Business

18:03, 01-Jul-2018

Is China’s economy clouded by stocks and currency tumble?

Updated

17:16, 04-Jul-2018

CGTN

While there are gnawing worries about investor sentiment as the stock market of the world’s second largest economy has entered bear-market territory, one thing is becoming evident – the equity market dominated by retail investors does not reflect China’s economic fundamentals and is not a signal of an impending recession. It’s a herd mentality.

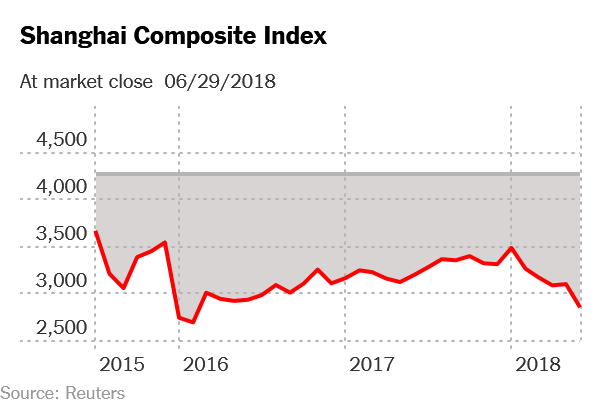

As of this week, the Chinese stock market is down more than 20 percent from its January highs, crossing the bear-market threshold.

Highly ‘speculative’ stock market

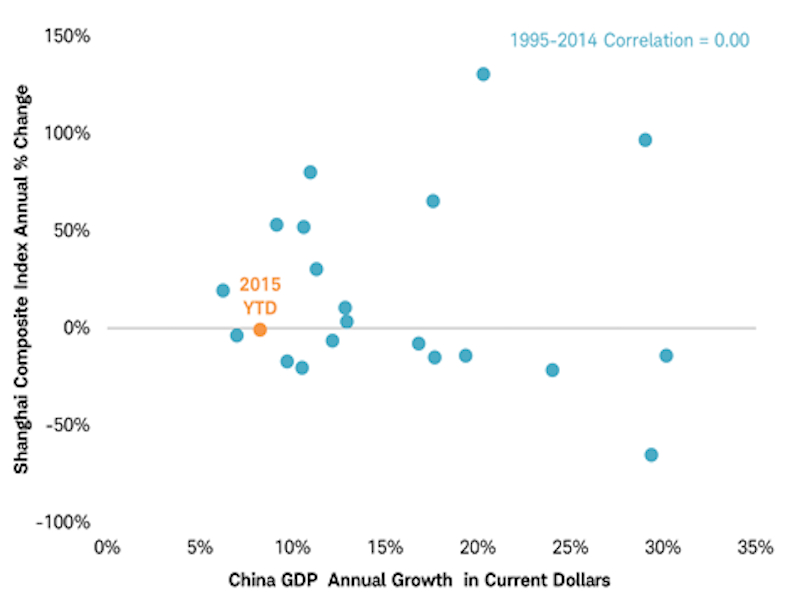

Unlike stock markets in the US, where it is a reliable indicator of economic performance, China’s stock market plays a smaller role and has fewer linkages to the economy.

This becomes apparent by taking a look at the graph below.

Source: Reuters

Source: Reuters

The correlation between Shanghai Composite Index and the country’s economic growth is less than 2 percent and statistically insignificant. This separation presents an interesting and defining characteristic of the Chinese stock market.

Retail investors, having a total of 112 million accounts in Shanghai and 142 million in Shenzhen, hold about 80 percent of Chinese equities.

Retail traders tend to buy and sell based on speculations and hearsay, as opposed to institutional investors who base themselves on fundamental analysis. If the price were to increase, everyone will jump on the train and buy. If the price would go down, everyone would head for the exit at the same time trying to sell.

This herd mentality has spurred extreme market volatility, and speculation takes over from valuation on China’s stock market.

The uniqueness of China’s stock market can be traced back to the listing and delisting procedures which the China Securities Regulation Commission (CSRC) is working to reform.

The stock market has not played a role as prominent as the banking sector in providing financing for firms and promoting economic growth in China.

At present, 75 percent of Chinese financing comes from indirect financing channels.

It is very different for Western capital markets where direct financing accounts for more than 80 percent of overall financing.

Direct financing, including issuing shares or bonds, links borrowers and investors directly, while indirect financing is where money is borrowed from a financial intermediary, such as a bank or an insurer.

Positive outlook for 2018

VCG Photo

VCG Photo

Despite rising tensions with the US over trade, China’s growth this year shows no signs of slowing.

A Bloomberg survey of 60 economists showed that the economy is estimated to grow 6.5 percent this year, matching the government target.

Economists raised their second quarter forecast from 6.6 percent in the last survey to 6.7 percent, down from the 6.8 percent achieved in the first quarter of 2018, although China and the US both pledged to impose tariffs on each other’s goods from early next month.

The result reflects confidence in the resilience of the country’s economy backed by the global economic recovery.

China's economy is transforming, moving away from being a low-cost producer and exporter, to becoming a consumer driven society. It wants to professionalize its financial services sector, and build a green-tech economy to help eliminate its pollution problems.

Currency skids toward worst month

On the forex market, the renminbi has shed about 3.3 percent of its value against the US dollar in June, its biggest fall this year. It is off nearly 6 percent from its peak in late March.

The mounting losses highlighted investor anxiety, but "there is nothing to worry about, as there is no basis for continued depreciation in the renminbi," said Xu Wei, an analyst with Hongxin Securities.

The yuan may face further devaluation pressure in the short term, but will be buoyed up by a basically stable economy and capital inflows following wider opening up of the financial market, said E Yongjian, an analyst with Bank of Communications.

The analyst attributed the weakening of the yuan mainly to a stronger US dollar backed by the US economic recovery, the US Federal Reserve's interest rates hike earlier this month, the easing policies of European and Japanese central banks and risk aversion sparked by concerns over worsening trade friction.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3