Opinion

19:16, 01-Feb-2019

How could block chain boost capital flow to poorer countries?

Noah Wang

Editor's note: Noah Wang is co-founder and chief marketing officer of TOP Network, a Silicon Valley-based tech firm developing a business-friendly public blockchain and the world's first blockchain-based cloud communication network. The article reflects the author's views, and not necessarily those of CGTN.

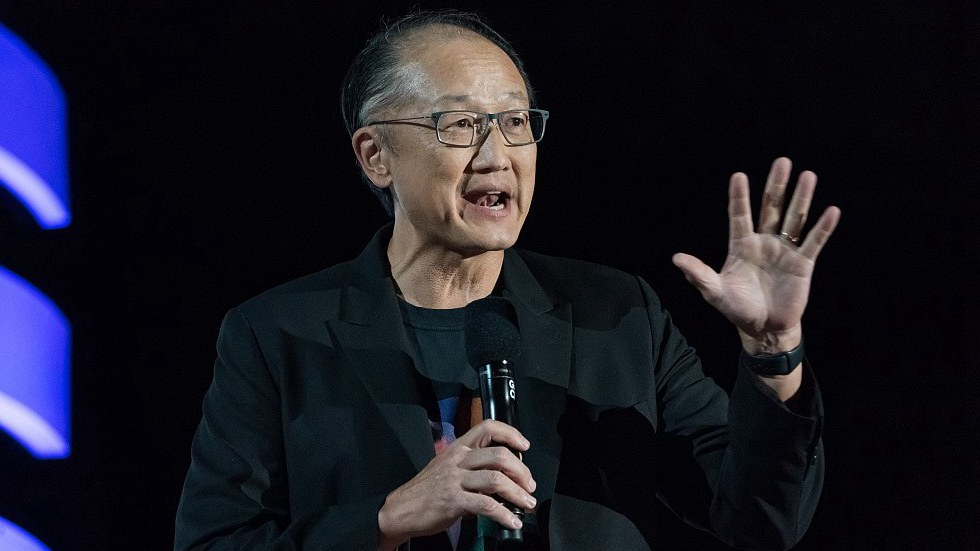

On February 1, Jim Yong Kim left the World Bank, where he served as president since 2012, following his abrupt resignation announcement in January.

In an email to World Bank staffers, Kim said he'll join a private company targeted at infrastructure investments in developing countries. Shifting to private finance, he said, will enable him to “make the largest impact on major global issues like climate change and the infrastructure deficit in emerging markets.”

World Bank President Jim Yong Kim spoke about human capital at Global Citizen Festival in New York City's Central Park on September 29, 2018. /VCG Photo

World Bank President Jim Yong Kim spoke about human capital at Global Citizen Festival in New York City's Central Park on September 29, 2018. /VCG Photo

Kim's unexpected embrace of the private sector came amid discussions about major multilateral development banks', or MDBs, failure to boost sufficient private capital flows to poorer countries. From 2004 to 2013, the combined amount of guarantees, an effective instrument for developing economies to seek private funding, only accounted for 4.2 percent of the total financing approved by major MDBs, according to a report by U.K. think tank Overseas Development Institute.

The financial services industry is tapping into disruptive innovations including blockchain, a move that would accelerate private investments into developing economies. The much-touted digital ledger technology has shown great potential in creating intermediary-free trust, cutting operating costs, streamlining the transaction process and opening easy access to individual investors worldwide.

In August, when Kim was still at the helm of the World Bank, the multinational lender rolled out “Bondi,” the world's first public blockchain-based bond.

Created and operated using a private blockchain on Ethereum, one of the world's most popular blockchain platforms, Bondi raised around 80 million U.S. dollars from private-sector institutions such as Commonwealth Bank of Australia (CBA) and Northern Trust as well as several state treasuries in Australia.

High angle view of coins with Ethereum logo. /VCG Photo

High angle view of coins with Ethereum logo. /VCG Photo

Without blockchain, Bondi's issuance would have been laden with intermediaries just like many other traditional fundraising activities. Under the conventional financial framework, from the bookbuild to the settlement, numerous agencies are involved in establishing trust among different transacting parties, who have to pay a significant amount of money for middlemen's services.

The reliance on intermediaries is dragging today's capital markets down to a quagmire of dangerous opaqueness and low traceability. A middleman operates in a centralized manner – all its business information is handled exclusively by a single authority, i.e., the middleman itself, so outsiders are unlikely to verify its compliance with laws and contracts. Transacting parties have no other choice but either to trust the middleman or to turn to another centralized agency, exposing themselves to potential manipulation and fraud.

Centralized intermediaries also undermine the efficiency of the current financial system. In traditional security trading, for example, every participating agency maintains its independent ledger, which could lead to errors, confusions, and inconsistency that take a great deal of money and time to set straight.

Blockchain, however, could bring high transparency and data accuracy. The digital ledger, realized by sophisticated codes, creates a tamper-proof database shared among transacting parties that updates itself in real time without centralized control. Blockchain supports self-executing contracts that digitize terms and clauses of real-world contracts with well-orchestrated algorithms, which can ensure transacting parties act in compliance with the law.

The core technology of blockchain is an accurate algorithm. /VCG Photo

The core technology of blockchain is an accurate algorithm. /VCG Photo

As all the relevant data are traceable on an open ledger and everybody is monitored by the immutable codes, on the blockchain, transacting parties no longer need to hire intermediaries to build trust, which would significantly reduce costs of financial activities and enhance information accuracy by eliminating record duplication. Such a trustworthy, highly streamlined system could create a manipulation- and bureaucracy-free environment where the private sector works efficiently with institutions like the World Bank to invest in developing countries.

Bondi might be groundbreaking in a centralized financial world, but it is far from the ideal of true decentralization. The bond runs on a private blockchain, which means only a limited number of devices selected by the World Bank and its partners can run blockchain-related algorithms, still leaving space for intermediary involvement and possible manipulation.

On public blockchain operating on large, truly decentralized peer-to-peer networks, private-sector investors will find more tools to help them put capital in the emerging markets.

One promising use case is blockchain-powered peer-to-peer lending and crowdfunding apps, which will likely mature in the next five to 10 years. Clear of middlemen and manipulation, these apps would allow private-sector investors around the world to easily and safely access investable startups and individuals in poorer countries. Investments are completed with decentralized cryptocurrencies so that investors don't have to navigate the obsolete, inefficient banking systems or risks of fiat currency devaluation in regions like Africa.

To address the lack of private capital flows to developing countries requires collaboration among all players in the global financial system. Blockchain technology could become a powerful solution to this issue by creating a transparent, secure platform where private-sector investors work efficiently with multilateral economic institutions as well as people in emerging markets.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3