Business

07:45, 15-Dec-2018

Asian investors' focus should shift from Fed to ECB in 2019

Updated

07:36, 18-Dec-2018

By Jimmy Zhu

Editor's note: Jimmy Zhu is chief strategist at Fullerton Markets. The article reflects the author's opinion, and not necessarily the views of CGTN.

Asian investors' lack of attention to the policy path set by the European Central Bank (ECB) has caused many of them to make the wrong bet in 2017. More future policy uncertainties may come from the ECB instead of the United States Federal Reserve, based on ECB's latest policy meeting held on Thursday.

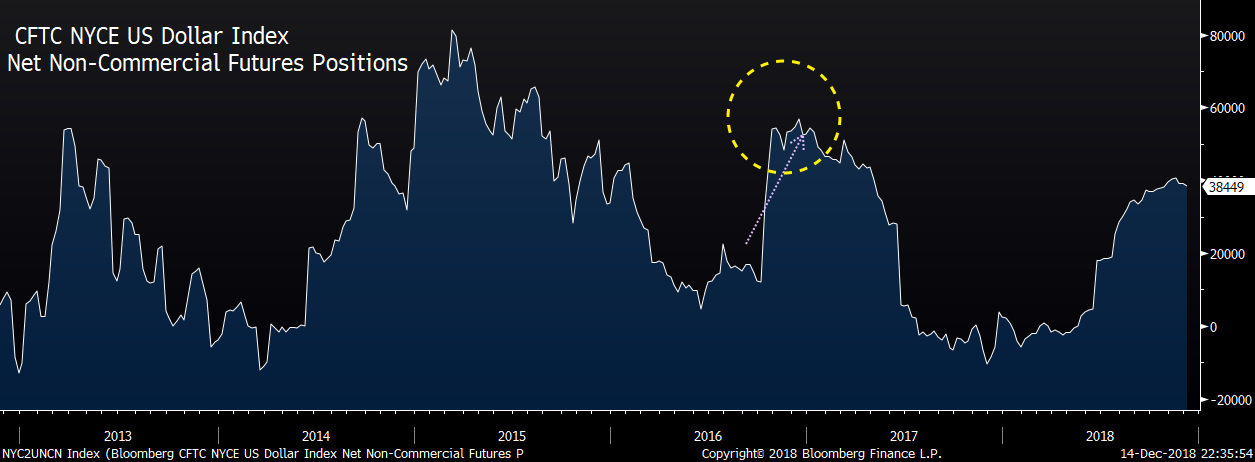

Let's recall what happened in 2017. There were many fresh positions built on buying the dollar at the end of 2016 after the Fed hinted it would accelerate the pace of rate hikes in the coming year and also started to unwind its mega-sized balance sheet.

CFTC dollar Index net non-commercial futures positions, most of which are built by hedge funds and banks' proprietary trading desks surged. However, these dollar buying positions seemed to surrender quickly.

Source: Bloomberg

Source: Bloomberg

However, the dollar index fell by 9.87 percent last year, even with a promised balance-sheet unwinding and three rate hikes.

Many investors were confused by this movement because their investment strategies simply overlooked the development in the euro zone.

Besides the synchronized global recovery at that time, intensive speculation on ECB to tighten the monetary policy was the principal cause behind the dollar sell-off.

Euro dollar's move would easily influence the whole dollar index in an opposite way, thanks to its constitution of 57.6-percent weight in dollar index, far exceeding the Japanese yen at 13.6 percent, the second biggest weighing currency in the index.

Indeed, impact from the euro's move to other markets is much heavier than the rest of non-dollar currencies.

For example, correlation between the euro and onshore yuan stands at 0.878 in the past 12 months, but the figure is only at 0.778 for the yen and the yuan.

The yuan's move on Friday evening was another classic example. Weaker-than-expected euro zone factory PMI released at 6 p.m. (GMT+8) triggered a sharp euro dollar sell-off, and that directly pushed the Chinese yuan to weaken above 6.90 versus the U.S. dollar.

