Tech & Sci

23:18, 09-Jul-2018

How smart is your city mobility?

Updated

22:55, 12-Jul-2018

By Hu Nan

00:55

After releasing its first wave of 18 cities from Europe and the US, Deloitte recently released its second wave of City Mobility Index (DCMI) focusing on Asian cities, including Tokyo, Seoul, Beijing, Shanghai, Singapore, etc., making the total number of cities up to 53 worldwide.

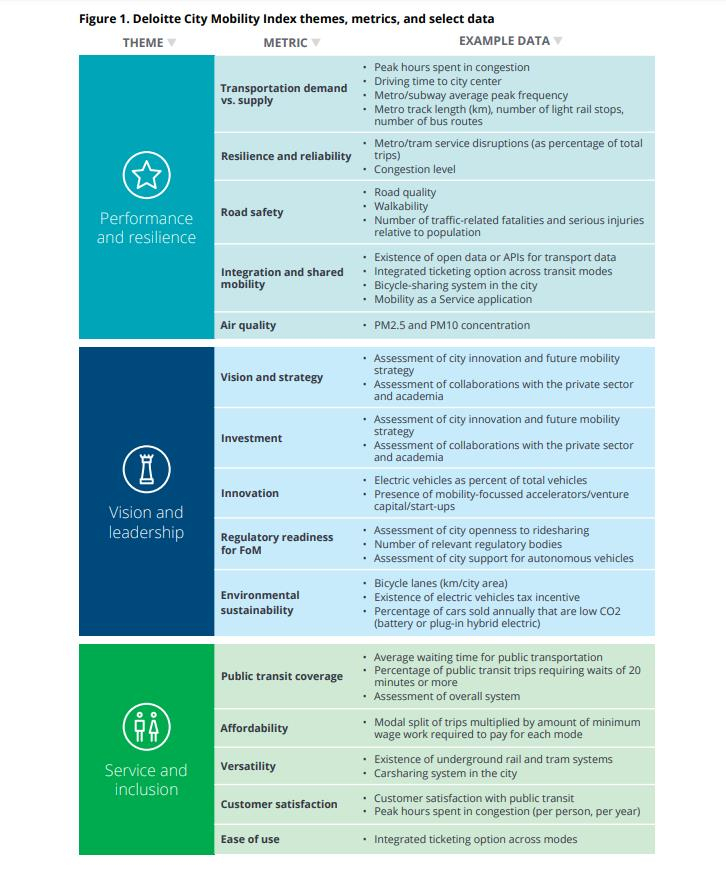

Listed cities were measured against three core themes: performance and resilience, vision and leadership, and service and inclusion.

Cities best positioned for long-term success are those whose transport networks are efficient, propel innovation and coordination with stakeholders, and are accessible to all residents. For example, cities including Tokyo, Seoul, London, and Singapore rated high on the index for their use of innovative solutions, which enable better and more efficient movement of people.

Themes, metrics and data sources of the Deloitte City Mobility Index (DCMI) /DCMI Photo

Themes, metrics and data sources of the Deloitte City Mobility Index (DCMI) /DCMI Photo

Tokyo now has more electric vehicle (EV) charge points than petrol stations with the Tokyo Metropolitan Government (TMG) planning to reduce the cost of setting up residential EV charging facilities to zero. Dubai has already started experimenting with autonomous road-based and aerial vehicles and provides several incentives to increase the use and adoption of electric vehicles. While casual ride-sharing is common in Washington DC and New York, it is less common in other cities.

In Northern Europe, cities such as Amsterdam are famous for their cycling culture and have higher rates of cycling than cities or geographic areas in other parts of the world that have similar population profiles.

Emerging technologies are poised to fuel the future of mobility in China. Chinese cities are rapidly improving their city mobility systems, positioning themselves to be leaders in the years to come.

Shenzhen has already marked its presence on the global map by switching on the world’s largest electric bus fleet. Embracing new technologies including electric vehicles and shared mobility models is driving vibrancy and livability in Beijing – and the city is continuing to invest in operational improvements. In Hong Kong, authorities are focused on increasing the number and use of commercial EVs, and have introduced tax exemptions on the purchase of private EVs.

Following are the summary of Chinese cities listed in DCMI:

Beijing:

Beijing has taken multiple measures to make itself a livable city. It has a forward-looking approach to its transport issues and has formulated strong development plans for the next five years. These plans involve expansion of public transport and sustainable modes of transport, evident in the 72 percent share occupied by public transport and active modes. In addition, the city has embraced testing of new mobility solutions, such as EVs and shared-mobility models. A number of these initiatives are already bearing results.

Nonetheless, the city faces some immediate challenges in terms of ongoing air pollution, traffic congestion, and the need for operational improvements in public transport and stronger coordination efforts among the various government agencies.

An electric vehicle (EV) charged in Beijing /VCG Photo

An electric vehicle (EV) charged in Beijing /VCG Photo

Hong Kong:

Hong Kong provides one of the most reliable, efficient, accessible and well-maintained public transport networks, with a highly integrated cross-modal electronic payment system. The high use of public transportation reflects this.

Regarding trials of new technologies, Hong Kong has been lagging and has taken a conservative approach to new mobility models, such as ride-sharing and autonomous vehicle testing. Also, the city has scope to expand active modes of transport, which can help in reducing congestion in the central district. Hong Kong has the potential to become a global model for public transport by embracing new technologies and promoting innovation.

Shanghai:

Shanghai is recognized across the globe for its metro system, the longest, busiest, safest, and one of the most punctual on the planet. The city also has massive expansion plans for its transportation infrastructure and has seen huge investments in infrastructure projects over the last five years. It is visible in the expansion of the Shanghai metro, where each kilometer of metro line costs between 500 million yuan to 1.3 billion yuan. Also, the city has developed a strong pedigree of sustainable transport with a robust underground pedestrian network in the central business district.

However, as with other Chinese cities, congestion levels are high, and air quality has been low, despite government efforts, and this may require further stringent measures to bolster the already restrictive license plate system.

Shenzhen:

With its consistent focus and investments in the electrification of transport modes, Shenzhen has marked its presence on the global map by switching on world’s largest electric bus fleet. The city has a very strong car and bike sharing systems, which helps make the transportation system sustainable and provides first- and last-mile solutions.

The transport authority of Shenzhen is currently focusing on tackling the high congestion levels in the city by using technologies and effective parking management. If Shenzhen can keep its transit system growing at the same pace as its economy, it can potentially become the leading global city for public transportation.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3