17:53, 28-Feb-2019

State-owned Enterprise Reform – Challenges & Conundrums

Robert Lawrence Kuhn

I have three basic questions about China’s state-owned enterprises, SOEs. First, in terms of political economy, what’s the optimal role of SOEs in China’s “Socialist Market Economy”? Second, in terms of market competition, what’s the optimal relationship between SOEs and private companies in different industries? And third, in terms of SOE operations and governance, what’s the optimal structure of SOE management and boards of directors, including state controls? Everyone agrees that there is need for SOE reform, but what kind of reform, and how fast? That’s the dispute.

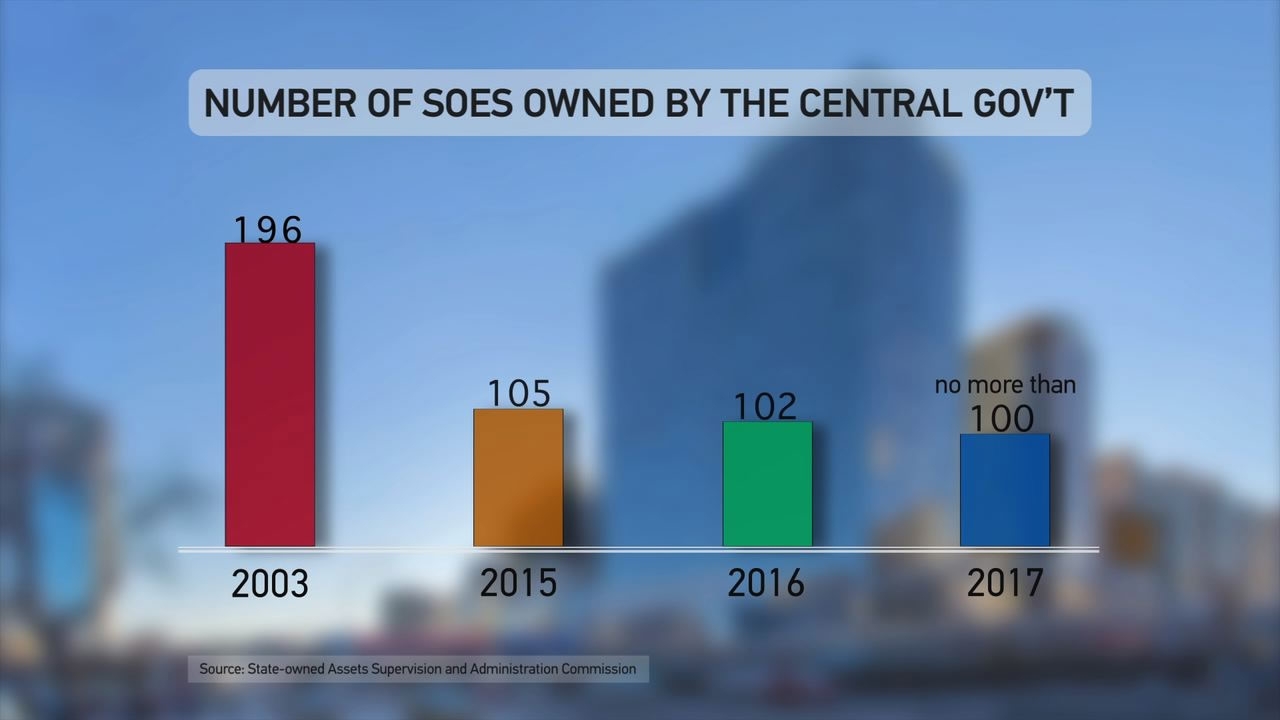

The number of state-owned enterprises in China has declined steadily since 2003.

The number of state-owned enterprises in China has declined steadily since 2003.

What’s the ideal SOE structure? It depends on the priority of the objectives. If efficient use of resources to build national wealth is the highest good, then most SOEs should move toward complete independence from state control. If there is a need for SOEs to provide social benefits in addition to wealth creation, or to enable rapid government intervention in crises, then SOE reforms should move more cautiously and not seek detachment from state ownership. This is all the more true if maintaining state ownership is deemed essential in the socialist system. But then accept the fact that SOEs will be less efficient always. There’s natural tension between, on the one hand, making SOEs more efficient by loosening ties with government, and, on the other hand, maintaining SOEs as levers of government policy. In all cases, SOE management must have incentives to work, not for their own interests, not for personal power and perks, but for the interests of all their shareholders, whether government or private investors. I applaud the open debate among experts. That’s how we get Closer To China

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3