Business

20:27, 04-May-2018

Experts on the financial meaning of China's opening-up of iron-ore futures

CGTN’s Wang Yue

03:07

China’s opening-up of iron ore futures will allow the country to get more control in the pricing of global iron ore, said experts said.

At this year's Boao Forum, Chinese President Xi Jinping said that China would further liberalize its financial market. After the Shanghai International Energy Exchange started to offer yuan-denominated oil futures earlier this year, the opening-up of iron ore futures on the Dalian Commodity Exchange is regarded as another significant step to fulfill China’s promise.

“We have to pay more attention to financial aspects of the future’s trading. We normally take it as commodity trading. That’s true but that’s not enough. The opening of iron ore future’s market is part of China’s financial market opening up,” He Weiwen, a senior fellow at the Center for China and Globalization, told CGTN.

01:27

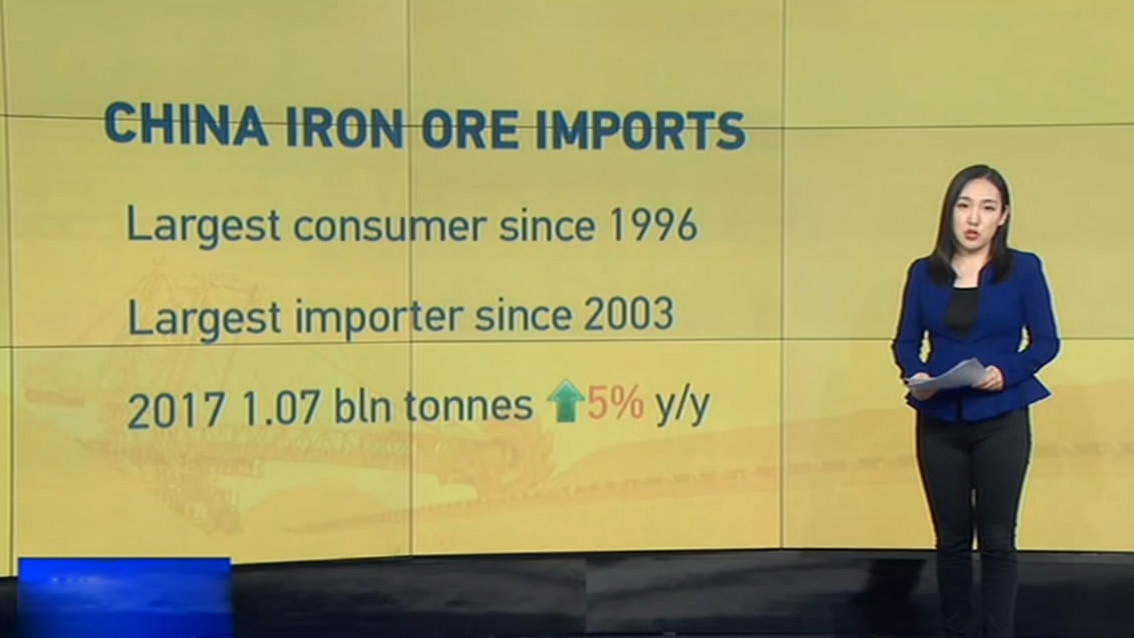

And it also helped China gain a bigger voice in the pricing of key commodities. China has been the largest consumer of iron ore since 1996. The country is also the world's largest iron ore importer, importing a record one billion tons of iron ore last year.

There are three indexes in the global iron ore futures markets, including Platts Iron Ore Index (IODEX), CFR China (TSI) and Metal Bulletin Iron Ore Indices (MBIOI). He said that the indexes follow the trading data around the world and decide the price level. “So no matter how much China buy, it should follow that index,” he continued.

But after this decision, “Dalian future’s trading will be the part of the global [iron ore future] pricing system and will bring more transparency into the industry,” He noted.

He also mentioned that we should be cautious about the speculation in the market, suggesting that the country “enhance expertise and governors tremendously up to international standard” as soon as possible.

(CGTN’s Hu Binyi and Yan Yunli also contributed to the story.)

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3