Market's view on President of ECB Mario Draghi's tone at his latest press conference is a mix, as there haven't been any unanimous views formed in the market.

Two signals that Draghi revealed showed its statement should be taken as a dovish one.

First of all, besides the ECB downgraded the inflation and growth forecast as expected, Draghi argued that better financial conditions are helpful to the growth, a gesture that he could prefer a delayed rate-hike at this moment.

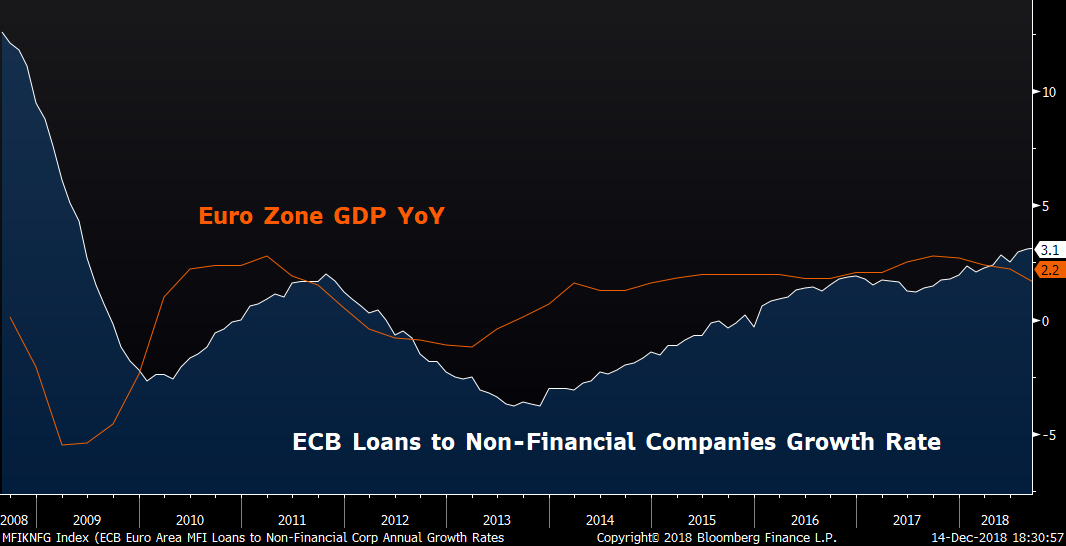

The euro zone's recent divergent credit and GDP data suggest the delay of the rate hike is necessary.

Credit conditions started to ease after the ECB launched its unprecedented QE program four years ago, so did the growth activities in the currency bloc.

However, GDP growth rate has been slowing down since the beginning of 2018, which could prompt the ECB to extend its accommodating policy environment.

Source: Bloomberg

Source: Bloomberg

Secondly, the ECB has tweaked its reinvestment strategy, including widening the reinvestment window from the existing three months to 12 months.

Such an announcement widely contained the volatility in the bond markets, with German bonds rising even with an end of the historic asset purchases.

The market should pay more attention to ECB's next year rate path, especially in reading the right indicators that the ECB watches.

German bonds market may have an answer. The German 10-year bund yield shows it's more relevant to euro zone's PMI, instead of its CPI rate.

Such reaction shows that ECB's focus could weigh more on the growth activities, instead of inflation, on which currently Fed focuses.

Both China and the U.S. show signs of slowing down according to recent economic data, and this set for adding tremendous downward growth pressure on the euro zone due to its growth highly relying on the external recovery.

Exports in euro zone contributed about 50 percent to its entire GDP.

Even as the Fed chair Powell said the U.S. policy rate is close to its neutral level, the dollar index remains at a steady pattern. Apart from the trade tensions between the two largest economies spurring the demand on the greenback, ECB's outlook should be another key factor.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3