Opinion

10:33, 24-Jan-2019

Opinion: How can China maintain stable economic growth?

Liang Haiming

Editor's note: Liang Haiming is the chairman of the China Silk Road iValley Research Institute and a Visiting Scholar at Princeton University. This article was also co-authored with Feng Da Hsuan, a chief adviser of the China Silk Road iValley Research Institute and former Vice President for Research at the University of Texas at Dallas. The article reflects the authors' opinion, and not necessarily the views of CGTN.

Faced with significant impact from internal and external factors, the 2019 Chinese economic growth rate will certainly be affected significantly. To this end, we believe that this year, the Chinese GDP growth rate will be somewhere between 6 to 6.5 percent, and most likely to be 6.3 percent. As the economic growth target changes, in order to achieve the annual GDP growth of more than 6 percent and to expand domestic demand, the central government will loosen monetary and fiscal policies, cultivate new economic growth points, and add new infrastructures.

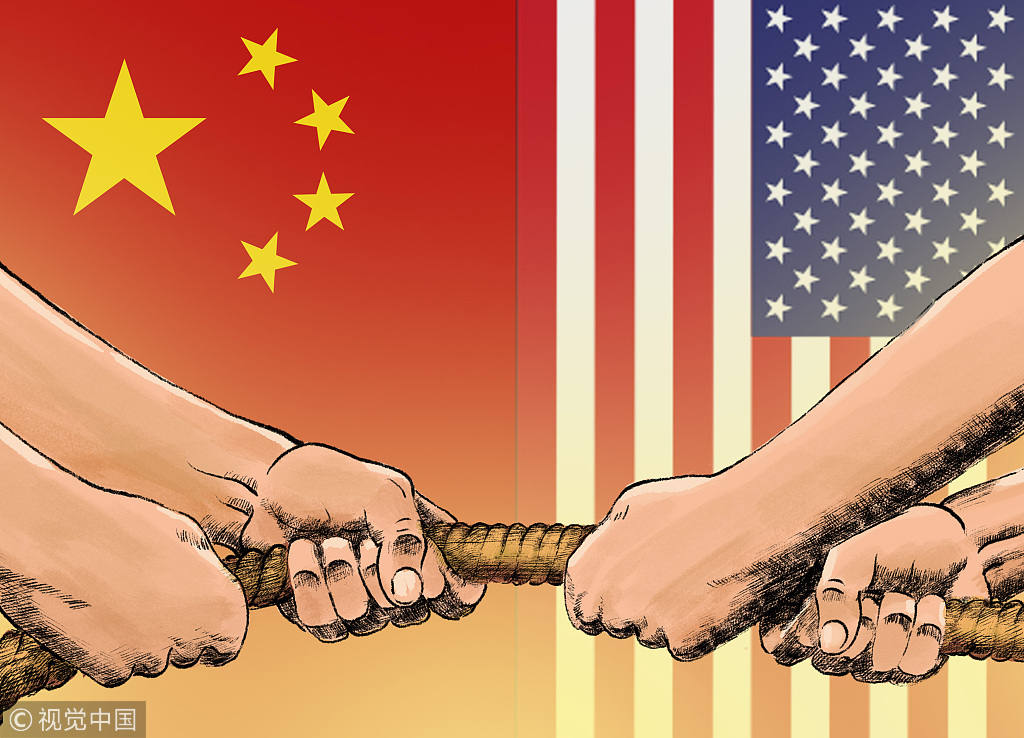

On the external front, besides the hovering Sino-U.S. trade conflict, other well-known factors such as the French “yellow vest” protest, Brexit, the “America First” policy, the “Italians First” and “Brazil Above All Else” slogans have all highlighted a universal anti-economic globalization sentiment.

