Opinion

11:06, 13-Apr-2019

China's further opening-up is an inevitable choice

Wang Jianhui

Editor's note: Wang Jianhui is the general manager of the Research and Development department at Capital Securities. The article reflects the author's opinion, and not necessarily the views of CGTN.

During recent years, it seems that words like "globalization" or "multilateral" have been lost their charm in many parts of the world; some populist politicians and right-wing media are complaining about the existing international trade framework instead of reflecting on their domestic economic issue. They accuse China, a major beneficiary of the globalization yet to open up to a more satisfactory degree, even though "openness" has only become one of the most important themes of today's China.

China has learned the value of openness through its long history and bitter memory of being defeated. China's opening-up policy and the pursuit of international trade can date back to the ancient Silk Road but unfortunately interrupted in the early 18th century, when Emperor Yong Zheng of Qing Dynasty (1644-1911) banned foreign missionaries and trade.

Less than hundred years later, David Ricardo established his genius theory that different countries could combine their competitive advantages to create more wealth and welfare by allowing factors of production flow (in another word, trade) cross the border. And the Opium Wars has officially opened the chapter of China's road to openness. And it has gone through from forced opening of ports to China's active move to further opening-up as the second-largest economy today.

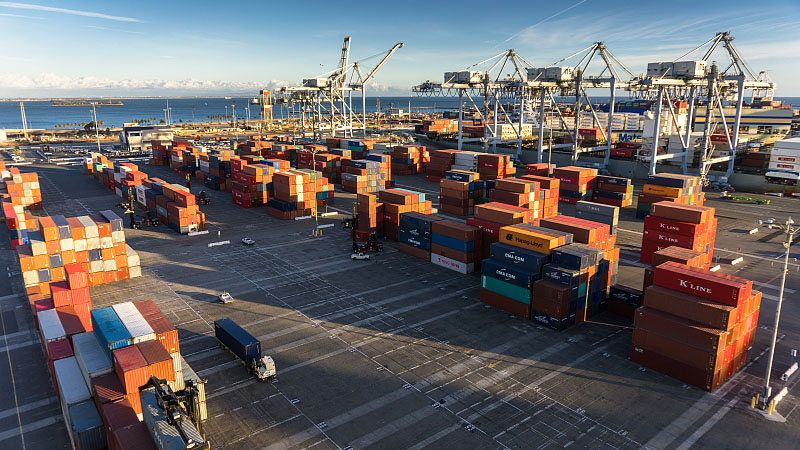

A port in Nantong, Jiangsu Province, China. /VCG Photo

A port in Nantong, Jiangsu Province, China. /VCG Photo

Although being delayed, China's participation in the globalization four decades ago was courageous and successful. As one of the ordinary people born in the 1960s, I can still remember clearly how an embarrassed foreign visitor in Beijing tried desperately to get rid of the crowd surrounding him, because the blue eyes and blown hair like his were rarely seen before.

Nowadays, 30.54 million inbound foreign visits were recorded in a year.

From 1995 to 2018 foreign trade surged from 281 billion U.S. dollars to 4622.9 billion U.S. dollars, making a major contribution to the GDP, which has also a stunning growth of 12.7 times within 23 years. Although the annual FDI inflow seemed to have plateaued between 110 billion U.S. dollars and 130 U.S. billion dollars since 2011, China still holds the top position, second only to the United States.

The strategy of globalization has helped China to rise to the second largest economy in the world. It has now turned to a major engine of world economic growth. In 2018 China's incremental output reached 1.4 trillion U.S. dollars, contributing 30% of the increase to the global growth and exceeding the U.S. contribution rate of 21.5%.

In the same year, 149.7 million outbound Chinese visits have been recorded. The deficit in service trade in tourism has more than doubled to 237.4 billion dollars.

Chinese tourists at The Mall Firenze in Florence, Italy. /VCG Photo

Chinese tourists at The Mall Firenze in Florence, Italy. /VCG Photo

Despite the supervisory measures in recent years, China's outward direct investment reached 129.8 billion U.S. dollars in 2018, exceeding 100 billion dollars for the sixth consecutive year. It is expected that the Belt and Road Initiative could drive cross border investment to a higher level in the future.

As a developing economy having joined the WTO at the beginning of the new Millennium, China surely has a lot of work to do to make the internal system adapted to the international rules, and to improve the business environment constantly.

The tax burden, for instance, needs to be reduced. The non-tax expenditure should be minimized. So far, the total tax and revenue account for 17.4% of GDP, higher than the world median of 14.4%. The central government has been well aware of the situation and remedies have been implemented or on the way.

From 2002 to 2018 the import duties' share at the tax revenue has declined from 4.0% to 1.8%. Premier Li Keqiang promised during the Two Sessions that value-added tax in the manufacturing industry would be cut by 3 percentage points (an 18.75% drop) after the personal income tax reduction this year. We can certainly expect more positive changes for a more open Chinese market.

(If you want to contribute and have specific expertise, please contact us at opinions@cgtn.com.)

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3