Business

15:54, 26-Nov-2018

Down 36% in one week, is this finally the end of Bitcoin?

Updated

15:27, 29-Nov-2018

Nicholas Moore

Beleaguered cryptocurrency Bitcoin has fallen by as much as 36 percent in one week, and is down by almost 80 percent since hitting its peak last December. But does anyone really care anymore?

At the time of writing, Bitcoin was just above 3,900 U.S. dollars, rebounding slightly after a new 2018 low of 3,494 U.S. dollars, according to data from Coindesk.

The Bitcoins in circulation on December 17, 2017 had a total value of 327 billion U.S. dollars. Today, that market cap is down to 68.5 billion U.S. dollars, underlining how much the cryptocurrency bubble has burst.

100 billion U.S. dollars have evaporated from the entire cryptocurrency market in the past 10 days alone.

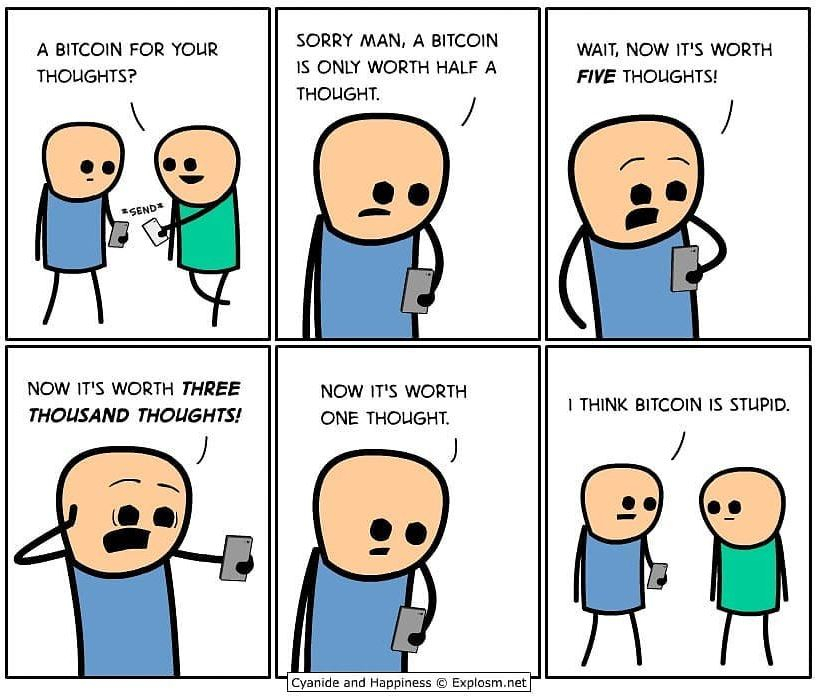

The Internet reacts to Bitcoin and its price fluctuations. /Image via Twitter @Explosm

The Internet reacts to Bitcoin and its price fluctuations. /Image via Twitter @Explosm

The Bitcoin community has been left battered and bruised throughout 2017, and November has left many wondering if it – and their investments – can ever recover.

Headlines on numerous Bitcoin-enthusiast websites tell the same story:

“Bitcoin must be dead now, surely?”

“Is it over yet?”

“The great crypto crash of 2018.”

Talking to Bloomberg, Stephen Innes of forex company Oanda Corp. warns that if the price gets any lower, “this thing is going to be a monster. People will be running for the exits.”

But does anyone care anymore?

Investors still waiting for Bitcoin to rebound to the levels seen a year ago are fewer and fewer, while those who always warned it was a bubble will be more than happy to say “I told you so.”

Chinese investors in particular can be thankful that authorities clamped down on the cryptocurrency well before the bubble burst.

Bans on initial coin offerings and the closure of China-based Bitcoin exchanges happened back in September 2017, with the National Internet Finance Association of China warning at the time that financial and social risks had “accumulated to a level that cannot be ignored.”

On a global scale, it's hard to say how many investors are still backing Bitcoin. Data from BitInfoCharts suggest more than 14.75 million “addresses” hold more than one U.S. dollar worth of Bitcoin, while CNBC reported in March that only eight percent of Americans owned it.

Bitcoin has recovered from previous slumps of more than 75 percent before, but it is difficult to see how it can regain investor confidence after this latest crash.

What lies ahead for Bitcoin and crypto?

Despite major names like Goldman Sachs announcing they were looking at Bitcoin, efforts to establish official Bitcoin ETFs, derivative funds and crypto trading desks have been shelved, rejected by national authorities or put permanently on the backburner.

JPMorgan's chief Jamie Dimon has long maintained that Bitcoin is a “fraud,” and most other financial firms remain highly cautious or skeptical.

If Bitcoin does disappear completely from investor portfolios, it will still leave behind a long-lasting legacy.

Bitcoin farmers have started turning their machines off following the latest crash. /VCG Photo

Bitcoin farmers have started turning their machines off following the latest crash. /VCG Photo

Its massive adoption on a global scale, particularly in currency-crisis countries like Venezuela and Zimbabwe, proves there is demand for a decentralized digital currency, while its high volatility also proves there is a strong demand for better regulation.

Bitcoin has inspired innovation in blockchain technology, with banks around the world, including China, looking at digital wallets and other areas of Fintech connected to the blockchain.

Even International Monetary Fund chief Christine Lagarde said earlier this month that central banks should consider establishing their own digital currencies.

Such innovation will be what eventually consigns Bitcoin to history. Already its users complain about slow transaction times, hacking and price fluctuations. That doesn't even begin to address its environmental impact – crypto-mining consumes vast amounts of electricity.

Once the dust settles from this crash, the next major digital currency to take the world by storm will surely be safer and faster, and its users will have Bitcoin to thank for that.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3