Opinion

10:41, 25-Apr-2019

BRI: A channel for economic integration

Updated

15:39, 26-Apr-2019

CGTN

Editor's Note: With the Second Belt and Road Forum (BRF) for International Cooperation opening this week, the Belt and Road Initiative (BRI) has been thrust into the media limelight. What has been achieved in the past five years since the BRI was first put forward? How to turn its vision into reality? Five Years of the Belt and Road Initiative is a book series co-published by Chongyang Institute for Financial Studies, Renmin University of China and Foreign Languages Press, analyzing the BRI from the perspectives of policy communication, infrastructure connectivity, trade connectivity, financial integration and people-to-people exchanges. Here is an excerpt of the episode on financial integration.

It has been over 70 years since the international economic order with the U.S. dollar as a global currency was established. However, many aspects of this order have proved to be outdated in today's world. In this context, China has incorporated finance integration into the Belt and Road Initiative.

In the past five years, China and the BRI countries have achieved tremendous progress in the innovation of regional financial mechanisms, the integration of financial markets, the establishment of financing institutions and so forth.

Under the BRI, the Executives' Meeting of East Asia-Pacific Central Banks, the ASEAN and China-Japan-ROK (10+3) Financial Cooperation Mechanism, the South East Asian Central Banks, the Shanghai Cooperation Organization Finance Ministers and Central Bank Governors Meeting were established to better analyze macroeconomic policies and communicate solutions to global economic challenges.

China Jiangxi Corporation Ltd. construction site in Lusaka, Zambia, December 12, 2018. /VCG Photo

China Jiangxi Corporation Ltd. construction site in Lusaka, Zambia, December 12, 2018. /VCG Photo

Take the Chiang Mai Initiative as an example. With the scale of the currency swap reaching 240 billion U.S. dollars, the initiative has made significant contributions to the construction of regional currency swap networks and thus tremendously maintained stability of regional currencies.

As of the first half of 2018, the China Securities Regulatory Commission had signed a slew of memoranda of understanding on regulatory cooperation with its counterparts in 62 countries and regions. As of the end of 2017, the China Banking and Insurance Regulatory Commission had signed bilateral memoranda of understanding and agreements with authorities in 32 BRI countries.

Apart from the establishment and innovation of financial frameworks, the BRI's role in promoting market integration deserves applause. Since February 5, 2018, Chinese yuan and Thai baht have realized direct trading, making Baht the 24th currency that has been listed for direct exchange with Chinese yuan.

Moreover, Philippine President Rodrigo Duterte recently expressed his full support for the BRI and has been leading 13 Philippine banks in signing a memorandum of agreement with the Bank of China, promoting direct foreign exchange between the yuan and the Philippine peso.

An open and transparent financial market also means prosperous bond and stock market. Under the BRI, the People's Bank of China has initiated interbank bond market cooperation with Mongolia, Malaysia, Singapore, Thailand and other BRI countries, and proposed to jointly build an Asian bond market. More than 300 billion U.S. dollars in bonds were issued by the bond markets across Asia in 2017, reaching a new high.

