career as a banking officer, and his comprehensive understanding of capital markets will be a perfect fit for the current environment of the Chinese market, which is seeking further capitalization and opening up, a direction that will boost the growing private sector and widen its funding channels.

Existing data shows that room for further capitalization in China is substantial. China's stock market capitalization to GDP ratio stands at around 70 percent, much lower than most major economies. The U.S. ratio is around 150 percent, while Japan, S. Korea, Thailand and Malaysia all have ratios above 100 percent.

Domestic stock market to lure more foreign inflows

The foreign participation rate in Chinese stocks is still relatively low compared to other major markets. Successfully attracting more foreign capital would not only further stabilize the stock market, but it would also help the domestic market to operate more effectively and market-oriented.

In order to achieve that, regulators may continue to relax criteria for the QFII and QDII schemes at a gradual pace, allowing greater foreign market participation.

Meanwhile, the Shanghai-London Stock Connect scheme should launch this year, but the timing will likely be dependent on Brexit.

Most importantly, currency hedging tools should be further developed as many foreign firms take FX risks very seriously. Monetary authorities in China are expected to further widen the tools available for overseas investors and lower the costs of hedging.

Shanghai's Science and Technology Innovation board

The new NASDAQ-style registration-based technology board, announced by Chinese President Xi Jinping last week, will be a flagship program for regulators this year. Due to various restrictions in the past, many tech companies have chosen to list overseas.

Currently, details of the new tech board remain unclear. But there are some expectations on reforms which have already formed in the market, such as new trading rules, tweaks to the daily 10 percent trading limits and increasing access to retail investors.

(Top image: Yi Huiman, the new chairman of the China Securities Regulatory Commission. /VCG Photo).

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3