Markets

19:56, 07-Jan-2019

Three clues investors may miss on PBOC’s broad-based RRR cut

Updated

19:17, 10-Jan-2019

By Jimmy Zhu

Editor's Note: Jimmy Zhu is chief strategist at Fullerton Markets. The article reflects the author's opinion, and not necessarily the views of CGTN.

Predicting the monetary actions of a central bank is never simple, but look closely at the People's Bank of China's (PBOC) past behavior and there were plenty of clues that last week's broad-based reserve requirement ratio (RRR) was on the cards.

Manufacturing gauge an indicator of RRR cuts

The RRR cut announced last Friday by China's central bank was widely expected, but a broad-based one was not – such a move has not been seen since March 2016.

FTSE China A50 futures reacted aggressively to the announcement; the Aussie dollar, a proxy of Chinese economic outlook, also rallied and quickly returned to territory above 0.70 versus the US dollar.

Why did PBOC make the move? The chart below shows that the most important trigger for a broad-based cut – not only the recent one, but for all such cuts in the past decade – is a contraction in manufacturing activity.

Source: Bloomberg

Source: Bloomberg

There have been three easing cycles since the global financial crisis:

1. PBOC started to cut RRR in October 2008, when China's manufacturing purchasing managers index (PMI) dipped to below 50 from 51.2 the previous month.

2. The second cycle of broad-based cuts started in December 2011, after manufacturing PMI dropped below 50 in November from 50.4 a month earlier.

3. The third cut cycle kicked off in February 2015, after PMI dropped below 50 in January from 50.1 a month prior.

China's PMI fell to 49.4 in December 2018, which may well explain why the central bank chose to re-start a broad-based RRR cut last week, a move aimed at injecting more liquidity into the manufacturing market.

RRR cuts favor local bond markets, not equities

The Shanghai composite index dropped over 24 percent in 2018, and investors are keenly analyzing whether the index is approaching the bottom.

Many factors drive the value of the domestic stocks market, including economic outlook, monetary and fiscal policies, and even the exchange rate of the yuan.

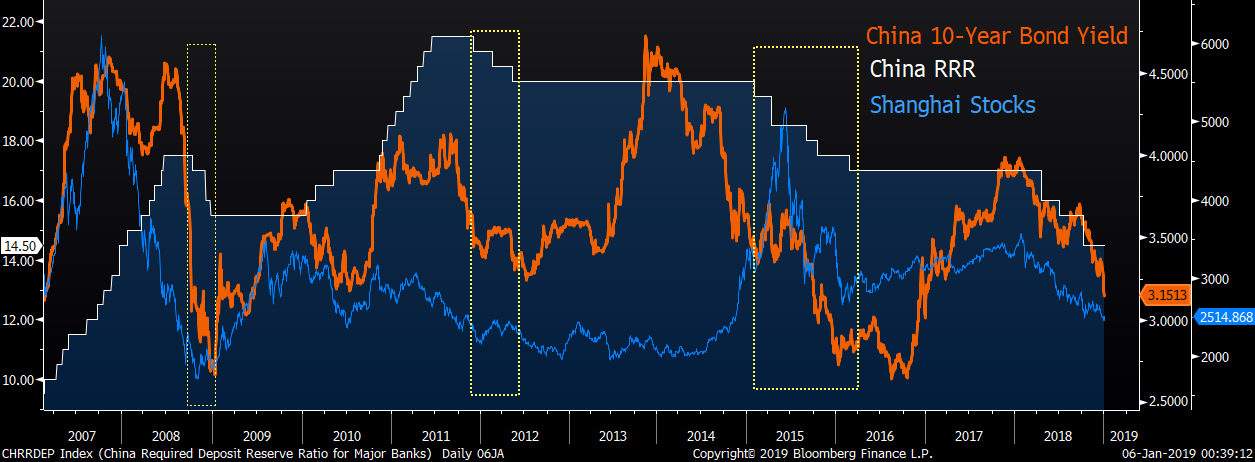

However, as the chart below shows, RRR cuts have boosted bond prices while stocks tended to embark on roller coaster rides in these periods.

Source: Bloomberg

Source: Bloomberg

It's not difficult to explain such phenomena. History shows that when PBOC started to conduct broad-based RRR, manufacturing activities usually had already moved into contraction territory.

Monetary policy can boost confidence in capital markets, but confidence alone is not enough to push stocks to a sustainable base without meaningful improvement in the macro-economic conditions.

It typically takes at least three to six months for monetary policies to impact the real economy, as infrastructure and growth activities are only able to kick off when the credit is available.

Correlation between Shanghai stocks and China manufacturing PMI stands at 0.721 in the past three years, which indicates growth holds the key to the value of domestic stock prices.

But the RRR cut creates favorable conditions for bonds market as the ample liquidity easily lowers interbank funding costs and increases the carry trade opportunities.

For now, the overnight repo rate stands at 1.58 percent, way below the one-year government bond yield at 2.45 percent, so there is substantial room for fixed-income traders borrowing and paying interest to buy bonds.

Benchmark rate cuts to be expected

China's four easing cycles since 1996 show that the central bank repeatedly cut the benchmark rates after RRR cuts.

Source: Bloomberg

Source: Bloomberg

There are opportunities for PBOC to cut the benchmark rates within the year, as previous targeted RRR cuts have yet to spur lending in the real economy.

As well as boosting lending, a benchmark rate cut – a move to reduce the gap between market and benchmark rates – can also support the central bank's financial reform agenda.

PBOC Governor Yi Gang said last April that by maintaining a prudent monetary policy, China will see a convergence between the market rate and the benchmark rate.

China's current benchmark lending rate stands at 4.35 percent, 86 basis points higher than the Shanghai Interbank Offered Rate (SHIBOR) 12-month rate.

Source: Bloomberg

Source: Bloomberg

However, the yuan's exchange rate and the U.S.-China rate differentials will influence PBOC's rate decision.

If China sticks to defending the yuan from sliding below 7 to the U.S. dollar, then the current USD/CNY near 6.87 is not in a safe-zone.

Hence, PBOC may wait to see if the U.S. dollar depreciates before cutting the rate to mitigate the side-effects.

The gap between China-U.S. 10-year sovereign bond yields stays at around 48 basis points. Yi described a 90-basis point gap as a comfortable level.

The spread may widen this year however, as macro-conditions in the U.S., such as a more dovish Federal Reserve and increased funds shifting into safe haven assets suppressing U.S. bond yields, are changing.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3