Opinion

20:27, 18-Apr-2019

Stability is key to understanding China's first quarter economy

Zhao Yuanzhen

Editor's note: This article is based on an interview with Wang Jianhui, the general manager of the Research and Development department at Capital Securities. This article reflects the author's views, and not necessarily the views of CGTN.

It is again the time of the year when China releases sets of economic data for the first quarter. It grabs media attention as the first quarter economic figures are usually considered the parameter for the year's economic situation. And so far it seems the word "stability" has become this year's theme.

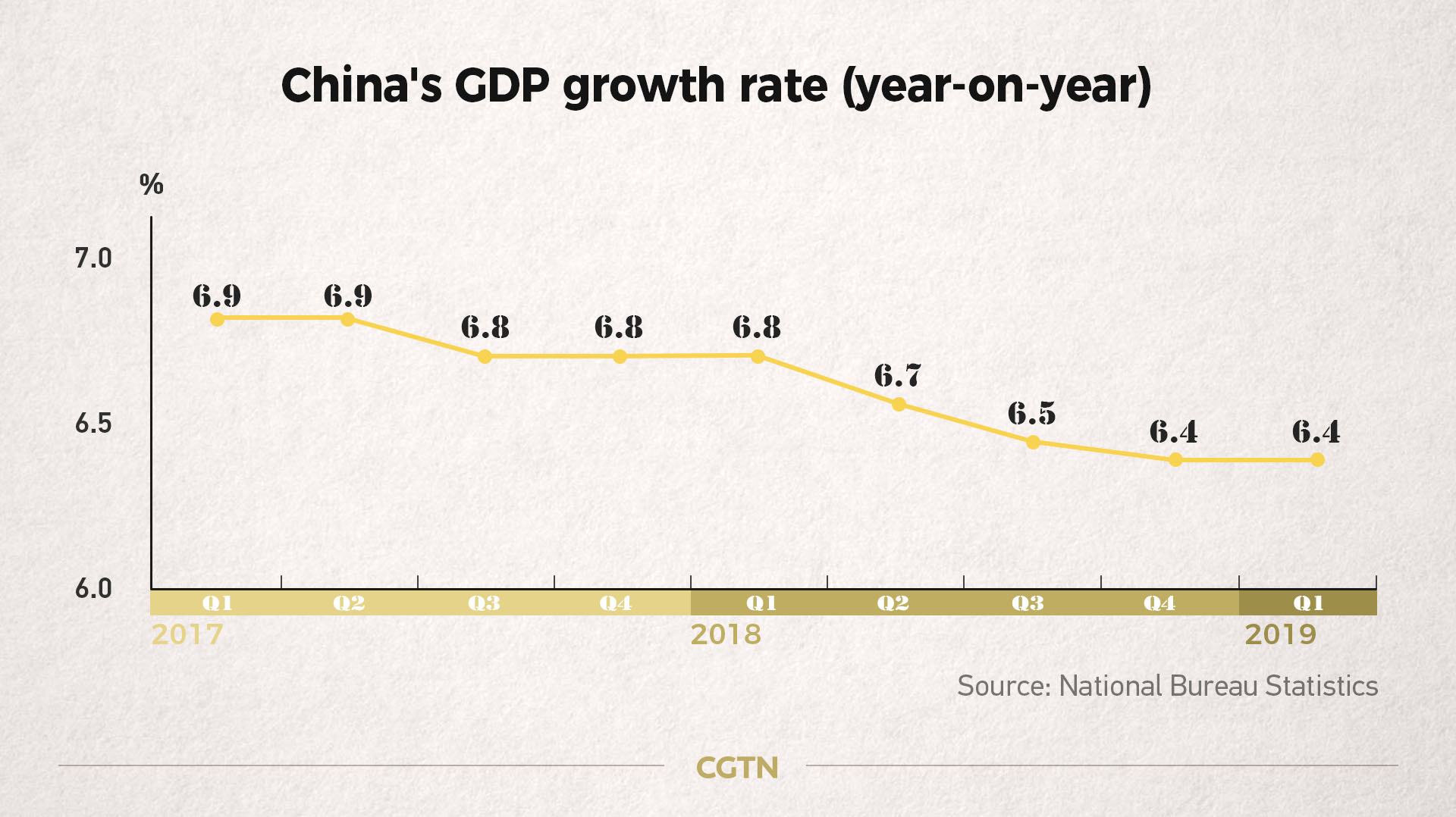

The first quarter GDP growth is 6.4 percent which has exceeded market expectations. Foreign exchange reserve has also increased with a stable yuan exchange rate. Trade in goods increased by 3.7 percent. With growing protectionism around the world and a cautious economic outlook, it seems that China's economy has kicked off with a good start.

With China and the U.S. concluding their trade talks and massive tax cuts underway, different financial bodies have upgraded their expectations on China's growth: IMF adjusted its forecast of China's economic growth from 6.2 percent to 6.3 percent; UBS revised up China's growth from 6.1 percent to 6.4 percent.

/VCG Photo

/VCG Photo

With the increase of external risks, it seems that China's policies in stabilizing foreign investment and international trade in 2018 have started to show.

There's a well-known rule in the economics that with a stable economy comes a stable currency. The stability of the Chinese economy with positive momentum is also reflected in China's foreign exchange data for the first quarter.

According to China's State Administration of Foreign Exchange, from January to March, banks bought 436.2 billion U.S. dollars' worth of foreign currencies, sold 445.4 billion U.S. dollars' worth of foreign currencies, with a net forex sales of 9.1 billion dollars, a year-on-year drop of 50 percent.

To Wang Jianhui, general manager of the Research and Development department at Capital Securities, these figures show that expectations for the Chinese economy has become more positive and balanced, which could be attributed to various factors.

"The main reason for the narrowing of net forex sales is successful expectation management. It means administrative measures have taken effects and expectation towards the value of the yuan has become more balanced rather than predictions of a weaker yuan," said Wang.

In general terms, forex sales reflect more demand for foreign currencies than supply in the market.

China's economic stability also contributed to the changes in expectations. As China and the U.S. are detailing the final draft of a trade agreement and the recent release of 6.4 percent GDP growth for the first quarter, all these factors have played a part in the narrowing of net forex sales.

According to Wang, it also reflects a change in the market where people used to buy foreign currencies for hedging and now they are buying foreign currencies according to real needs. In the future when demand becomes a driving factor in foreign currency sales, we can expect more fluctuations.

The increase in foreign exchange reserve is due to the foreign trade surplus of the first quarter, which has seen a 70 percent increase year-on-year, according to data released by the General Administration of Customs. The surplus has played a crucial role in improving foreign exchange balance.

/VCG Photo

/VCG Photo

There are also other "technical" reasons such as the price rising of U.S. dollar bonds and gold. On the whole, this has caused an increase in the foreign exchange reserve.

"In a nutshell, the regulation policy has been successful in maintaining the stability of China's foreign exchange; in the meantime, China's positive economic performance has also contributed to a more balanced expectation to RMB value," Wang concluded that in the future China's foreign exchange revenue will be managed more by market itself rather than administrative measures.

(If you want to contribute and have specific expertise, please contact us at opinions@cgtn.com.)

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3