Business

15:30, 22-Jun-2018

One year for China's A-shares MSCI inclusion

CGTN

It has been one year since China’s A-shares got the green light of MSCI Emerging Markets Index (EMI) and the MSCI All Country World Index (ACWI) inclusion on June 21, 2017.

The two-step inclusion process set in June and September this year goes well with 234 large-cap A-shares being included in the MSCI EMI at a 2.5-percent partial inclusion factor starting from June 1. And that figure will be raised to five percent after the index review this August.

Among the China A-shares to be included in the MSCI EMI are Industrial and Commercial Bank of China and China Construction Bank, and PetroChina.

China A-shares only currently represents 0.73 percent in the whole MSCI EMI, and 0.1 percent of the MSCI ACWI.

The prospect of full inclusion, however, is expected to give Chinese stocks an approximately 18 percent weighting in the index. Full inclusion would help China provide investors with more diversified investment portfolios, dwarfing many large emerging markets such as Brazil, Russia and India

Besides, the China MSCI entry will connect interested parties with Chinese blue chip stocks that will injected nearly 20 billion US dollars into the Chinese stocks.

Ma Jun, general manger of hedge fund manager Shanghai Solon Investment Co, said that increased investment from global institutions will add depth and breadth to China’s stock market, which is now dominated by retail investors.

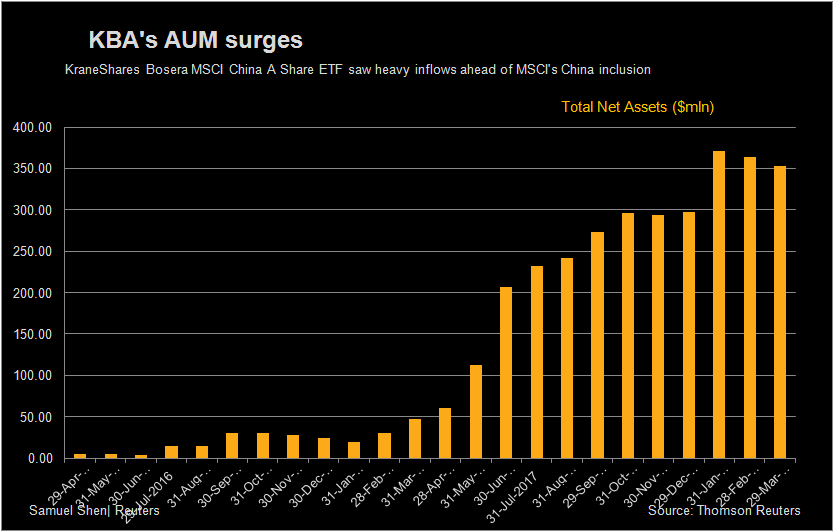

New York-based, China-focused asset manager KraneShares forecast that China’s weight within MSCI Emerging Markets Index – including both A-shares and overseas-listed Chinese companies – will grow from 30 percent today to over 40 percent over the next several years due to the inclusion.

Reuters Photo

Reuters Photo

Brendan Ahern, chief investment officer of Krane Funds Advisors, said that the inclusions have provided a positive catalyst for performance of local markets, adding that changes to MSCI's Global Standard Index definitions can have a dramatic impact on the affected markets due to fund flows from asset managers that benchmark to MSCI indexes.

While this first inclusion is a first step, it will pave the way for further inclusions for equity markets and also for China's bond market to follow a similar path, Ahern said.

Source(s): Reuters

,Xinhua News Agency

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3