Opinions

22:45, 29-Jun-2018

Opinion: Chinese and foreign player can enjoy benefits from a bigger cake

Updated

21:56, 02-Jul-2018

CGTN

Editor’s note: The article is based on an interview with Li Wei, a research fellow at the Chinese Academy of International Trade and Cooperation.

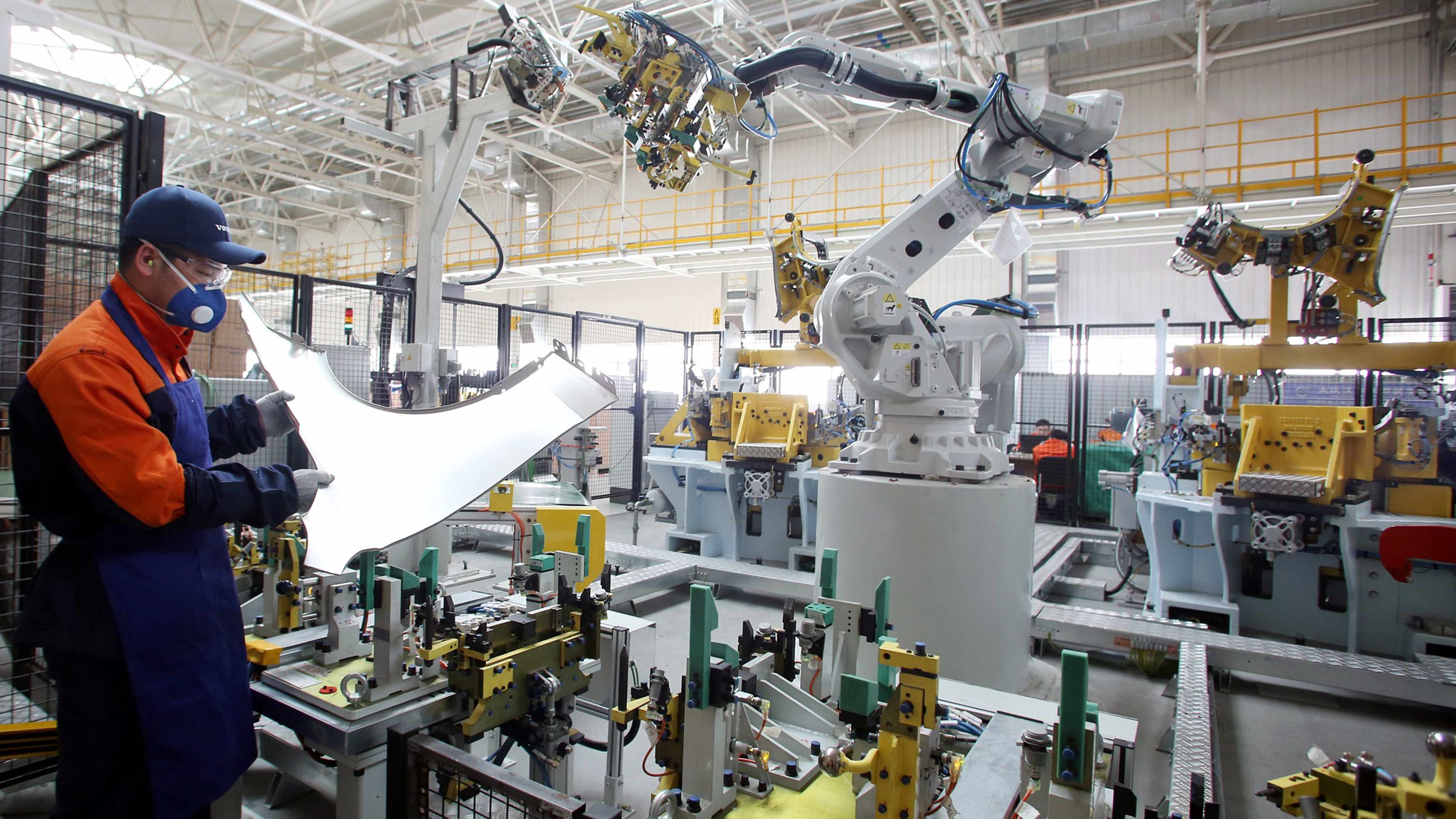

China unveiled on Thursday a long-anticipated easing of foreign investment curbs on sectors including banking, the automotive, heavy industries, and agriculture. It's the latest move that Beijing made to fulfill its promise to open its markets further.

The new version of the so-called "negative list" will be shorter, have less restrictions and open the market, and will take effect on July 28.

The number of items on the list was cut to 48 from 63 in the previous version last year. It widens market access for foreign investment to 22 industries.

“It must be very encouraging news for foreign enterprises that have long been trying to enter the Chinese market, and the opening degree is very great from the revised negative list,” said Li Wei, a research fellow at the Chinese Academy of International Trade and Cooperation.

01:50

“The list has been shortened. And we have noticed that the sectors in the inactive list have been shortened from 63 to 48. It involves 22 sectors in this newly revised list, and it covers all the industries, from primary to secondary to tertiary industries.”

In Li’s opinion, we can see a very clear timetable and roadmap for automobiles and finance sectors. It has reflected the openness degree and China's strong determination to further open up, which will help facility China's new landscape all the round in opening up.

Through such kind of wider and further opening, it will help China promote the innovation, the high-quality development, as well as the atomic domestic reform, which will also help accelerate the pace of China's high-quality economic development.

China's top trading partner, the United States, and the European Union have long been calling for less restrictions on entering the world's second-largest economy. But China has repeatedly said it will continue market reforms at its own pace, stressing it will open up markets based on its own needs and not due to external pressure.

Many of the measures are implemented following the promise that China flagged in April.

Li pointed out that this new list will offer many opportunities for foreign competitors, because in some sectors, they are not fully open or directly excluded foreign competitors previously. But now they have many opportunities to enjoy their competitive advantage in the Chinese market.

02:35

For example, in the service sector, we can see finance, infrastructure, professional services and logistics. Many of these have been opened to foreign sectors and foreign competitors.

And in manufacturing sectors, such as automobile, ship and airplane building, it is also the same. And we have also opened every culture and energy sector.

All these have provided massive opportunities for foreign enterprises that have not been able to enter the Chinese market previously.

Of course, the coin has another side. The new measures will also bring some pressures to domestic players. Li thought that the tough competition is inevitable.

“Actually, this is not the first time Chinese enterprises have met this kind of fierce competition since we accessed to the WTO in 2001. But competition is not always bad, as through malign competition, the Chinese companies can make themselves stronger,” said Li.

For domestic players, Li said that the only better option for them is to provide even higher quality products and services to Chinese consumers, which have strong demand for those things.

And through that process, the domestic enterprises, as well as foreign competitors, can create an even bigger market, which will make them both happy and they can enjoy the benefits from the bigger cake.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3