Biz Analysis

13:31, 09-May-2019

China industrial demand steady as imports from Australia surge

Jimmy Zhu

Editor's Note: Jimmy Zhu is chief strategist at Fullerton Research. The article reflects the author's opinion, and not necessarily the views of CGTN.

Chinese imports from Australia in April grew at their fastest pace since August last year, a signal that the nation's infrastructure spending is picking up. Authorities are likely to further roll out more pro-growth measures to counter rising external uncertainties, after exports unexpectedly contracted last month.

Exports dropped 2.7 percent in dollar terms last month, after a 14.2 percent increase in March. Exports growth to China's major partners slid at a faster pace, with growth of Chinese outbound shipments to the U.S., Japan and South Korea falling by 13.1 percent, 16.3 percent and 7.6 percent respectively.

Still, trade figures for a single month can be volatile and do not necessary reflect overall underlying trends. Manufacturing PMIs for both Japan and South Korea rose sharply last month, suggesting industrial demand in these two countries was improving.

However, Chinese biggest trading partner – the U.S. – saw its ISM manufacturing PMI slip to 52.8 on April, its lowest reading since 2016. Together with a huge contraction in growth in Chinese exports to the U.S., signs are showing that the U.S. economy is losing its strength.

Chinese exports to the European Union also moderated last month, with growth at 6.5 percent down from 23.7 percent in March. Exports to Germany, France and Italy all slowed significantly. On May 7, the European Commission downgraded its growth forecasts for the euro area and slashed its projection for Germany, with sentiment taking a hit from disruptions in the auto industry, social unrest, and uncertainty related to Brexit.

April exports to the U.S. and EU accounted for 29.3 percent of total exports, so any confirmation of a slowdown in these areas will darken the external outlook for China in the latter half of the year. Some central banks have already taken action to counter slowing global growth. New Zealand's central bank cut its benchmark interest rate on Wednesday, citing a slowdown in global growth and saying the door for further rate cuts remains open.

In order to mitigate the negative effect from external weaknesses, Chinese authorities are likely to implement further pro-growth measures to spur domestic demand, including greater infrastructure spending by maintaining interbank borrowing costs at low levels.

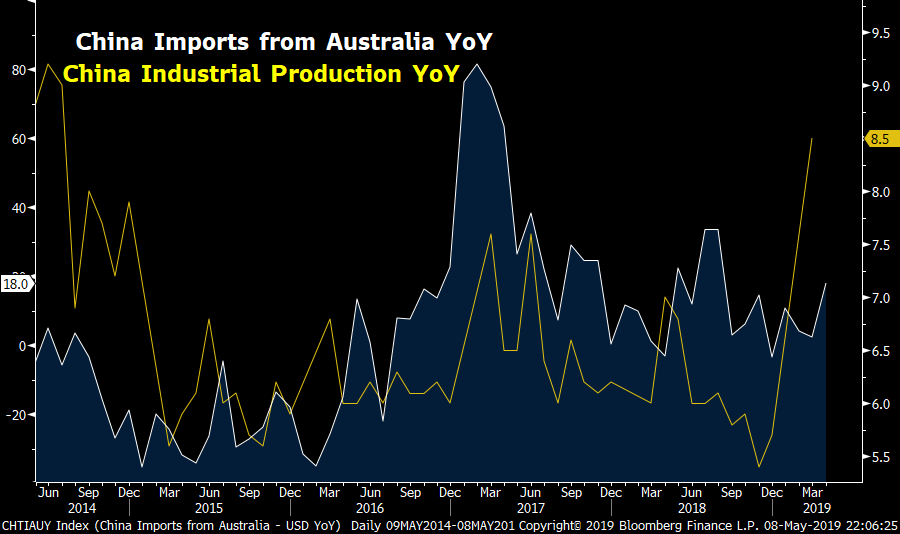

Import data for April show that industrial demand may have already picked up. Purchases from Australia surged 18 percent last month, up from 2.4 percent in March. Among all the products that Australia exports to China, most are raw materials such as iron ore.

Sharp increases in imports from Australia signal that infrastructure spending may have picked up in April, with greater demand for raw materials arising. The chart below shows that Chinese imports from Australia have been consistent with the nation's industrial production over the past five years.

Source: Bloomberg

Source: Bloomberg

Still, increasing imports from Australia for just one month are not enough to confirm a sustainable recovery in domestic industrial demand. Given increasing external uncertainties, domestic demand becomes more crucial to stabilizing growth this year, and we continue to expect more infrastructure projects to be rolled out.

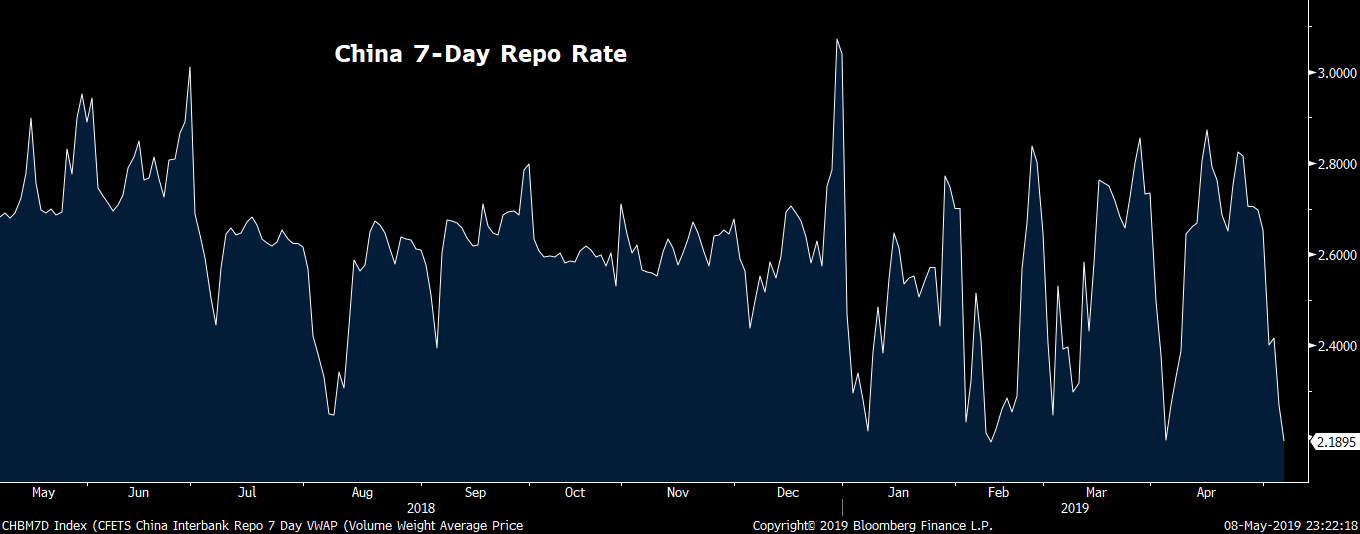

On the other hand, the People's Bank of China announced earlier this week that the RRR for some banks would be cut, at a time when liquidity in the interbank market is already very ample, with the chart below showing the 7-day repo rate at its lowest level in the past 12 months.

Such moves back the central bank's determination to further improve funding conditions for private firms, with further policy support needed to offset external weakness. If export growth slows further, there is a possibility that the central bank will announce another broad-based RRR cut to boost domestic demand.

Source: Bloomberg

Source: Bloomberg

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3