Biz Analysis

12:53, 31-Jan-2019

PMI data suggests PBOC will introduce more support for SMEs

Jimmy Zhu

Editor's Note: Jimmy Zhu is chief strategist at Fullerton Markets. The article reflects the author's opinion, and not necessarily the views of CGTN.

China's manufacturing PMI data for January showed a modest pickup in the headline figure, which was mainly due to a rise in commodity prices, with the new order PMI index dropping for an eighth consecutive month. Meanwhile, further declines in small and medium enterprises' PMI may prompt authorities to further introduce more supportive policy measures.

The improvement in the PMI data reflected front-loading activities before the Chinese New Year holiday, as well as recent broader policy support. However, one of the sub-indices of China manufacturing PMI, its producer price index, has stayed below the 50 threshold for a third month, putting producer prices at risk of falling into contraction territory in the coming months.

Correlation between the producer price PMI index and monthly PPI growth has stood at 0.659 in the past two years. With PPI only growing by 0.9 percent last month, a producer price PMI index consistently below 50 indicates that PPI growth for this month may continue to slow and move closer to the deflationary zone in the coming months.

The chart below shows that factory deflation has prompted the People's Bank of China to cut its benchmark interest rates on several occasions in the past 20 years.

PPI growth fell below zero in April 2001, and the PBOC decided to cut the benchmark rate in eight months. The next two occasions when factory deflation happened, during the global financial crisis period and March 2012, the central bank cut interest rates almost simultaneously. When PPI growth failed to climb into positive territory in November 2014, the PBOC started its rates easing cycle once again.

Source: Bloomberg

Source: Bloomberg

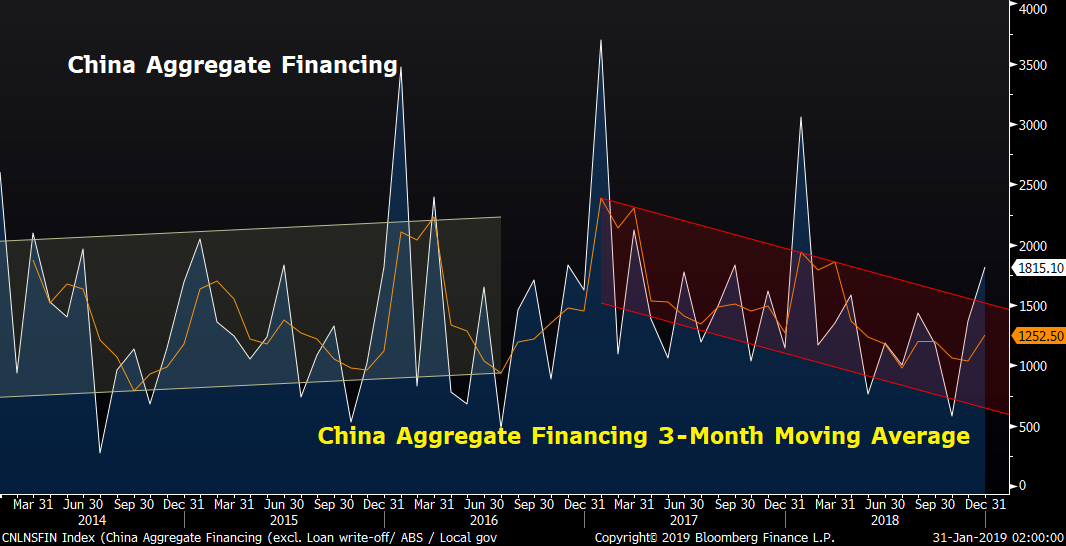

Medium companies' PMI further declined to 47.2, the lowest reading in the past seven years. Cutting the benchmark rate could also later on be a monetary solution for improving credit conditions for private firms. Based on the three-month moving average for total aggregate financing, lending activities stayed subdued last year despite four separate cuts to major banks' reserve ratio requirements in that period.

Another chart below shows that lending activities only gradually picked up when the PBOC initiated its previous rate cut cycle, starting from November 2014.

Source: Bloomberg

Source: Bloomberg

The past three years saw US monetary policy in a tightening cycle, a policy that largely restricted the PBOC's policy easing space due to fears of a sudden deprecation of the yuan and massive capital outflows. However, the Fed's policy meeting overnight suggested such an environment is changing.

Fed Chief Powell said that the case for any additional rate hikes has weakened. Such comments show that such patience may not only lead to a prolonged pause in rate hikes, but also that the current tightening cycle is possibly close to the end. The Federal Open Market Committee dropped previous language calling for “some further gradual increases” in interest rates, and opened the door for the next move to be either up or down.

Rate cuts always have side effects, and one of those is usually a negative impact on the yuan exchange rate. However, current macro conditions allow authorities to have a higher tolerance level due to a potential boost in FX reserves. According to our estimates, US government bonds count for around 60 percent of total China FX reserves. A current synchronized global slowdown scenario would lift prices of US Treasuries, and increase the China FX reserves' portfolio due to gains in the majority of the assets it holds.

Furthermore, the Chinese yuan has gained about 3.6 percent versus the greenback since the end of last year, and was trading at 6.6933 as of Thursday morning after a dollar selloff overnight. The yuan's outlook has become much more stable than in the second half of last year, when trade tensions kept escalating.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3