China-U.S. trade dispute /VCG Photo

China-U.S. trade dispute /VCG Photo

To add insult to injury, in the past two to three decades, there is a palpable failure in the global social distribution mechanism, along with the gradual disappearance of the technological advancement dividends. These profound global dilemmas could and probably will hinder the pace of global economic growth. What is most disturbing is that there is no sign that such a trend will be reversed any time soon. All these will undoubtedly affect China's exports and impact China's economic performance in a serious manner.

Internally, facing uncertainties and coupled with pessimistic forecasts, the Chinese consumer and investor confidence has sharply fallen. The decline in investor confidence has already caused a decrease in the growth rate of the fixed-asset investment, which has not only affected the performance of the A-share market and real estate but also brought about a negative wealth effect. In addition, in order to “save for a rainy day,” consumers have further weakened their demand.

Residents shop at the fruit and vegetable section of a supermarket in Hai 'an, Jiangsu province, November 9, 2018. /VCG Photo

Residents shop at the fruit and vegetable section of a supermarket in Hai 'an, Jiangsu province, November 9, 2018. /VCG Photo

It is well known that China's economic growth is mainly propelled by exports, investments, and consumption. When such a troika simultaneously encounters challenges, it will undoubtedly affect China's economic stability and thus influence China's job market. When the Chinese economy is facing the double whammy of internal and external shocks, the central government will naturally adjust the economic growth target.

In 2019, a 6.5 percent economic growth rate will no longer be guaranteed, but policies will be instituted to keep it no lower than 6 percent. In fact, in order to maintain the economic growth rate to remain somewhere between 6 and 6.5 percent, it is expected that the central government will take several measures to maintain the so-called “six stabilizations”: stabilizing employment, finance, foreign trade, foreign investment, domestic investment, and expectations.

First, the central government will continue to stimulate the economy through relatively loose fiscal and monetary policies. The People's Bank of China is expected to cut the deposit reserve ratio two to three times this year. Meanwhile, the central government may also introduce large-scale tax cuts and fee reduction measures to improve the operation of SMEs in order to stabilize employment.

The People's Bank of China, January 17, 2019. /VCG Photo

The People's Bank of China, January 17, 2019. /VCG Photo

Second, the central government will promote the local government debt issuance in order to support and accelerate infrastructure investments that have the obvious effect of supporting the economy and employment. In the future, with the central government in the lead, together with local coordination and promotion, there will be a significant increase not only in traditional infrastructures such as transportation and water conservancy investments, new investments in eco-environmental protection, urban rail transit, navigation airports, and communication networks will also be increased.

In the arena of the “Belt and Road Initiative (BRI)” construction, the central government will place strong and equal emphasis on the concept of “going out” and “bringing in.” In the past five years, the Chinese enterprises have placed greater emphasis on “going out.” It is expected that in the coming few years, they should and will pay greater attention to and encourage “bringing in” in order to expand the domestic demand, which will undoubtedly render new contributions to China's economic growth.

South Africa's booth at the first China International Import Expo, Shanghai, November 10, 2018. /VCG Photo

South Africa's booth at the first China International Import Expo, Shanghai, November 10, 2018. /VCG Photo

It is worth noting that the central government will institute another measure to further stimulate consumption. In recent years, it is quite noticeable that the consumption growth rate has been higher than that of exports and fixed assets, accounting for more than half of the Chinese GDP. It clearly indicates that China's economy has become consumption-led, with the consumer retail market absorbing more employment.

In this scenario, the central government will continue to stabilize the commodity market represented by retail sales. Meanwhile, it will provide more support for the service market of tourism, medicine, education, culture, sports, entertainment, etc. The provision of new growth points for the consumer market can promote stable economic growth.

We believe that by implementing the above-mentioned appropriate policies, the central government can and will guarantee the economic growth rate of 6 percent or more in 2019. However, if the external situation were to suddenly deteriorate, there is no doubt that the central government will not and cannot rule out the possibility of reducing the interest rate in order to appease the market and stabilize the economy.

(If you want to contribute and have specific expertise, please contact us at opinions@cgtn.com.)

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3