Business

22:25, 16-Aug-2018

Turkey will emerge stronger from lira crisis, finance minister tells investors

Updated

22:19, 19-Aug-2018

CGTN

Finance Minister Berat Albayrak assured international investors on Thursday that Turkey would emerge stronger from its currency crisis, insisting that the country’s banks were healthy and strong.

In a conference call with thousands of investors and economists, Albayrak - who is President Tayyip Erdogan’s son-in-law - said Turkey fully understood and recognized all its domestic challenges but was dealing with what he described as a market anomaly.

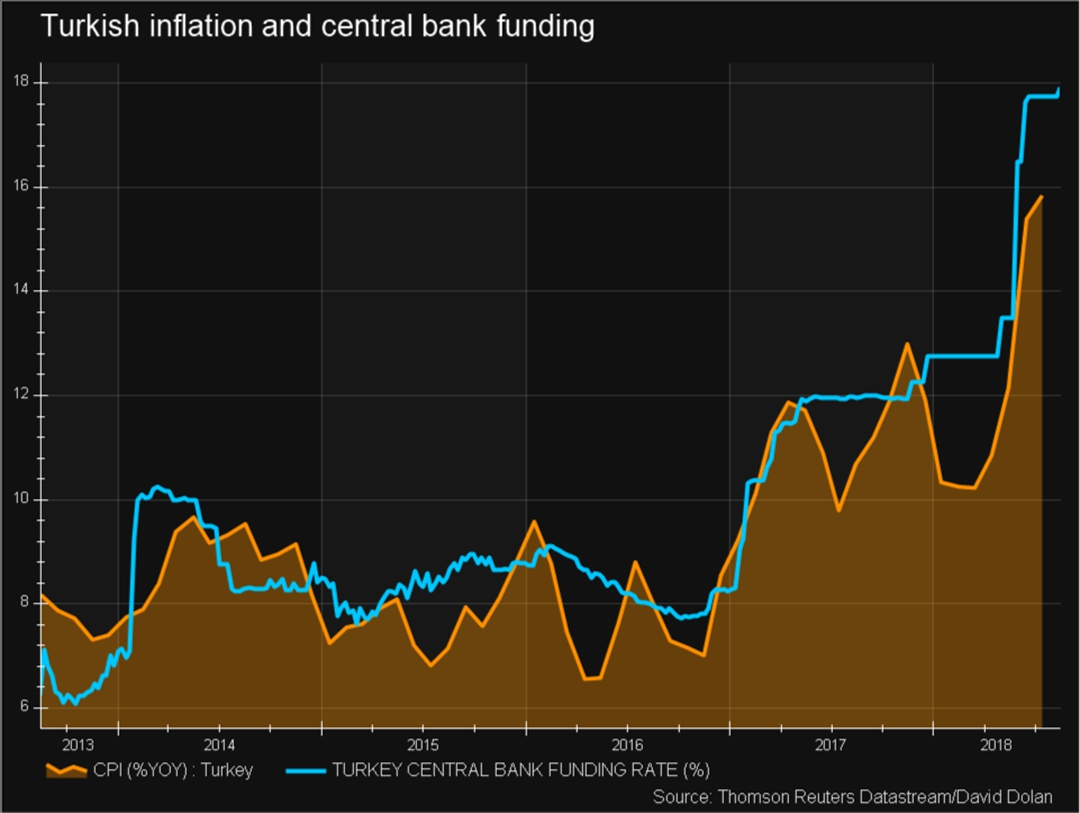

The Turkish lira hit a record low of 7.24 to the dollar this week, down 40 percent this year, as investors fretted over Erdogan’s influence over monetary policy and a bitter dispute with the US.

Facing Turkey’s gravest currency crisis since 2001 in his first month in the job, Albayrak has the daunting task of reassuring the investors that the economy is not hostage to political interference.

Albayrak, a 40-year-old former company executive with a doctorate in finance, said Turkey would not hesitate to provide support to the banking sector. The banks were capable of managing the volatility, and there had been no major flow of cash out of deposits lately, he added.

Before he spoke, the Turkish lira strengthened more than three percent, despite signs that a rift with the US is as wide as ever.

The currency shrugged off US comments ruling out the removal of steel tariffs on Turkey even if it frees an American pastor who lies at the center of the complex feud between Washington and Ankara.

The currency gained some support from the announcement late on Wednesday of a Qatari pledge to invest 15 billion US dollars in Turkey.

Reuters Photo

Reuters Photo

The lira, still down 34 percent against the dollar this year, firmed to 5.7700 from a close of 5.95. Other Turkish markets were less buoyant: the main share index dipped 1.4 percent and the 10-year benchmark bond yield rose to 21.37 percent from 21.02 percent.

JP Morgan said moves by Turkish authorities to curb the lira’s fall showed they were committed to stabilizing the currency with technical measures such as restricting foreign exchange swaps and cancelling repo auctions to push up the average cost of bank funding.

“Yet at the same time [Turkish authorities] are reluctant to adopt orthodox policy frameworks,” JP Morgan said.

Source(s): Reuters

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3