Biz Analysis

16:21, 28-Feb-2019

Chinese PMI data show yuan assets could be a 2019 safe-haven

Jimmy Zhu

Editor's Note: Jimmy Zhu is chief strategist at Fullerton Research. The article reflects the author's opinion, and not necessarily the views of CGTN.

A deep contraction in China's manufacturing PMI this month mainly reflected a deteriorating external environment, as export orders fell to their lowest level since the global financial crisis. Meanwhile, a pick-up in the new orders index is an encouraging sign. A divergence between the two suggests that yuan assets may become a “safe-haven” this year.

Divergence of new orders, new export orders PMIs catches attention

The new orders PMI, the leading indicator for gauging domestic demand, rebounded to 50.6 from 49.6 in the previous month, rising for the first time in nine months. Together with surging credit growth in January, there are valid reasons to show that earlier pro-growth measures have had some positive impact on the real economy and boosted domestic demand, despite ongoing external challenges.

Source: Bloomberg

Source: Bloomberg

However, the China New Export Orders PMI slumped to 45.2 this month. The big decline reflects a more challenging external outlook this year weighing on Chinese exporters. For now, the drag in demand is mainly from the Eurozone. Both Germany and Italy's factory PMIs have fallen below 48, with such readings suggesting the two economies are close to recession.

Chinese exporters may also find it harder to ship their products to the U.S. this year, even though the American economy remains stable. Chinese exports to the U.S. showed negative growth in the past few months, as front-loading activities last year began to have an impact. Moving forward, outbound shipments to the U.S. will become more challenging if U.S. manufacturing activity fails to accelerate.

On the other hand, the divergence between the new orders and new export orders indicate that yuan-denominated assets will gain more inflows this year, when global investors may seek Chinese assets as a safe-haven if its economy outperforms others. The onshore yuan is currently the second-best performer among its Asian peers, and Shanghai stocks are the top performers among major global indices.

China PMI calls for policies to be more target-oriented, less broad-based

A weaker-than-expected manufacturing PMI may increase the market's expectations that policymakers will introduce more broad-based stimulus, but another indicator in February's PMI data shows such expectations may not be fully realized.

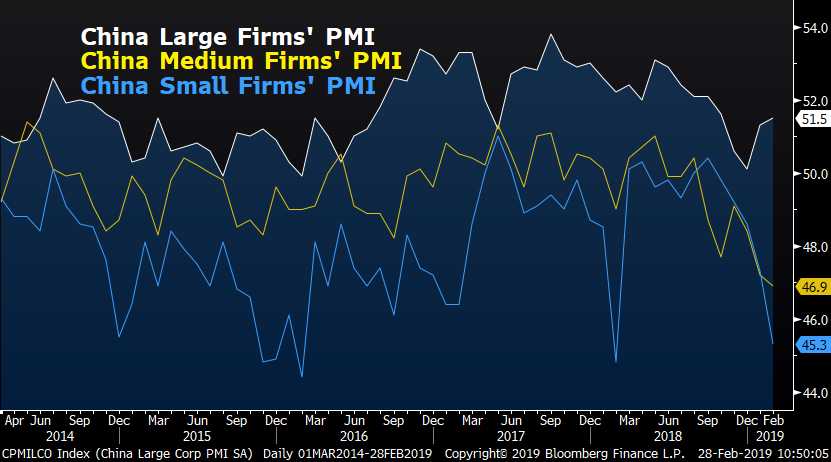

The chart below shows that recent policies may have favored larger companies over smaller ones. Large firms' PMI rose to 51.5 this month, while medium firms' PMI dropped to 46.9 and smaller firms' PMI slid to 45.3. Most private firms are SMEs, which account for 60 percent of GDP, 80 percent of employment and 70 percent of technological innovation.

Source: Bloomberg

Source: Bloomberg

With authorities pledging more support to the private sector and looking to boost the technology sector ahead of the launch of the new tech board, the policy now should focus more on those private firms. Historical experience shows that broader-based monetary easing is likely to favor larger companies the most, and this may not fit what the Chinese economy currently needs.

Policymakers are expected to channel more liquidity and funding into the private sector, instead of broad-based liquidity injection. Besides the divergence between the large and small companies' PMI, January's credit surge and the recent bullish stock market also suggest a more targeted approach will be more appropriate, even with softer manufacturing PMI data.

Without a broader stimulus, the bull-run in Chinese stocks market has the potential to take a break, and the bond market may attract more inflows. China's 10-year government bond yield may revisit the level of 3.10 percent in the near run before the economy bottoms out. Also, the less broad-based stimulus also means the Chinese yuan will remain largely stabilized, and that may also attract more foreign inflows into Chinese assets such as the sovereign bonds market.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3