Business

17:43, 16-Nov-2018

Euro zone bond yields creep up, Brexit strife limits rise

Updated

17:12, 19-Nov-2018

CGTN

Government bond yields in the euro area edged up on Friday as some stability returned to British markets following the previous day's Brexit-driven turmoil.

Still, 10-year borrowing costs in the bloc's benchmark issuer Germany, were set for their biggest weekly fall in three weeks in a sign that uncertainty in Britain and Italy continued to support demand for safe-haven assets.

British Prime Minister Theresa May was grappling with the biggest crisis of her premiership on Friday after a draft divorce deal with the European Union provoked the resignations of senior ministers and mutiny in her party.

This backdrop meant any rise in bond yields in countries such as Germany and France was likely to be limited, especially ahead of a weekend when most investors tend to favor holding safer assets in case of a negative surprise, analysts said.

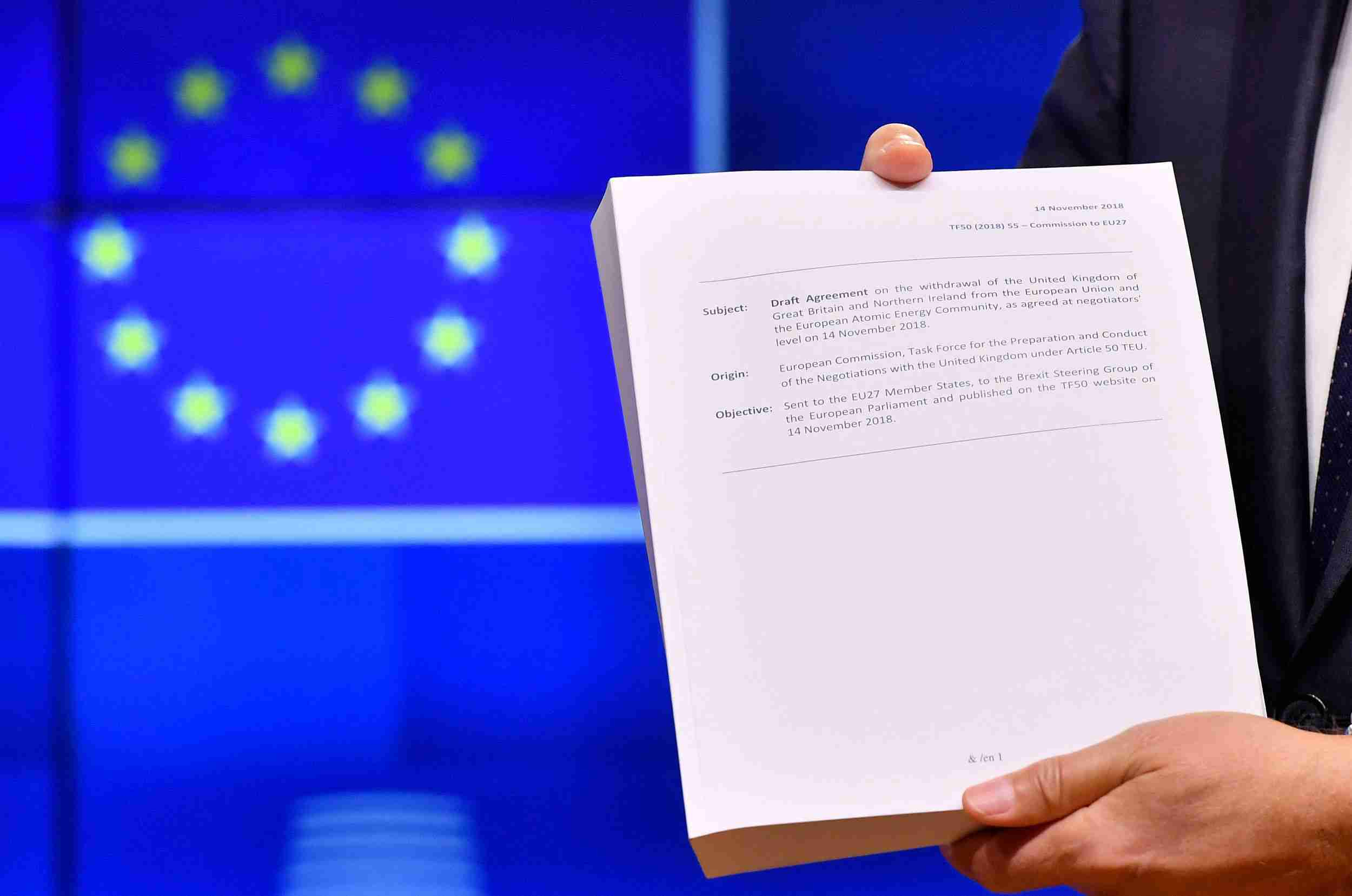

UK and EU officials have agreed the draft text of a Brexit agreement on November 13, 2018. / VCG Photo

UK and EU officials have agreed the draft text of a Brexit agreement on November 13, 2018. / VCG Photo

"Given the political uncertainty in the UK, investors are still worried about how things could play out and will remain interested in the safe-haven qualities of higher-rated government bonds,” said an analyst at a German bank, who asked not to be named.

In early Friday trade, most 10-year bond yields in the single currency bloc were marginally higher on the day.

Germany's 10-year bond yield was up about a basis point at 0.37 percent – above more than two-week lows at around 0.35 percent hit on Thursday as Brexit turmoil triggered a slide in sterling and the biggest one-day fall in 10-year gilt yields since just after the 2016 Brexit vote.

British gilt yields are down 12 basic points this week, reflecting demand for safe-haven assets as well as a view that renewed uncertainty in the UK makes a rate rise from the Bank of England unlikely next year.

German Bund yields are five basis points lower this week, while in contrast, Italian 10-year bond yields are set to end the week about nine bps higher on concerns about tension with the European Union over Rome's draft 2019 budget.

That draft “significantly” deviates from commitments, the vice president of the EU Commission Valdis Dombrovskis said in an interview with daily Il Sole 24 Ore on Friday, threatening a procedure for excessive debt against Rome.

Still, Italy's 10-year bond yield dipped one bps to 3.48 percent, reflecting the slightly improved tone to riskier assets early on Friday.

Analysts said there was also some focus on European Central Bank Chief Mario Draghi, who speaks later this session.

Source(s): Reuters

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3