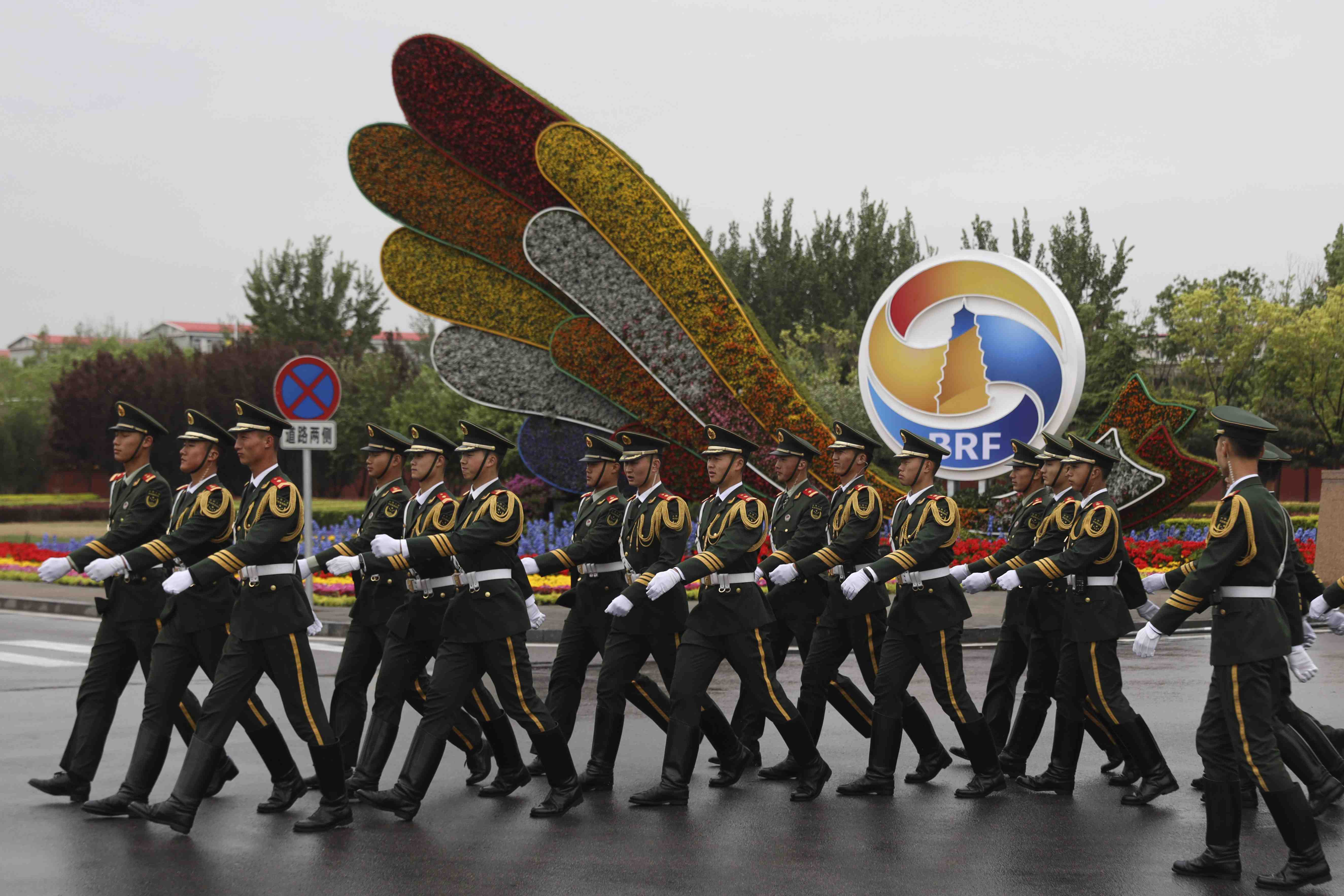

Chinese paramilitary policemen march past decor for the BRF outside the special plane terminal at Beijing International Airport where foreign leaders are expected to arrive in Beijing, April 24, 2019. /VCG Photo

Chinese paramilitary policemen march past decor for the BRF outside the special plane terminal at Beijing International Airport where foreign leaders are expected to arrive in Beijing, April 24, 2019. /VCG Photo

Open stock exchanges have become an important driver for the integration of capital markets in the BRI countries. China-Europe International Exchange officially opened for business in Frankfurt, Germany, on November 18, 2015. The Astana International Finance Center was put into operation on July 5, 2018, of which the Shanghai Stock Exchange holds a 25 percent share. The Moscow Exchange signed a memorandum of understanding with CITIC Securities and Galaxy Securities on December 22, 2016, strengthening Sino-Russian cooperation in cross-border investment.

The openness of the bond markets can alleviate financial strains in the BRI countries and give play to the capital markets in resource allocation, price setting and self-risk management.

Supportive institutions are required for high-level financial integration. The Asian Infrastructure Investment Bank (AIIB) has become a mainstay in this regard. Since its establishment, 93 countries have joined it as member states. The AIIB, according to its senior economist Cheng Zhangbin, has entered a new stage of development and will strive to reach a balance between social benefits and financial returns in the future.

The Silk Road Fund means new momentum to financial integration. As of August 2018, the Silk Road Fund had signed 25 investment projects with the actual amount of funding exceeding 6.8 billion U.S. dollars. These investments will help adjust and upgrade receiving countries' industrial structure. The Hassyan Power Plant in Dubai, for instance, will provide 20 percent of the city's electricity.

The New Development Bank (NDB) is another supportive institution that can mobilize emerging markets. According to the latest figure from the NDB's official website, the bank has issued loans for 26 projects, totaling 6.638 billion U.S. dollars. NDB Vice President Leslie Maasdorp said earlier that the NDB will always be the hope of developing countries.

The BRI has moved from conception to action in the past five years, to which financial integration has made significant contributions. The BRI members should make use of the existing financing institutions to form a common risk management mechanism and lay a solid foundation for future financial cooperation.

Stories in this series:

(If you want to contribute and have specific expertise, please contact us at opinions@cgtn.com)

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3