Opinion

08:29, 11-May-2019

Tariffs on Chinese goods will be passed on to U.S. consumers

Bobby Naderi

Editor's note: Bobby Naderi is a journalist, current affairs commentator, documentary filmmaker and member of the Writers' Guild of Great Britain. The article reflects the author's opinion, and not necessarily the views of CGTN.

U.S. President Donald Trump continues to bamboozle the public that his lousy 19th-century trade policy of tariffs on Chinese goods "is partially responsible for our great economic results," and now the tariffs have been increased from 10 percent to 25 percent after Friday's negotiations.

The man, who claims he's defending the American workers and for that is setting up the 2020 presidential elections, ramped up the tough talk on China on Twitter: "The Tariffs paid to the U.S. have had little impact on product cost, mostly borne by China. The trade deal with China continues, but too slowly, as they attempt to renegotiate. No!"

This is by no means an attempt to dispute the fact that Trump's trade policy of not playing by the book or shortchanging in trade negotiations with China (11 rounds so far) has helped boost the GDP of the U.S. to some extent.

The "tariff man" can take to Twitter to defend himself on that odd GDP number. He can even claims that "tariffs are an excellent alternative to a trade deal with China." As usual, however, he's probably not telling the whole truth.

All the economic evidence to date on Trump's hapless tariff war with China indicate the opposite of his declarations, not just with regard to the performance of the U.S. economy but the global economy as well.

To begin with, his tariffs announcement on May 9 sent U.S. stocks stumbling for a fourth consecutive session. On May 10, U.S. futures also fell as traders reacted to Trump's tariffs hike on Chinese goods. This is because U.S. markets are now apparently ruled not only by news headlines, but also by Trump's parallel tweets.

U.S. President Donald Trump waves while walking to board Marine One on the South Lawn of the White House in Washington, U.S., May 8, 2019. /VCG Photo

U.S. President Donald Trump waves while walking to board Marine One on the South Lawn of the White House in Washington, U.S., May 8, 2019. /VCG Photo

And that's just part of the tariff drama staged by the man who loves his base but also loves to lord over the markets.

Beyond the impact on the U.S. stock market and irrespective of how China would respond, Trump's new tariffs reportedly, on some 6,000 Chinese products, will be passed on to American consumers as well. These are essential goods that the Americans don't produce but need. The first set of tariffs was passed on to American farmers.

With that in mind, if Trump's tariffs go into effect and expand on almost everything the U.S. imports from China, prices of goods such as home appliances, sports equipment, consumer electronics, smartphones, textile and clothing will go up through the roof, dragging down sales nationwide.

Simply put, low-income households will no longer be able to buy them. As a consequence, this will hit profits of small business, freak investors, trigger market selloffs, slow down U.S. GDP, and increase unemployment rate.

There is no question that if Trump doesn't reverse his destructive decision, tariffs on 200 billion U.S. dollars' worth of Chinese goods will rattle small American businesses and company profits as well.

We still don't know how extreme the impact would be. But it will go in either direction, depending on the result of the 11th round of trade talks between the world's two largest economies.

Without sounding alarmist, Beijing has threatened to roll out punitive measures of its own now that Trump has doubled down on his threat.

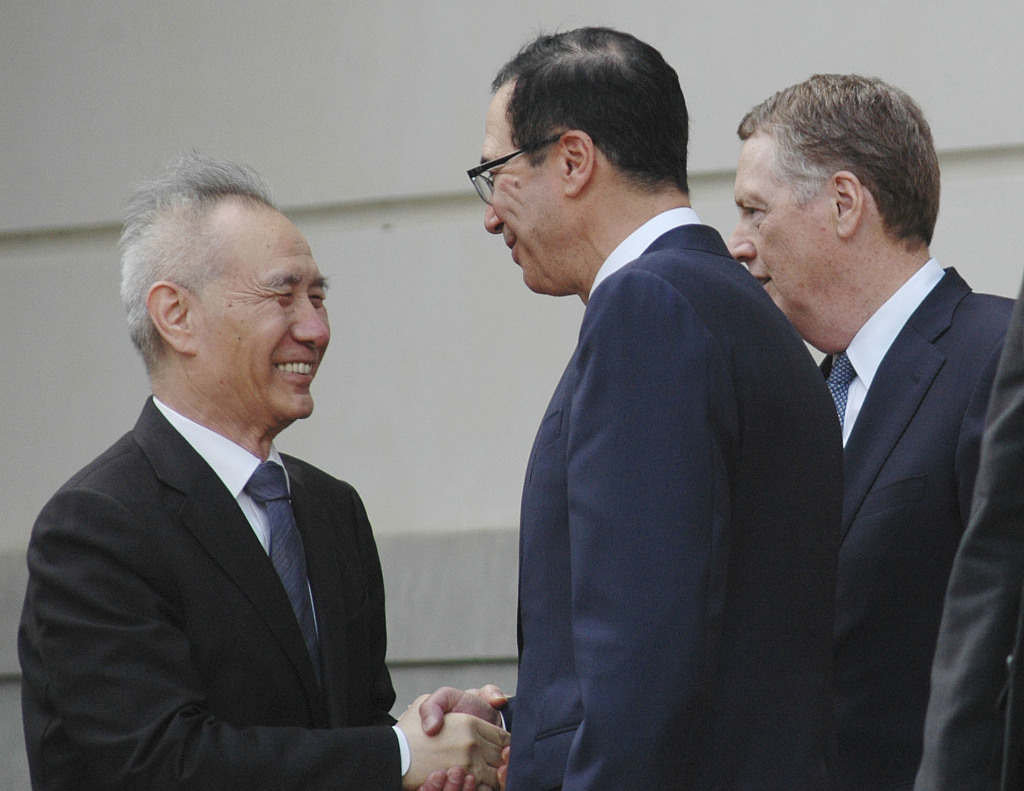

U.S. Trade Representative Robert Lighthizer (R) and Treasury Secretary Steven Mnuchin (C) greet Chinese Vice Premier Liu He in Washington, May 9, 2019. /VCG Photo

U.S. Trade Representative Robert Lighthizer (R) and Treasury Secretary Steven Mnuchin (C) greet Chinese Vice Premier Liu He in Washington, May 9, 2019. /VCG Photo

It is true that China agreed in previous negotiations to pay some of the cost in order to remain competitive in the U.S. market. The fact still remains that American consumers, producers, small businesses, investors, workers, and farmers will take on most of this new burden.

Looking back, it's the reason why American industry groups are also freaked. They are still feeling the crunch and have called on Trump to drop tariffs. They have raised their concerns with the White House that if Trump does follow through, there will be a serious market reaction, with huge impact on American consumers.

Their argument is honest: Tariffs have increased production costs for manufacturers and pushed up prices for consumers. Chinese tariffs on U.S. agricultural exports have negatively impacted American farmers. New tariffs will weaken both American businesses and consumers.

That's worth our attention. Unlike what the "tariff man" would like to fervently wish, it's not the Chinese government paying to the American government but the American consumers paying for Trump's tariffs with higher prices.

These are the same people that elected Trump and will soon determine his fate in yet another presidential race with Democratic rivals, who implicitly accuse him of "only punishing U.S. farmers, small business owners and consumers with his hardline approach to China."

To get a sense of what Trump's new tariffs might mean for the global economy, add just one more detail: Unsurprisingly, the precise impact in the long-run is that tariffs will also slow down the global economy and interrupt global supply chains, according to the International Monetary Fund.

(If you want to contribute and have specific expertise, please contact us at opinions@cgtn.com.)

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3